2012 Chrysler 300 Limited on 2040-cars

1123 Freeway Dr, Reidsville, North Carolina, United States

Engine:3.6L V6 24V MPFI DOHC Flexible Fuel

Transmission:8-Speed Automatic

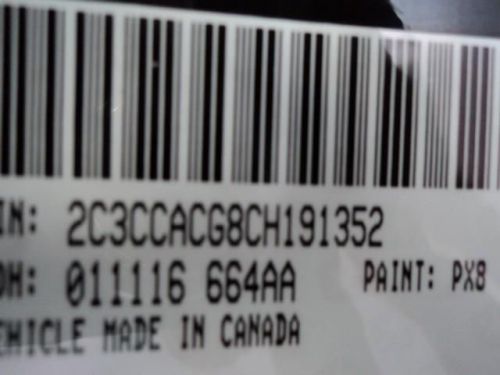

VIN (Vehicle Identification Number): 2C3CCACG8CH191352

Stock Num: P7082

Make: Chrysler

Model: 300 Limited

Year: 2012

Exterior Color: Gloss Black

Interior Color: Black

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 59769

***USED CAR DISCOUNT REBATE*** Contact DUANE @ 888-450-8347 for today's DI$COUNT PRICE and to check if its still for sale! At Reidsville Nissan, cars move fast so give us a call TODAY!!!

Chrysler 300 Series for Sale

2012 chrysler 300c base

2012 chrysler 300c base 2011 chrysler 300 base(US $18,277.00)

2011 chrysler 300 base(US $18,277.00) 2006 chrysler 300 touring(US $11,000.00)

2006 chrysler 300 touring(US $11,000.00) 2007 chrysler 300 touring(US $7,900.00)

2007 chrysler 300 touring(US $7,900.00) 2004 chrysler 300m base

2004 chrysler 300m base 2006 chrysler 300 touring

2006 chrysler 300 touring

Auto Services in North Carolina

Xtreme Detail ★★★★★

Winston Road Automotive ★★★★★

Whites Tire Svc ★★★★★

Whites Tire Svc ★★★★★

Westgate Imports ★★★★★

West Jefferson Chevrolet ★★★★★

Auto blog

North Carolina driver charged for flattening Trump sign

Thu, Mar 17 2016Police in Wilmington, NC are investigating a viral video that shows a local man driving off the road to run over a Trump for President campaign sign. Julien Schuessler of Wilmington posted a video to Facebook on March 15 showing him driving his white Jeep off the road in a reckless manner to smash a Trump sign. He captioned the video, "I love having a Jeep sometimes." The video immediately went viral, reaching nearly a million views and 25,000 shares in less than twenty-four hours. Any elation Schuessler may have felt at having his video go viral was short lived, though. According to WWAY, Wilmington Police were tipped off to the existence of the video on the afternoon of March 16. They were, understandably, less than pleased. In an official tweet, WPD stated that they were aware of the video and were investigating. A spokesperson for the WPD stated that Schuessler faces multiple charges for his little stunt, including hit and run, reckless driving, and failure to maintain lane control. WWAY reached out to Schuessler for comment, but he has declined to respond. News Source: wwaytv3 Government/Legal Weird Car News Chrysler Jeep Driving Safety SUV Off-Road Vehicles Police/Emergency Trump north carolina hit and run vandalism wrangler

Marchionne open to combination with Ford or GM

Fri, Mar 13 2015At the depths of the auto industry implosion, there was widely reported talk that General Motors and Chrysler would be merged into a mighty import-beating behemoth. While such notions clearly never materialized, that doesn't mean the idea is dead. In fact, FCA boss Sergio Marchionne still welcomes the idea of a partnership with either GM or Ford. He responded positively to the idea, calling it "technically feasible," when asked about it at the 2015 Geneva Motor Show, Automotive News reports. "There's bantering that goes on all the time," Marchionne told AN, before quashing suspicions that a plan was in the works by adding that "nothing substantive" was going on. Our favorite black sweater enthusiast isn't quite as interested in the idea of teaming with a foreign manufacturer like PSA Peugeot Citroen, or in the rumored tie-up with Volkswagen, though. That is a shame, particularly in regards to Marchionne's shut down of a partnership with the French, although it isn't necessarily surprising – FCA already consists of eight automakers, and as Sergio told AN, there's really nothing at PSA that could help the company out. What are your thoughts? Is there an obvious project or segment that would benefit from an FCA partnership with Ford or GM? Have your say in Comments. News Source: Automotive News - sub. req.Image Credit: Marco Bertorello / AFP / Getty Images Chrysler Fiat Ford GM Sergio Marchionne FCA merger

2017 Chrysler Pacifica Hybrid electrifies the family hauler

Mon, Jan 11 2016The 2017 Chrysler Pacifica Hybrid is the first-ever hybrid minivan – why didn't anyone think of this before? The extra jolt of electric propulsion lets Chrysler estimate this hauler can get a very green 80 miles per gallon equivalent, with 30 miles of full electric range. To make those amazing numbers possible, the Pacifica Hybrid uses a version of the 3.6-liter Pentastar V6 that runs on the Atkinson cycle for improved efficiency, matched with an electric motor. A 16-kWh lithium-ion battery sits underneath the second-row floor to supply the energy. The PHEV doesn't launch until the latter half of 2016, but Chrysler currently estimates the powertrain's output at 248 horsepower, versus 287 hp from the non-hybrid Pacifica. Charging the system to full takes just two hours from a 240-volt outlet. Other than the charging port just head of the driver's door and different wheel designs, the Pacifica Hybrid looks the same as the other model. The nearly identical styling isn't a bad thing because this is one of the most attractive minivans ever. The aesthetics are similar inside, too, but the battery removes the ability to stow the second row of seats. However, the third row can still fold flat. First hybrid powertrain in minivan segment "Due to its large footprint and multiple daily trip patterns, the minivan is ideally suited for electrification technology," said Bob Lee, Vice President and Head of Engine, Powertrain and Electrified Propulsion Systems Engineering, FCA – North America. "The all-new 2017 Chrysler Pacifica lives up to this promise and then some, with efficiency, power and refinement." Launching in second half of 2016, the Pacifica Hybrid is the industry's first electrified minivan. With an estimated 248 horsepower, the vehicle will deliver an estimated range of 30 miles solely on zero-emissions electric power from a 16-kWh lithium-ion (Li-ion) battery. In city driving, it is expected to achieve an efficiency rating of 80 miles per gallon equivalent (MPGe), based on U.S. Environmental Protection Agency standards. When the battery's energy is depleted to a certain threshold, the Pacifica Hybrid becomes a part-time electric vehicle, like a conventional hybrid. Power to the wheels is supplied by the electric drive system or supplemented by a specially adapted new version of the award-winning FCA US Pentastar 3.6-liter V-6 engine.