2008 Chrysler 300 Limited Htd Leather 18" Wheels 57k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Vehicle Title:Clear

Engine:See Description

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Certified pre-owned

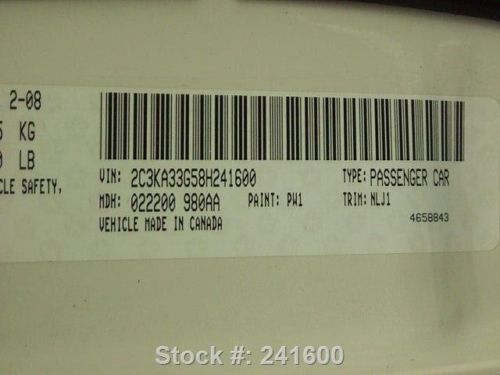

Year: 2008

Make: Chrysler

Warranty: Vehicle has an existing warranty

Model: 300 Series

Trim: Limited Sedan 4-Door

Options: Leather

Power Options: Power Seats, Power Windows, Power Locks, Cruise Control

Drive Type: RWD

Mileage: 57,522

Sub Model: WE FINANCE!!

Number Of Doors: 4

Exterior Color: White

Inspection: Vehicle has been inspected

Interior Color: Gray

CALL NOW: 281-410-6079

Number of Cylinders: 6

Seller Rating: 5 STAR *****

Chrysler 300 Series for Sale

Chrysler 300 4dr sedan 300s rwd low miles automatic gasoline 3.6l v6 vvt engine

Chrysler 300 4dr sedan 300s rwd low miles automatic gasoline 3.6l v6 vvt engine 2005 used 5.7l v8 16v automatic rwd sedan

2005 used 5.7l v8 16v automatic rwd sedan 2013 chrysler 300 motown nav rear cam 22" wheels 8k mi texas direct auto(US $24,980.00)

2013 chrysler 300 motown nav rear cam 22" wheels 8k mi texas direct auto(US $24,980.00) 2013 chrysler 300 s htd leather nav rear cam 20k miles texas direct auto(US $26,480.00)

2013 chrysler 300 s htd leather nav rear cam 20k miles texas direct auto(US $26,480.00) 2009 chrysler 300c hemi sunroof nav heated seats 23k mi texas direct auto(US $22,780.00)

2009 chrysler 300c hemi sunroof nav heated seats 23k mi texas direct auto(US $22,780.00) 2005 chrysler sedan 4d touring 300-v6 low miles 77,000(US $9,800.00)

2005 chrysler sedan 4d touring 300-v6 low miles 77,000(US $9,800.00)

Auto Services in Texas

Yescas Brothers Auto Sales ★★★★★

Whitney Motor Cars ★★★★★

Two-Day Auto Painting & Body Shop ★★★★★

Transmission Masters ★★★★★

Top Cash for Cars & Trucks : Running or Not ★★★★★

Tommy`s Auto Service ★★★★★

Auto blog

Carmakers ask Trump to revisit fuel efficiency rules

Mon, Feb 13 2017Car companies operating in the US are required to meet stringent fuel efficiency standards (a fleet average of 54.5MPG) through 2025, but they're hoping to loosen things now that President Trump is in town. Leaders from Fiat Chrysler, Ford, GM, Honda, Hyundai, Nissan, Toyota and VW have sent a letter to Trump asking him to rethink the Obama administration's choice to lock in efficiency guidelines for the next several years. The car makers want to revisit the midterm review for the 2025 commitment in hopes of loosening the demands. They claim that the tougher requirements raise costs, don't match public buying habits and will supposedly put "as many a million" jobs up in the air. The Trump administration hasn't specifically responded to the letter, although Environmental Protection Agency nominee Scott Pruitt had said he would return to the Obama-era decision. The automakers' argument doesn't entirely hold up. While the EPA did estimate that the US would fall short of efficiency goals due to a shift toward SUVs and trucks, the job claims are questionable. Why would making more fuel efficient vehicles necessarily cost jobs instead of pushing companies to do better? As it is, even a successful attempt to loosen guidelines may only have a limited effect. All of the brands mentioned here are pushing for greater mainstream adoption of electric vehicles within the next few years -- they may meet the Obama administration's expectations just by shifting more drivers away from gas power. This article by Jon Fingas originally appeared on Engadget, your guide to this connected life. Related Video: News Source: ReutersImage Credit: Daniel Acker/Bloomberg via Getty Images Government/Legal Green Chrysler Fiat GM Honda Hyundai Nissan Toyota Volkswagen Fuel Efficiency CAFE standards Trump

Chrysler 100 hatchback caught cruising around Santa Monica

Thu, 21 Feb 2013A coming hatchback said to be called the Chrysler 100 has been caught on video traipsing around Santa Monica by Autoblog reader Zach Dillman. Still wearing the scrapyard assemblage of Alfa Romeo Giulietta body panels as it was when spy photographers began capturing it last summer, its arrival date is still a question mark: some outlets have reported that it will go on sale this year, others have said it won't be in showrooms until 2016.

In fact, quite a few questions remain. Based on Fiat's Compact US Wide (CUSW) platform that supports the Dodge Dart and expected to be about the same size, the 100 is thought to be a small premium hatchback that will be priced above the Dart and below the Chrysler 200, with the idea that it can challenge the Ford Focus and Hyunda Elantra at the value end and the Buick Verano and Acura ILX at the premium end. Word is that there will be no sedan version.

It looks like there'll be plenty of gewgaws inside, with buttons for Adaptive Cruise Control, Lane Departure Warning, Forward Collision Warning and a button to toggle the traction control.

2015 Chrysler 200 nets 10,000 orders in first day

Thu, 15 May 2014Chrysler is having a "crazy impressive" launch for its 2015 200, claims company spokesperson Rick Deneau. Within the first two days of opening the order books, the Pentastar took over 17,000 requests for its swoopy new family sedan - 10,000 of them in the first day. The company says that's enough to keep its Sterling Heights, MI, factory running at full capacity through mid-July.

Deneau tells Autoblog that the last time he saw such an immediate popularity for a model was when Ram launched its 1500 EcoDiesel pickup. That truck sold out of its initial order allocation in just three days earlier this year. As you'd expect, "most of these are dealer orders," Deneau admits. In other words, they're not necessarily coming at the behest of individual customer, but that's standard operating procedure as dealers look to fill up their showrooms.

For the moment, it's too early to know which trim or engine will prove most popular in the new 200. At present, most of the ordered models are highly optioned. That's normal for a new vehicle launch, as early adopters tend to want all the bells and whistles and dealers want to show off their new stock by putting their best foot forward.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.038 s, 7971 u