2014 Chrysler 200 Series Lx on 2040-cars

Salt Lake City, Utah, United States

Engine:4 Cylinder Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:Automatic

For Sale By:Dealer

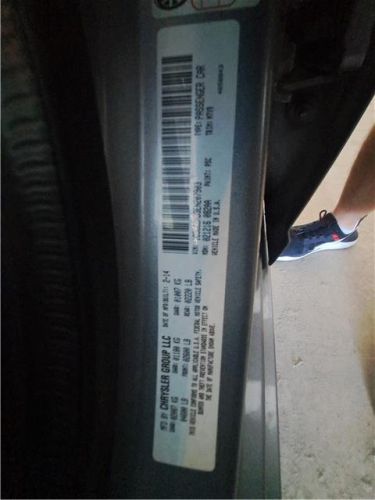

VIN (Vehicle Identification Number): 1C3CCBAB3EN207903

Mileage: 100930

Make: Chrysler

Trim: LX

Drive Type: FWD

Horsepower Value: 173

Horsepower RPM: 6000

Net Torque Value: 166

Net Torque RPM: 4400

Style ID: 361977

Features: ENGINE: 2.4L I4 PZEV 16V DUAL VVT

Power Options: Hydraulic Power-Assist Steering

Exterior Color: Silver

Interior Color: --

Warranty: Unspecified

Model: 200 Series

Chrysler 200 Series for Sale

2015 chrysler 200 series limited sedan 4d(US $11,499.00)

2015 chrysler 200 series limited sedan 4d(US $11,499.00) 2014 chrysler 200 series lx 4dr sedan(US $1,397.50)

2014 chrysler 200 series lx 4dr sedan(US $1,397.50) 2014 chrysler 200 series(US $5,495.00)

2014 chrysler 200 series(US $5,495.00) 2015 chrysler 200 series c(US $9,950.00)

2015 chrysler 200 series c(US $9,950.00) 2015 chrysler 200 series limited sedan 4d(US $9,800.00)

2015 chrysler 200 series limited sedan 4d(US $9,800.00) 2011 200 series limited 2dr convertible(US $8,995.00)

2011 200 series limited 2dr convertible(US $8,995.00)

Auto Services in Utah

Vargas Auto Service ★★★★★

Trav`z Tire & Repair ★★★★★

Tom Dye`s Automotive ★★★★★

Midas Auto Service Experts ★★★★★

Ken Garff Automotive Group ★★★★★

John`s Towing ★★★★★

Auto blog

Hyundai reportedly eyeing a takeover of FCA

Fri, Jun 29 2018The CEO of Hyundai Motor Group plans to launch a takeover bid for Fiat Chrysler ahead of the planned retirement of FCA Chief Executive Sergio Marchionne next spring, Asia Times reports, citing unnamed sources close the situation. CEO Chung Mong-koo will wait for an expected decline in the Italian-American automaker's shares to make his move. Hyundai isn't commenting on the rumors, unsurprisingly, but would presumably stand to benefit by gaining Chrysler's dealer network and the lucrative Jeep brand and probably Ram, too. An FCA spokeswoman in Auburn Hills told Autoblog the company had no comment. But like any story about a possible takeover, this one gets complicated with inside players — and President Trump's posturing on international trade issues. FCA has been the subject of takeover interest before, including by Hyundai, but Marchionne has denied a merger was likely, instead saying his company was in talks with the Korean automaker about a technical partnership. In 2015, Marchionne lobbied General Motors hard, but unsuccessfully, for a tie-up; he was also spurned by Volkswagen. Marchionne had repeatedly stressed the need for car companies to merge to decrease overcapacity and better afford the massive investments needed for things like autonomous and electric vehicles. In the case of Hyundai's reported interest, there is a cast of characters. One is Paul Singer, principal of the hedge fund Elliott Management, an activist shareholder with a $1 billion stake in Hyundai and a major owner of equities in Fiat's home turf of Italy. Then there is FCA Chairman John Elkann, who reportedly disagrees with Marchionne on a successor as CEO of Fiat Chrysler but has little interest in running the company himself and would prefer a merger. Compounding things is what the Trump administration would think of a further blending of Fiat Chrysler's international DNA, though a deal with a Korean automaker is thought to be more palatable to the president and members of Congress than by a Chinese conglomerate like Great Wall Motor, which has confirmed its interest in taking over all or parts of FCA. The full Asia Times piece is here. Related Video: News Source: Asia TimesImage Credit: REUTERS/Rebecca Cook Chrysler Fiat Hyundai Jeep RAM Sergio Marchionne FCA merger takeover

Chrysler 300 soldiers on for 2021 with pared-down range, higher price

Fri, Aug 28 2020Chrysler's last remaining sedan, the 300, will enter the 2021 model year with fewer trim levels and a higher price, according to a recent report. The 2021 model will be the second-generation 300's 10th year on the American market. Well-informed website CarsDirect received a dealer ordering guide, which reportedly confirms the Limited and 300C trims levels will not return for 2021. They're the two most expensive trims offered for 2020, and the publication added that removing them will likely mean upscale features like wood interior trim, Nappa leather upholstery, and quilted seats will no longer be available. It concluded the 2021 300 lineup will consist solely of the Touring and the 300S models, though it oddly made no mention of the Touring L. It doesn't sound like Chrysler will make any major visual or mechanical changes to the 300 — sorry, Hellcat fans. Available with rear- or all-wheel drive, the entry-level Touring model will be powered by the company's venerable 3.6-liter V6 tuned to make 292 horsepower and 260 pound-feet of torque. Marketed as a sportier sedan, the rear-wheel drive-only 300S will come standard with a 300-horse version of the V6, but buyers who want more power will be able to order a 5.7-liter Hemi V8 rated at 363 horsepower and 394 pound-feet of torque at extra cost. Pricing for the 2021 300 Touring will start at $31,940 including a $1,495 destination charge, a $405 increase over the 2020 model. Stepping up to the 300S will require spending $38,980, but the cost of the optional V8 will increase from $3,000 to $4,000, bringing its price to $42,890 once the aforementioned destination charge enters the equation. Keep in mind none of these figures are official, and Chrysler hasn't commented on the report. Most of the carmakers operating under the Fiat-Chrysler Automobiles (FCA) umbrella will announce the changes they're making for 2021 on September 1 — that's next Tuesday, so we won't have to wait long to find out what's in store for the 300. Chrysler has kept its lips sealed about what's next. Rumors claiming the sedan wouldn't live to see 2020 were evidently false, yet it can't remain in production for another decade. Sales fell by 37% to 29,213 units in 2019. Chrysler can either develop a third-generation model that will likely need to represent it in the sedan segment through the 2020s, or it can hike the path blazed by many of its rivals and throw in the towel.

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.