2013 Chrysler 200 Touring on 2040-cars

4990 University Parkway, Winston Salem, North Carolina, United States

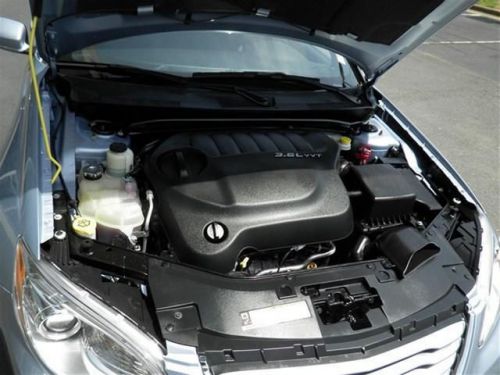

Engine:3.6L V6 24V MPFI DOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1C3CCBBG0DN706201

Stock Num: A25350

Make: Chrysler

Model: 200 Touring

Year: 2013

Exterior Color: Crystal Blue Pearlcoat

Interior Color: Black

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 28195

Don't bother thirsting for any other Sedan!! Move quickly! CARFAX 1 owner and buyback guarantee.. Priced below NADA Retail!!! What a value* All Around gem!!! Safety Features Include: ABS, Traction control, Curtain airbags, Passenger Airbag, Stability control...It has tons of features such as: Alloy Wheels, CD player, Cloth Seating, Tire Tread Depth; 9/32's, Power locks, Power windows, Climate control, Cruise control, Audio controls on steering wheel, Universal remote transmitter... Check us out at WWW.CUABS.COM OR CALL 888-789-4889. BEST PRICES, BEST PAYMENTS, ZERO RATE BUYDOWN NO HASSLE NO GIMMICK PRICING,OWNED BY CREDIT UNION OPEN TO THE PUBLIC, 3 DAY RETURN POLICY TRADE, BUY OR SELL OVER THE PHONE OR INTERNET. CREDIT UNION FINANCING,LESS THAN PERFECT CREDIT OK. FOR SPANISH CALL JULISSA 888-789-4889. Mention Cars.com!

Chrysler 200 Series for Sale

2013 chrysler 200 touring(US $14,998.00)

2013 chrysler 200 touring(US $14,998.00) 2013 chrysler 200 lx(US $14,697.00)

2013 chrysler 200 lx(US $14,697.00) 2013 chrysler 200 touring(US $17,989.00)

2013 chrysler 200 touring(US $17,989.00) 2015 chrysler 200 s

2015 chrysler 200 s 2015 chrysler 200 limited

2015 chrysler 200 limited 2015 chrysler 200 limited

2015 chrysler 200 limited

Auto Services in North Carolina

Willmon Auto Sales ★★★★★

Westend Auto Service ★★★★★

West Ridge Auto Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Automotive ★★★★★

Triangle Window Tinting ★★★★★

Auto blog

FCA compromises with France, moving Renault merger bid forward

Tue, Jun 4 2019FRANKFURT/PARIS – Renault directors were preparing to review Fiat Chrysler's $35 billion merger offer on Tuesday, after the Italian-American carmaker resolved differences with the French government overnight, three sources said. The compromise on French government influence over a combined FCA-Renault may clear the way for Renault's board to approve a framework agreement beginning the long process of a full merger, unless new issues surface at the meeting. France, Renault's biggest shareholder with a 15% stake, had been pressing for its own guaranteed seat on the new board and an effective veto on CEO appointments. But after late-night talks with FCA Chairman John Elkann, the French government has accepted a compromise that would see it occupy one of four board seats allocated to Renault, balanced by four FCA appointees, the sources said. Renault would also cede one of its two seats on a four-member CEO nominations committee to the French state, they said. Renault, FCA and the French government all declined to comment on the discussions. The same evening that the compromise was was negotiated, activist hedge fund CIAM wrote to the board of Renault to say it "strongly opposed" a planned $35 billion merger with Fiat Chrysler. Calling the deal "opportunistic," the fund said the current deal terms strongly favored Fiat Chrysler and offered no control premium. (Reporting by Arno Schuetze and Laurence Frost; additional reporting by Giulio Piovaccari in Milan and Simon Jessop; editing by Jason Neely and Rachel Armstrong) Government/Legal Chrysler Fiat Mitsubishi Nissan Renault merger

FCA axes Dodge Journey and Grand Caravan for 2021

Thu, Jul 2 2020FCA confirmed this week that Dodge will end production of both the Grand Caravan and the Journey after the 2020 model year, leaving the brand without a front-wheel drive crossover for the first time since 2008, and without a minivan for the first time in nearly four decades. "The year was 1983. Ronald Reagan was President of the United States of America. Lech Walesa was the Nobel Peace Prize Laureate. The Internet was created, and the first mobile phones were introduced to the public. U.S. astronauts completed the first space shuttle spacewalk; Michael Jackson performed the 'moonwalk.' The Baltimore Orioles won the World Series ... and Chrysler hit a home run with the introduction of the first minivan," FCA (then Chrysler LLC) said when it celebrated the minivan's 25th anniversary in 2008. 1984 Dodge Caravan View 9 Photos Since that anniversary, the Dodge variant of FCA's minivan has changed very little. It has received interior and powertrain improvements, including the introduction of the 3.6-liter "Pentastar" V6 in 2011, but its fundamental architecture has remained constant. The lack of attention it received came to light in 2019, when the outdated powertrain disqualified it from new-car sales eligibility in California. The prior 25 years notwithstanding, the story of the Dodge Journey is somewhat similar. Introduced in 2008 as a 2009 model, it was praised as one of Chrysler's better, more modern offerings when it hit dealerships. Like the Grand Caravan, it later benefited from an interior overhaul and the introduction of the 3.6-liter V6, but its bones remained unchanged for the duration. This lack of attention showed, as the Journey slipped from borderline-competitive to also-ran. 2010 Dodge Journey R/T View 3 Photos The discontinuation of the Grand Caravan and Journey eliminates 40% of the Dodge lineup. The two models represent more than 38% of the brand's sales volume so far in 2020. For 2021, only the Charger, Challenger and Durango will remain. Minivan buyers will still have options at Chrysler, which offers several variants of the Pacifica, including the new Voyager, which is a stripped-down model aimed at budget-conscious buyers who would previously have been drawn to the bare-bones Dodge. With this latest round of downsizing, Dodge will join Ram, Chrysler, Fiat and Alfa Romeo in the ranks of FCA brands offering four or fewer models; only Jeep will offer more. Related Video:

Chrysler 200 subtitles performance in latest round of advertising

Mon, 27 Oct 2014Every once in a while, we come across a car video narrated in a foreign language and subtitled in English. They usually center on foreign-made automobiles, but this latest series of videos comes straight from Detroit.

Airing for the first time during's NFL broadcasts, these four commercials for the 2015 Chrysler 200 were produced by Wieden + Kennedy Portland - the same advertising firm that created the now-legendary Eminem spot for the last-generation 200.

Each clip in the "Ready to Take on the World" campaign highlights a different aspect of the American sedan and is narrated in Japanese, German or Swedish - each with English subtitles - associating the 200's Japanese level of quality, German performance and Swedish safety standards. But while the clips are ostensibly set in Japan, Germany and Sweden, Automotive News reports that they were actually filmed at home in the US.