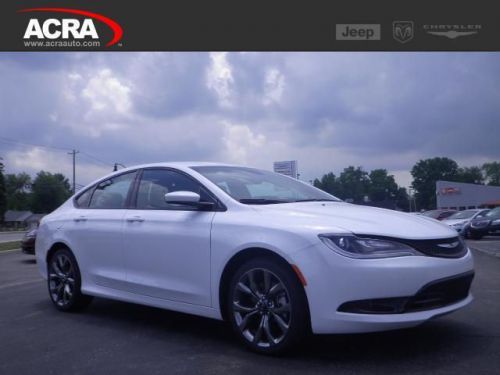

2012 Chrysler 200 Touring on 2040-cars

1200 IN-44, Shelbyville, Indiana, United States

Engine:3.6L V6 24V MPFI DOHC Flexible Fuel

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1C3CCBBGXCN205881

Stock Num: 131320A

Make: Chrysler

Model: 200 Touring

Year: 2012

Exterior Color: Mineral Gray

Interior Color: Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 37033

This 2012 Chrysler 200 is ready for the road with features like a Sunroof, an Auxiliary Audio Input, and Steering Wheel Audio Controls. It also has Child Locks, comedy, music, news & arts all at your fingertips with Satellite Radio, and an Auxiliary Power Outlet. As well as Automatic Climate Control, a Heated Front Windshield, and an MP3 Player / Dock. It also has Side Airbags for extra safety, Keyless Entry, and an Anti-Theft System. This vehicle also includes: Traction Control - Heated Mirror(s) - Steering Wheel Controls - Tire Pressure Monitoring System - Bucket Seats - Cruise Control - Front Wheel Drive - Garage Door Opener - Power Seat - Power Windows - Rear Head Air Bag - Disc Brakes - Air Conditioning - Power Locks - Power Mirrors - CD Single-Disc Player - Auto Headlamp - Compass - Leather Wrapped Steering Wheel - Cloth Seats - Center Console - Adjustable Head Rests - Flexible Fuel Capability - Fog Lights - Rear Window Defrost - Remote Trunk Release - Tilt Wheel - Vanity Mirrors - Trip Odometer - Digital Clock - Trip Computer - Center Arm Rest - Beverage Holder(s) For more photos and info on this vehicle visit our website http://www.acraauto.com >>> 4 LOCATIONS - PLEASE CALL 888-306-0471 FOR VEHICLE AVAILABILITY <<<

Chrysler 200 Series for Sale

2014 chrysler 200 limited(US $23,653.00)

2014 chrysler 200 limited(US $23,653.00) 2015 chrysler 200 s(US $26,140.00)

2015 chrysler 200 s(US $26,140.00) 2011 chrysler 200 limited(US $16,995.00)

2011 chrysler 200 limited(US $16,995.00) 2013 chrysler 200 touring(US $18,495.00)

2013 chrysler 200 touring(US $18,495.00) 2015 chrysler 200 s(US $26,484.00)

2015 chrysler 200 s(US $26,484.00) 2014 chrysler 200 limited(US $23,653.00)

2014 chrysler 200 limited(US $23,653.00)

Auto Services in Indiana

Zips Auto Repair ★★★★★

West Coliseum Auto Sales ★★★★★

WE Are Auto Care ★★★★★

Van Winkle Service Center ★★★★★

Stoops Buick GMC ★★★★★

Staples Pipe & Muffler ★★★★★

Auto blog

Fiat Chrysler and PSA boards sign off on merger

Tue, Dec 17 2019MILAN — The boards of French carmaker PSA, the owner of Peugeot, and Fiat Chrysler in separate meetings on Tuesday approved a binding agreement for a $50 billion merger, sources said. The two midsized carmakers announced plans six weeks ago for a tie-up to create the world's No. 4 carmaker and reshape the global industry. A merger is seen helping them deal with big challenges in the industry, including a global downturn in demand and the need to develop costly cleaner cars to meet looming anti-pollution rules. Both companies declined to comment. A source close to FCA had said earlier the two companies could formally announce the agreement early on Wednesday, followed by a conference call to explain further details later in the day. China's Dongfeng Motor Group, which now has a 12.2% equity stake in PSA, will have a reduced stake of around 4.5% in the merged group, two sources said, in a move that could help make regulatory approval easier. According to the deal approved by PSA's board on Tuesday, FCA's robot unit, Comau, will remain within the combined group rather than be spun off as was originally planned in October, the sources said. The new group will evaluate how to extract value from Comau. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA are expected to finalise a deal by the end of 2020 to create a group with 8.7 million annual vehicle sales, a source said. That would put it fourth globally behind Volkswagen AG, Toyota and the Renault-Nissan alliance. It was only six months ago that FCA abandoned merger talks with PSA's French rival Renault. FCA would gain access to PSA's more modern vehicle platforms, helping it meet tough new emissions rules, while Europe-focused PSA would benefit from FCA's profitable U.S. business featuring brands such as Ram and Jeep. However, the deal could still face close regulatory scrutiny, while governments in Rome, Paris and unions are all likely to be wary about potential job losses from a combined workforce of around 400,000. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company.

SRT belatedly claims Plymouth Prowler as one of its own

Wed, 19 Dec 2012Before Chrysler had Street and Racing Technology, it had Performance Vehicle Operations. What the two entities have in common, before SRT became its own brand, of course, is that each was created to take Chrysler and Dodge (and Plymouth, before it was unceremoniously killed off) vehicles to the next level of style and performance.

We'll leave the question of whether or not the old Plymouth (and later Chrysler) Prowler was ultimately a stylish, performance-oriented car to you, but the boys and girls currently leading the SRT charge at the Pentastar headquarters are keen to accept the retro-rod into the fold.

According to the automaker, all of SRT's current high-performance models owe a debt of gratitude to the old Prowler, due mostly to that car's use of lightweight bits and pieces and innovative construction techniques. If nothing else, the fact that the Prowler's frame is "the largest machined automotive part in history" is pretty cool. Read all the details here.

Chrysler stays IPO until 2014

Mon, 25 Nov 2013There will not be a Chrysler IPO in 2013. Fiat, according to a report from Forbes, has announced that it will not be able to make the American brand's initial public offering before the end of the year, saying that the short, five-week window that makes up the rest of 2013 is "not practicable."

Not surprisingly, the issue with the Chrysler IPO is the same as it's always been - a disagreement between parent company Fiat, which owns 58.5 percent of the Chrysler Group and a UAW healthcare trust, which owns 41.5 percent. Fiat wants to buy out the UAW VEBA healthcare trust, which is responsible for shouldering retiree healthcare costs, but the two sides are hung up on an actual price tag for the remaining two-fifths of the company.

The original idea saw an IPO as a way of setting a fair market price for the remaining shares, although it's not entirely clear what broke down and led to a delay of the IPO plan. As Forbes points out, by waiting until 2014, Chrysler could be risking a cool-off in the IPO market, which could mean less money in its pocket when the automaker finally goes public.