2012 Chrysler 200 Lx on 2040-cars

660 Huffman Mill Rd, Burlington, North Carolina, United States

Engine:2.4L I4 16V MPFI DOHC

Transmission:Automatic

VIN (Vehicle Identification Number): 1C3CCBAB7CN127341

Stock Num: 15V1946B

Make: Chrysler

Model: 200 LX

Year: 2012

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 32290

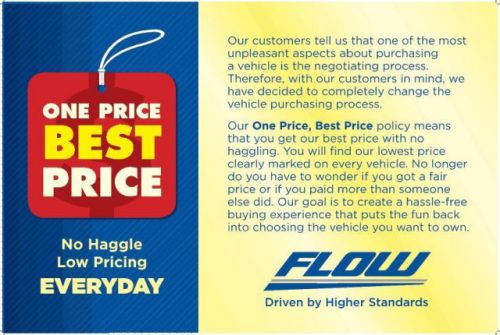

2.4L I4 PZEV 16V Dual VVT, Cloth, Easy to buy with One Price/Best Price!, FLOW CERTIFIED***, Panic alarm, Speed-Sensitive Wipers, and Steering wheel mounted audio controls. Are you interested in a simply great car? Then take a look at this gorgeous 2012 Chrysler 200. This 200 is nicely equipped with features such as Panic alarm, Speed-Sensitive Wipers, Steering wheel mounted audio controls, 4 Speakers, 4-Wheel Disc Brakes, ABS brakes, Air Conditioning, AM/FM radio, Anti-whiplash front head restraints, Brake assist, Bumpers: body-color, CD player, Delay-off headlights, Driver door bin, Driver vanity mirror, Dual front impact airbags, Dual front side impact airbags, Electronic Stability Control, Four wheel independent suspension, Front anti-roll bar, Front Bucket Seats, Front Center Armrest w/Storage, Front reading lights, Heated door mirrors, Illuminated entry, Low tire pressure warning, MP3 decoder, Outside temperature display, Overhead airbag, Passenger door bin, Passenger vanity mirror, Power door mirrors, Power steering, Power windows, Premium Cloth Bucket Seats, Radio: Media Center 130 CD/MP3, Rear anti-roll bar, Rear seat center armrest, Rear window defroster, Remote keyless entry, Security system, Speed control, Split folding rear seat, Tachometer, Telescoping steering wheel, Tilt steering wheel, Traction control, and Variably intermittent wipers. You just simply can''t beat a Chrysler product. Come see us at the all new Flow Volkswagen of Burlington. Our One Price / Best Price sales process makes buying a pre-owned vehicle easy and fast. All vehicles are certified and come with a warranty. Let us show you why we are the BEST place to shop and buy from in Burlington, NC. Call now...855-748-6869.

Chrysler 200 Series for Sale

2012 chrysler 200 lx(US $14,900.00)

2012 chrysler 200 lx(US $14,900.00) 2014 chrysler 200 s(US $37,230.00)

2014 chrysler 200 s(US $37,230.00) 2015 chrysler 200 c(US $32,125.00)

2015 chrysler 200 c(US $32,125.00) 2014 chrysler 200 limited(US $34,735.00)

2014 chrysler 200 limited(US $34,735.00) 2014 chrysler 200 limited(US $34,735.00)

2014 chrysler 200 limited(US $34,735.00) 2014 chrysler 200 s(US $37,230.00)

2014 chrysler 200 s(US $37,230.00)

Auto Services in North Carolina

Wheel Works ★★★★★

Vintage & Modern European Service ★★★★★

Victory Lane Quick Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

University Ford North ★★★★★

University Auto Imports Inc ★★★★★

Auto blog

Buy Ford and GM stock and make 5%

Tue, Feb 2 2016Want to make a five-percent return when 10-year treasuries are paying around two percent? Ford (F) and General Motors (GM) have solid balance sheets, strong cash flow, solid earnings, and growing markets. By all accounts, they are smart investments. But the market is down on these stocks. Why? Some of the stupid excuses include: They are cyclical companies The Detroit 3 have lost 3.5 million in sales since 2000 The world economy is shaky GM recently filed for bankruptcy Their markets have peaked They haven't changed their ways Let's take these criticisms one by one: They Are Cyclical Companies Yes, they are cyclical. Every company is cyclical. Every industry is cyclical. Some more than others, but not every company is immune from swings in the market. Banks used to be 'non-cyclical' leader, not anymore. Airline stocks are just as cyclical as auto stocks, yet they are trading at multiples greater than the auto industry. Why? And what accounts for the irrational stock price for Tesla (TSLA)? At least Ford (F) and General Motors (GM) make money and have positive cash flows. In fact, both companies have a net positive cash position. They have more cash on hand than liabilities. Auto sales in the United States hit a record 17.5 million vehicles in 2015. During the Great Recession, Ford (F) and General Motors (GM) cut their break even points to 10 million vehicles per year. Anything above an annual U.S. volume of 10 million vehicles is profit. And what a profit they make. Sales of Ford's F-150 continues to be the best-selling vehicle in the United States for over 30 years. Detroit 3 Have Lost 3.5 million in Sales Since 2000 Automotive News reports General Motors (GM), Ford (F) and Chrysler (FCA) have lost a combined 3.5 million vehicles sales since 2000. So how can they be making more money? Two big reasons – Fleet Sales and the UAW. Fleet Sales The Detroit 3 used to own car rental companies to keep their factories running. Ford owned Hertz (HTZ), General Motors owned all of National Car Rental and 29 percent of Avis, and Chrysler, the forerunner to Fiat Chrysler (FCA), used to own Thrifty Car Rental and Dollar Rent-A-Car. The Detroit 3 owned these rental companies to have a place to sell their bad product and keep their factories running. These were low margin sales, and in many cases, were money losers for the Detroit 3. They no longer own auto rental companies.

Zombie cars: A dozen discontinued vehicles people still buy new

Thu, Jan 6 2022Car models come and go, but as revealed by monthly sales data, once a car is discontinued, it doesn't just disappear instantly. And in the case of some models, vanishing into obscurity can be a slow, tedious process. That's the case with the 12 cars we have here. All of them have been discontinued, but car companies keep racking up "new" sales with them. There are actually more discontinued cars that are still registering new sales than what we decided to include here. We kept this list to the oldest or otherwise most interesting vehicles still being sold as new, including a supercar. We'll run the list in alphabetical order, starting with *drumroll* ... BMW 6 Series: 55 total sales BMW quietly removed the 6 Series from the U.S. market during the 2019 model year. It had been available in three configurations, a hardtop coupe, a convertible and a sleek four-door coupe-like shape. Â BMW i8: 18 total sales We've always had a soft spot for the BMW i8, despite the fact that it never quite fit into a particular category. It was sporty, but nowhere near as fast as similarly-priced competitors. It looked very high-tech and boasted a unique carbon fiber chassis design and a plug-in hybrid powertrain, but wasn't really designed for maximum efficiency or maximum performance. Still, the in-betweener was very cool to look at and drive, and 18 buyers took one home over the course of 2021. Â Chevy Impala: 750 total sales The Impala represented classic American tastes at a time when American tastes were shifting away from soft-riding sedans with big interior room and trunk space and into higher-riding crossovers. A total of 750 sales were inked last year. Â Chrysler 200: 15 total sales The Chrysler 200 was actually a pretty nice sedan, with good looks and decent driving dynamics let down by a lack of roominess, particularly in the back seat. Of course, as we said regarding the Chevy Impala, the number of Americans in the market for sedans is rapidly winding down, and other automakers are following Chrysler's footsteps in canceling their slow-selling four-doors. Even if Chrysler never really found its footing in the ultra-competitive midsize sedan segment, apparently dealerships have a few leftover 2017 200s floating around. And for some reason, 15 buyers decided to sign the dotted line to take one of these aging sedans home last year.

What car should James Robertson buy to drive his famous 21-mile commute?

Thu, Feb 5 2015The Internet has been abuzz this week with the story of Detroit resident James Robertson, the 56-year-old factory worker who has walked some 21 miles to work for the last 10 years. The Detroit Free Press brought Robertson's story to the fore, helping an online fundraising campaign to generate more than $275,000 (as of this writing). The original goal was just $5,000, or about enough to replace the used Honda that died on Robertson back in 2005, and left him walking. So, newly flush with funds, what's the perfect car for Robertson to buy? Let's look at the specifics of his situation, and try to pick out the best options. Here's what we know: Robertson's commute is (famously) 21 miles; he lives in downtown Detroit (for now) and seems pretty humble, so something very flashy is probably out; former Honda aside, his ties to the city (and statements about being a Ford fan) seem to indicate a Detroit Three company product is best; he's a single guy with a girlfriend; he's got to deal with Michigan weather, and the sometimes fickle snow removal processes in The D. Here are some choices: Ford F-150 Robertson is on record as being a Taurus fan, and after a decade of walking I've no doubt that the big sedan would offer a cozy respite. Still, as a car guy and a student of the industry, I'd have a hard time recommending a sedan so clearly in need of replacement. Especially when The Blue Oval has such great stuff within the rest of its roster. The 2015 F-150 seems almost perfect for Robertson. Opting for either of the new EcoBoost V6 engines should help keep fuel bills in reasonable check, while healthy ride height and four-wheel drive will get him to work on time even during the snowiest of snow days. Better still, with a fat options sheet and car-like ride quality, Robertson can have just about every amenity he might want, in a package that won't disrespect his blue-collar roots. Chevrolet Colorado You guys saw this one coming, right? The smaller footprint of the midsize Chevy pickup, relative to some of the other options here, should be an advantage for urban parking and driving. And again, 4x4 is an option for the nasty weather, the running costs should stay pretty low and there aren't many tech/luxury features that can't be had in-cabin. I'd go ahead and splash out on the Crew Cab bodystyle, too, just in case Robertson feels like starting a carpool.