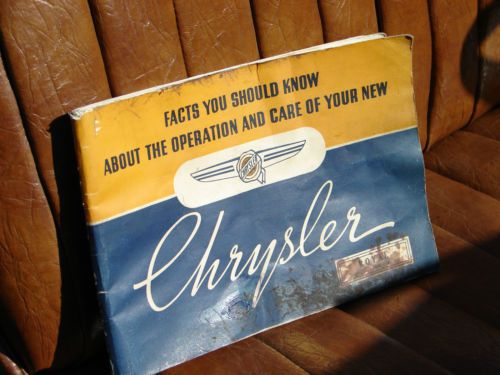

1938 Chrysler Royal on 2040-cars

Stevens Point, Wisconsin, United States

|

Restored Chrysler 4-door convertible touring car. Refinished in Chinese yellow with gold trim. Custom glass window vents and wood windshield frame. Smooth shifting three speed transmission with overdrive. Deluxe heater and radio finish off art deco themed dash. Updated with electric fuel pump and alternator makes for a reliable high quality driver. Engine fitted with period correct Edmunds performance aluminum head and intake twin Stromberg carbs. This car has a very sporty package and a blast to drive. Questions or concerns please call 715-459-9129 (central time). No e-mails and the reserve price will not be given out.

|

Chrysler 200 Series for Sale

2006 chrysler 300 srt-8 6.1l hemi leather sunroof nav! texas direct auto(US $14,980.00)

2006 chrysler 300 srt-8 6.1l hemi leather sunroof nav! texas direct auto(US $14,980.00) 2005 chrysler crossfire limited convertible 2-door 3.2l(US $14,500.00)

2005 chrysler crossfire limited convertible 2-door 3.2l(US $14,500.00) 2005 chrysler crossfire - red - low miles - garage kept(US $9,500.00)

2005 chrysler crossfire - red - low miles - garage kept(US $9,500.00) 2003 pt cruiser, no reserve

2003 pt cruiser, no reserve 1999 chrysler sebring lxi coupe 2-door 2.5l(US $1,800.00)

1999 chrysler sebring lxi coupe 2-door 2.5l(US $1,800.00) 2008 touring used 3.5l v6 24v automatic rwd sedan

2008 touring used 3.5l v6 24v automatic rwd sedan

Auto Services in Wisconsin

Wisconsin Engine Parts Warehouse ★★★★★

West View Repair LLC. ★★★★★

Waukegan Gurnee Glass Company ★★★★★

Stommel Service ★★★★★

Stereo Doctors ★★★★★

Safelite AutoGlass - Green Bay ★★★★★

Auto blog

Fiat Chrysler to pay $800M in Jeep, Ram emissions cheating case

Thu, Jan 10 2019WASHINGTON — Fiat Chrysler Automobiles NV has agreed to a settlement worth about $800 million to resolve claims from the U.S. Justice Department and state of California that it used illegal software that produced false results on diesel-emissions tests, but still faces an ongoing criminal probe. The hefty penalty is the latest fallout from the U.S. government's stepped-up enforcement of vehicle emissions rules after Volkswagen AG admitted in September 2015 to intentionally evading emissions rules. The Fiat Chrysler settlement includes $311 million in total civil penalties to U.S. and California regulators, up to $280 million to resolve claims from diesel owners, and extended warranties worth $105 million. It covers 104,000 Fiat Chrysler 2014-16 Ram 1500 and Jeep Grand Cherokee diesels, the Justice Department said. Regulators said Fiat Chrysler used "defeat devices" to cheat emissions tests in real-world driving. Fiat Chrysler said in a statement that "the settlements do not change the Company's position that it did not engage in any deliberate scheme to install defeat devices to cheat emissions tests." The company did not admit liability. "You wouldn't pay $311 million total dollars to the federal government in civil penalties if there were not a serious problem," U.S. assistant attorney general Jeff Clark told a news conference. The settlement also includes $72.5 million for state civil penalties, and $33.5 million in payments to California to offset excess emissions and consumer claims. German auto supplier Robert Bosch GmbH, which provided the emissions control software for the vehicles, also agreed to pay $27.5 million to resolve claims from diesel owners. Owners will receive an average of $2,800 to obtain software updates as part of the emissions recall, Fiat Chrysler said. Elizabeth Cabraser, a lawyer for the owners, said the "substantial cash compensation" will ensure that consumers get the recall fix. Bosch, which also provided diesel emissions software to Volkswagen, also agreed to pay $103.5 million to settle claims with 47 U.S. states that said the supplier "enabled" the cheating and should have known its customers would use the software improperly, the New York Attorney General's Office said.

FCA nears plea deal in diesel emissions fraud probe

Wed, Oct 27 2021Fiat Chrysler Automobiles (FCA) is nearing an agreement to plead guilty to criminal conduct to resolve a multiyear emissions fraud probe surrounding Ram pickup trucks and Jeep sport-utility vehicles with diesel engines, people familiar with the matter said. FCA lawyers and U.S. Justice Department officials are brokering a plea deal that could be unveiled in coming weeks and include financial penalties totaling between $250 million and $300 million, the people said. Such a resolution with FCA, which is now part of Stellantis NV, would come more than four years after Volkswagen AG pleaded guilty to criminal charges to resolve its own diesel-emissions scandal involving nearly 600,000 vehicles.It would also mark the final significant chapter in the government crackdown on automakers' emissions practices that was precipitated by Volkswagen's deception, which became known as "Dieselgate." The FCA investigation focuses on roughly 100,000 diesel-powered vehicles that allegedly evaded emissions requirements. The plea negotiations are fluid and some terms, including the size of any financial penalties, could change as discussions continue, the people said. Justice Department officials are preparing paperwork that will likely be negotiated with FCA to finalize the plea deal, which could result in changes and also present an outside chance for the agreement to fall apart, the people said. A plea agreement would cap a series of investigations dating back to 2015 surrounding diesel-powered vehicles in FCA's U.S. lineup. The current criminal investigation targets the U.S unit of the Italian-American automaker. The affected vehicles span model years 2014 to 2016. Representatives for FCA parent Stellantis and the Justice Department declined to comment. The scandals over emissions cheating tarnished diesel technology and accelerated the industry's shift to electric vehicles. The European automakers had promoted "clean diesel" technology as a way to reduce carbon dioxide emissions and ease a transition to an all-electric future. When regulators on both sides of the Atlantic uncovered evidence that diesel vehicles polluted far more in real world driving, the argument for a slower transition to battery electric vehicles was shredded. Now, automakers are accelerating battery electric vehicle development to comply with tougher, post-Dieselgate pollution standards.

Dodge Challenger spied exercising supercharged Hellcat Hemi V8

Wed, 23 Oct 2013One of the prime complaints against the Dodge Challenger is that, even in SRT8 guise, its 470 horsepower is responsible for hauling over 4,200 pounds of vehicle. For comparison, the 420 hp in the Ford Mustang GT only has to deal with 3,618 lbs. Things only get worse from there, as the higher-performance variants of both the Mustang and the Chevrolet Camaro are far more powerful than an SRT8 without adding on much heft.

So what is Chrysler to do? The correct answer is add a whole lot more grunt to its hefty two-door and even the odds. That's where the all-new Hellcat engine comes into play. We reported on this engine in May, and suggested that the Hellcat, a supercharged powerplant based on a 6.4-liter V8, would easily generate 500 to 570 hp and could likely arrive boasting more than 600 ponies.

Chrysler's ace in its sleeve has now been spied testing, with a number of Hellcat-equipped Challengers running the potent new engine both in more urbanized areas and under the sun of Death Valley. The hoods on these testers have been raised to accommodate the engine, and that camouflage over the fascias of these prototypes is there to hide a larger air intake. We also note what appears to be a new split grille under wraps. As for power output, our spies are now suggesting a Viper-equalling 640 hp from the Hellcat-equipped cars.