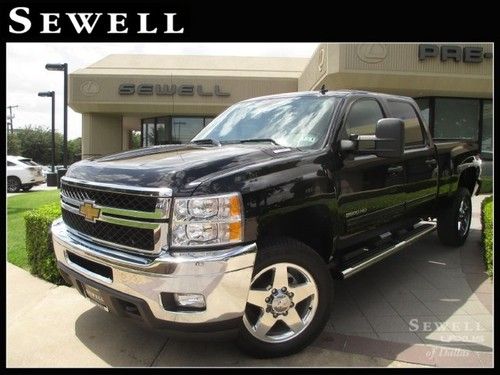

No Reserve Clean Carfax Lifted Navigation Rear Dvd Backup Camera/sensors on 2040-cars

Houston, Texas, United States

Fuel Type:Diesel

For Sale By:Dealer

Transmission:Automatic

Body Type:Pickup Truck

Cab Type (For Trucks Only): Crew Cab

Make: Chevrolet

Warranty: Vehicle has an existing warranty

Model: Silverado 2500

Mileage: 18,919

Options: Leather Seats

Sub Model: 4WD LTZ

Safety Features: Side Airbags

Exterior Color: Black

Power Options: Power Windows

Interior Color: Black

Number of Cylinders: 8

Vehicle Inspection: Inspected (include details in your description)

Chevrolet Silverado 2500 for Sale

2005 chevrolet silverado 2500 hd with 2003 carriage cameo 5th wheel trailer(US $36,000.00)

2005 chevrolet silverado 2500 hd with 2003 carriage cameo 5th wheel trailer(US $36,000.00) 2011 chevrolet silverado 2500 4wd lt 6.6l duramax backup cam 20-inch wheels

2011 chevrolet silverado 2500 4wd lt 6.6l duramax backup cam 20-inch wheels 2012 crew cab, short, box, heated leather, tow hitch, grill guard, spray liner,

2012 crew cab, short, box, heated leather, tow hitch, grill guard, spray liner, Chevrolet : 2006 silverado 2500hd reg cab knapheide service body low miles sharp

Chevrolet : 2006 silverado 2500hd reg cab knapheide service body low miles sharp

2500hd ltz diesel long bed 6.6l fabtech lift 35'' mud 44,462 miles leather

2500hd ltz diesel long bed 6.6l fabtech lift 35'' mud 44,462 miles leather

Auto Services in Texas

Wolfe Automotive ★★★★★

Williams Transmissions ★★★★★

White And Company ★★★★★

West End Transmissions ★★★★★

Wallisville Auto Repair ★★★★★

VW Of Temple ★★★★★

Auto blog

GM won't really kill off the Chevy Volt and Cadillac CT6, will it?

Fri, Jul 21 2017General Motors is apparently considering killing off six slow-selling models by 2020, according to Reuters. But is that really likely? The news is mentioned in a story where UAW president Dennis Williams notes that slumping US car sales could threaten jobs at low-volume factories. Still, we're skeptical that GM is really serious about killing those cars. Reuters specifically calls out the Buick LaCrosse, Cadillac CT6, Cadillac XTS, Chevrolet Impala, Chevrolet Sonic, and the Chevrolet Volt. Most of these have been redesigned or refreshed within the past few model years. Four - the LaCrosse, Impala, CT6, and Volt - are built in the Hamtramck factory in Detroit. That plant has made only 35,000 cars this year - down 32 percent from 2016. A typical GM plant builds 200,000-300,000 vehicles a year. Of all the cars Williams listed, killing the XTS, Impala, and Sonic make the most sense. They're older and don't sell particularly well. On the other hand, axing the other three seems like an odd move. It would leave Buick and Cadillac without flagship sedans, at least until the rumored Cadillac CT8 arrives. The CT6 was a big investment for GM and backing out after just a few years would be a huge loss. It also uses GM's latest and best materials and technology, making us even more skeptical. The Volt is a hugely important car for Chevrolet, and supplementing it with a crossover makes more sense than replacing it with one. Offering one model with a range of powertrain variants like the Hyundai Ioniq and Toyota Prius might be another route GM could take. All six of these vehicles are sedans, Yes, crossover sales are booming, but there's still a huge market for cars. Backing away from these would be essentially giving up sales to competitors from around the globe. The UAW might simply be publicly pushing GM to move crossover production to Hamtramck to avoid closing the plant and laying off workers. Sales of passenger cars are down across both GM and the industry. Consolidating production in other plants and closing Hamtramck rather than having a single facility focus on sedans might make more sense from a business perspective. GM is also trying to reduce its unsold inventory, meaning current production may be slowed or halted while current cars move into customer hands. There's a lot of politics that goes into building a car. GM wants to do what makes the most sense from a business perspective, while the UAW doesn't workers to lose their jobs when a factory closes.

Buick takes top spot in 2022 J.D. Power Initial Quality Study

Tue, Jun 28 2022People, economies, and supply chains weren't the only things continuing to get sick over the past year. The 2022 J.D. Power Initial Quality Study (IQS) is out, showing the average rate of problems per 100 vehicles (PP100) during the first 90 days of ownership increased overall. The average figure for the 32 ranked manufacturers in 2020 was about 166 problems per 100 vehicles. In the 2021 IQS, that dropped to an average of 162. This year, the average jumps to 180 problems. J.D. Power says that figure is a record high over the 36-year history of the study. Buick leapt to the top of the rankings this year with the fewest issues, at 139 problems per 100 vehicles in the first 100 days of ownership. After Dodge became the first American automaker to lead the IQS in 2020, followed by Ram in 2021, this year marks a three-peat for U.S. carmakers. Dodge took second this year at 143 PP100, Chevrolet third with 147 PP100, Genesis the first luxury maker on the chart in fourth with 156 PP100. Between February and May, this year's study gathered responses to 223 questions from more than 84,000 new 2022-model-year car owners and lessees. The questions are designed to zero in on real-world problems new owners encounter with nine categories of vehicle features: Infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; and climate. As has been the case in the past few year, infotainment has proved to be the most problematic bugbear making scores worse. Considering features individually, six of 10 of the worst problem areas dealt with infotainment, causing infotainment's score of 45 PP100 to be 19.5 PP100 worse than the second-placed feature. Consumers ranked getting Android Auto and Apple CarPlay to connect reliably as the most troublesome. GM didn't just score with Buick, which was one of only nine of the 33 ranked brands to show improvement this year. The conglomerate earned first place with the fewest PP100 among all the automaker groups, and scored the most model-level awards with nine, ahead of BMW with eight and Hyundai Group with three. This year's study again showed a gap between luxury and mass-market makers, thought to be down to the amount of tech in luxury vehicles that consumers aren't properly informed about or that doesn't act as expected — that latter issue exacerbated by the chip shortage.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.