Lt Diesel 6.6l Cd 4x4 Tow Hooks Power Steering Abs 4-wheel Disc Brakes A/c on 2040-cars

Alliance, Ohio, United States

Body Type:Pickup Truck

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Make: Chevrolet

Model: Silverado 2500

Warranty: Unspecified

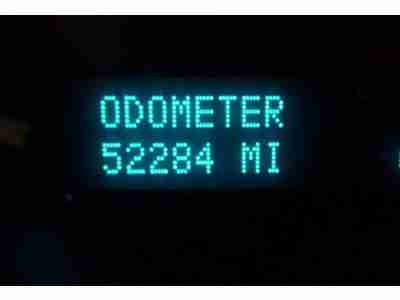

Mileage: 52,259

Sub Model: LT

Options: CD Player

Exterior Color: White

Power Options: Power Windows

Interior Color: Other

Number of Cylinders: 8

Chevrolet Silverado 2500 for Sale

2005 chevrolet silverado 2500hd duramax fabtech lift kit weld many many extras !(US $19,995.00)

2005 chevrolet silverado 2500hd duramax fabtech lift kit weld many many extras !(US $19,995.00) 2012 chevrolet 2500hd duramax **one owner!** crew cab lt leather & long box z71!(US $45,317.00)

2012 chevrolet 2500hd duramax **one owner!** crew cab lt leather & long box z71!(US $45,317.00) Crewcab 4x4 lift kit low miles navigation moonroof lowmiles leather heated seats

Crewcab 4x4 lift kit low miles navigation moonroof lowmiles leather heated seats Lt 6.0l 4x4 engine vortec z71 off road backup camera low miles

Lt 6.0l 4x4 engine vortec z71 off road backup camera low miles 2005 chevrolet 2500hd exented cab pickup, white, 6.0 l v-8(US $9,000.00)

2005 chevrolet 2500hd exented cab pickup, white, 6.0 l v-8(US $9,000.00) 07 chevy classic k2500 hd crew cab lt 4x4 6.6l duramax diesel 6 spd allison auto

07 chevy classic k2500 hd crew cab lt 4x4 6.6l duramax diesel 6 spd allison auto

Auto Services in Ohio

Yocham Auto Repair ★★★★★

Williams Auto Parts Inc ★★★★★

West Chester Autobody ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Sweeting Auto & Tire ★★★★★

Auto blog

GM wants to have 10 plug-in models in China in five years

Sun, Apr 24 2016Last we checked, General Motors was selling all of three plug-in vehicle models in its home country of the US, and is prepared to make the Chevrolet Bolt EV available on these shores later this year. So it's notable that the automaker is hatching plans to have at least 10 plug-in variants for sale in China within the next five years, according to Hybrid Cars. Which plug-ins are coming remains a mystery. GM started selling a hybrid version of the Buick LaCrosse in China this month. The strategy makes sense, as China is now the world's largest car market, and accounts for about a third of GM's annual revenue. The automaker, which operates in China under the SAIC-GM and SAIC-GM-Wuling joint ventures, sells cars there under the Chevrolet, Buick, Cadillac, and Boujun badges, and has been doing so for the better part of two decades. Most recently, GM started selling a hybrid version of the Buick LaCrosse in China this month. What we do know is that GM is building its Cadillac CT6 Plug-in Hybrid in China, with distribution to be split between China and the US. That model, which is scheduled to start sales by the end of the year, is being built overseas because of a combination of Chinese government support for new-energy vehicle technology through incentives and the fact that battery-pack maker LG Chem makes most of its cells in nearby South Korea. The plug-ins are part of a broader plan by General Motors to either introduce or substantially tweak about 60 models by the end of the decade. With such new models, GM looks to boost unit sales by as much as five percent a year for the next few years. As for the other nine plug-in models slated for China by 2021, the company is mum. GM spokesman Dan Flores declined to comment to AutoblogGreen. Related Video: Featured Gallery 2016 Cadillac CT6: First Drive View 32 Photos News Source: Hybrid Cars Green Cadillac Chevrolet GM Electric Hybrid PHEV

Chevrolet Bolt EV Concept foreshadows an affordable, 200-mile EV future [w/videos]

Mon, Jan 12 2015Confirming numerous reports and rumors, Chevrolet introduced the Bolt EV Concept, "a vision" of a 200-mile EV with an entry price of around $30,000. Those lofty promises ride atop a funky crossover that made its global debut at the 2015 Detroit Auto Show. The orange five door features a spacious greenhouse, complemented by a glass roof and thin D-pillar. A narrow grille and slim LED headlights crown a high fascia that leaves little ahead of its front axle. It's a similar story in back, as General Motors' design boss Ed Welburn sought to limit overhangs and maintain the Bolt's small footprint. "Form and function have never meshed so well together," Welburn said. "No compromises were made when it came to aesthetics and the elements that contribute to the Bolt EV concept's range, resulting in a unique proportion that's sleek, efficient and obviously a Chevrolet." The cabin is not unlike current Chevrolet compacts, with the MyLink touchscreen and a detached instrument cluster dominating the sparse dash. Unlike cars like the Sonic, which features a similar design for its instrument cluster, A Volt-like display is found over the steering column. "The Bolt EV concept is a game-changing electric vehicle designed for attainability, not exclusivity," CEO Mary Barra said. "Chevrolet believes electrification is a pillar of future transportation and needs to be affordable for a wider segment of customers." Take a look at both the official gallery of Bolt images, as well as our live shots. And then scroll on down for more comments from GM brass, in the official press release. Chevrolet Bolt EV Concept Signals Brand's EV Strategy Affordable, long-range concept builds on brand's electrification leadership 2015-01-12 DETROIT – Chevrolet today made a significant statement on its commitment to electrification with the introduction of the Bolt EV concept – a vision for an affordable, long-range all-electric vehicle designed to offer more than 200 miles of range starting around $30,000. "The Bolt EV concept is a game-changing electric vehicle designed for attainability, not exclusivity," said General Motors CEO Mary Barra. "Chevrolet believes electrification is a pillar of future transportation and needs to be affordable for a wider segment of customers." Leveraging the electrification prowess established by Volt and Spark EV, the Bolt EV concept is designed to offer long-range performance in all 50 states and many global markets.

Chevrolet only automaker to win EPA's 2015 Climate Leadership Awards

Fri, Feb 27 2015Chevrolet was the only automaker to be on the list of entities for the US Environmental Protection Agency (EPA) Climate Leadership Awards. Of course, the accolades had nothing to do with any vehicle's tailpipe emissions, General Motors can still be proud. The automaker is engaging in what it calls the Chevrolet Clean Energy Campus Campaign. Chevy is working with the US Green Building Council, among other groups, to find ways for buildings in primary and secondary schools as well as college campuses to reduce their collective carbon footprint via better design. The EPA pointed out the "carbon performance methodologies" used by Chevrolet to run the program and spur lower emissions from its campus partners. The effort is part of Chevrolet's broader goal to reduce greenhouse-gas emissions by as many as 8 million metric tons of CO2. And it's going to take more than bunch of plug-in Volt and Spark EVs to do that. Other entities feted by the EPA include UPS, Bank of America, the cities of San Francisco and Oakland, Clorox and Tiffany & Co. Yes, Tiffany. Take a look at the EPA's press release below, and find out more information on Chevy's program here. UPS, Bank of America, SC Johnson Among 16 Organizations across the U.S. Recognized for Climate Action / EPA also recognizes Chevrolet Clean Energy Campus Campaign, San Diego Regional Climate Collaborative in new Innovative Partnerships Category WASHINGTON – From an innovative partnership enabling colleges to sell carbon credits to fund clean energy projects on campuses to some of the country's leading corporations setting and exceeding aggressive emission reduction goals, the U.S. Environmental Protection Agency's Climate Leadership Award winners announced today are demonstrating that innovative actions to combat climate change are smart business decisions. Sixteen organizations and one individual representing a wide array of industries from finance and manufacturing to retail and technology show exemplary corporate, organizational, and individual leadership in response to climate change. "I am proud to recognize our Climate Leadership Award winners for their actions to reduce the harmful carbon pollution that's fueling climate change," said EPA Administrator Gina McCarthy. "Our winners are demonstrating that a healthy environment and a strong economy go hand in hand.