2010 Chevrolet Silverado 1500 Ltz Crew Cab Pickup 4-door 5.3l on 2040-cars

Wichita Falls, Texas, United States

Body Type:Crew Cab Pickup

Vehicle Title:Clear

Engine:5.3L 5328CC 325Cu. In. V8 FLEX OHV Naturally Aspirated

Fuel Type:FLEX

For Sale By:Private Seller

Make: Chevrolet

Model: Silverado 1500

Warranty: Vehicle has an existing warranty

Trim: LTZ Crew Cab Pickup 4-Door

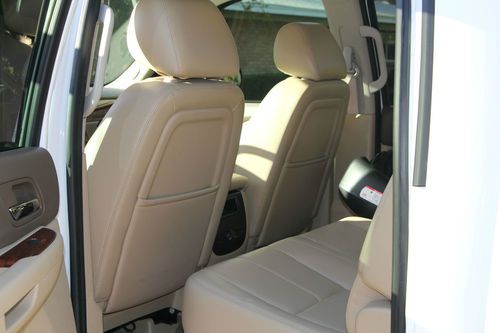

Options: Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 28,352

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: LTZ

Exterior Color: White

Disability Equipped: No

Interior Color: Tan

Number of Cylinders: 8

I've got my 2010 Chevrolet Silverado for sale. I have babied this truck. It is garage kept, non-smoker, very low miles. It still has roughly 8,000 miles left on the factory warranty. The Line-X bedliner is less than three months old. It has running boards, leather seats, Bose stereo system, towing package, etc. There are no major dents or scratches as I've made sure to avoid any door dings and kept in the garage every night that I've owned it. This is a one-owner vehicle. It has never been in an accident and has a clean Carfax report. I am only selling because I am moving across the country. I am asking $27,000 or best offer. Please let me know if you have any questions.

Chevrolet Silverado 1500 for Sale

Blw invoice new 13 ltz owner demo sale 4wd 4x4 black chrome camera leather(US $39,766.00)

Blw invoice new 13 ltz owner demo sale 4wd 4x4 black chrome camera leather(US $39,766.00) 2011 chevrolet silverado 1500 lt extended cab pickup 4x4 5.3l(US $26,999.00)

2011 chevrolet silverado 1500 lt extended cab pickup 4x4 5.3l(US $26,999.00) 2008 chevrolet silverado 1500 ltz extended cab pickup 4-door 5.3l

2008 chevrolet silverado 1500 ltz extended cab pickup 4-door 5.3l 1986 chevy silverado c20 - 3/4 ton 350 small block

1986 chevy silverado c20 - 3/4 ton 350 small block 2001 chevy silverado z71 excellent condition!(US $11,500.00)

2001 chevy silverado z71 excellent condition!(US $11,500.00) 2000 chevrolet silverado 1500 z71 ls extended cab pickup 4-door 5.3l

2000 chevrolet silverado 1500 z71 ls extended cab pickup 4-door 5.3l

Auto Services in Texas

WorldPac ★★★★★

VICTORY AUTO BODY ★★★★★

US 90 Motors ★★★★★

Unlimited PowerSports Inc ★★★★★

Twist`d Steel Paint and Body, LLC ★★★★★

Transco Transmission ★★★★★

Auto blog

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

GM promises to add 20 EVs and fuel-cell cars to lineup, paid for by SUVs

Mon, Oct 2 2017DETROIT — General Motors outlined plans on Monday to add 20 new battery electric and fuel-cell vehicles to its global product lineup by 2023, financed by robust profits from sales of gasoline-fueled trucks and sport utility vehicles in the United States and China. "General Motors believes in an all-electric future," GM global product development chief Mark Reuss said on Monday during a briefing at the company's suburban Detroit technical center. Future generations of GM electric vehicles "will be profitable," Reuss said, but added it was not clear when GM could make all its new vehicle offerings zero-emission electric cars. Regulators in China and some European countries have floated proposals to ban internal combustion engines by 2030 or 2040. "We will continue to make sure our internal combustion engines will get more and more efficient," Reuss said. GM shares were up more than 4 percent in midday New York trading on positive comments from Rod Lache, auto analyst at Deutsche Bank. Automakers, including electric vehicle market leader Tesla, lose money on electric cars because battery costs are still higher than comparable internal combustion engines. The company offered sneak peeks of three EV prototypes: a Buick SUV, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM funds its forays into new technology using a river of cash generated by old-technology vehicles popular with its core customer base in the United States heartland. In comparison, Tesla has burned through an estimated $10 billion in cash and has yet to show a full year profit. GM earned more than 90 percent of its $12.5 billion in pretax profits last year in North America, amid robust demand for its lineup of large sport utility vehicles and pickup trucks. The company's profitable operations in China rely on consumer demand for an expanding lineup of gasoline powered SUVs. GM has previously announced plans to make some of its future electric vehicles capable of driving themselves in robot taxi fleets. The company offered sneak peeks of three electric vehicle prototypes: a Buick brand sport utility vehicle, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM collaborated with Korean battery maker LG Chem to build the Bolt battery system. Company officials did not say what companies would supply batteries for the larger fleet of vehicles promised by 2023. Fuel-cell vehicles will also play a role in GM's future, the company said.

GM extends production cuts, affects Cadillacs, Camaro and Acadia

Thu, Apr 8 2021General Motors is extending production cuts at some of its North America factories due to a chip shortage that has roiled the global automotive industry, the U.S. carmaker said on Thursday. The move's impact has been baked into GM's prior forecast that the shortage could shave up to $2 billion off this year's profit. GM's Lansing Grand River assembly in Michigan will extend its downtime through the week of April 26. The plant makes Chevrolet Camaros and Cadillac CT4 and CT5 sedans. It has been out of action since March 15. GM's Spring Hill assembly in Tennessee will shut down for two weeks starting the week of April 12. The plant makes the Cadillac XT5, XT6 and GMC Acadia. The company said it has not taken downtime or reduced shifts at any of its more profitable full-size truck or full-size SUV plants due to the shortage. The news was first reported by CNBC. Reporting by Ankit Ajmera in Bengaluru; Editing by Maju Samuel and Sriraj Kalluvila