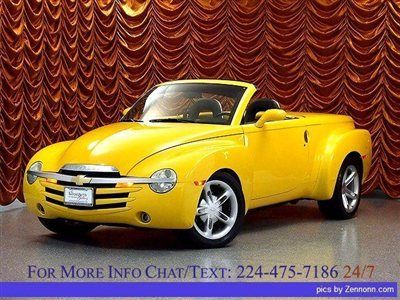

2003 Chevrolet Ssr Convertible 2-door 5.3l on 2040-cars

Festus, Missouri, United States

|

We have owned this vehicle for 3 years. Before it had at least 2 previous owners both who were collectors of autos, not drivers. It had appx. 9,000 mile on it when we purchased it. Now it has appx 12,600. This vehicle is in very good condition. I need to clean out some toys and this is the one my wife and I decided that must go. |

Chevrolet SSR for Sale

2006 chevrolet ssr final production run # 352

2006 chevrolet ssr final production run # 352 525 hp magna supercharged ls6 all the bells & whistles super low miles(US $34,995.00)

525 hp magna supercharged ls6 all the bells & whistles super low miles(US $34,995.00) 1 owner very very low miles clean carfax leather multi disc player heated seats(US $28,900.00)

1 owner very very low miles clean carfax leather multi disc player heated seats(US $28,900.00) 2005 used 6l v8 16v automatic rwd premium

2005 used 6l v8 16v automatic rwd premium Reg cab 116.0" wb ls low miles truck automatic gasoline 5.3l v8 sfi slingshot ye

Reg cab 116.0" wb ls low miles truck automatic gasoline 5.3l v8 sfi slingshot ye 2005 chevrolet ssr deluxe

2005 chevrolet ssr deluxe

Auto Services in Missouri

West 60 Auto Parts Inc ★★★★★

Wes Jerde Performance Center ★★★★★

Waterloo Automotive ★★★★★

The Dent Devil of St Louis ★★★★★

Springfield Yamaha ★★★★★

Spectrum Glass Inc ★★★★★

Auto blog

2016 Green Truck of the Year, Commercial Green Car of the Year finalists

Sat, Oct 24 2015Not only are commercial-grade haulers getting more green love lately, they're getting more different kinds of green love. The 2016 Green Truck of the Year, the second time the award has been handed out, is being decided by judges from Green Car Journal and the San Antonio Auto & Truck Show. This year the award is joined by the new 2016 Commercial Green Car of the Year, which crowns one of the little vans increasingly used by small business as cargo and delivery vehicles. The Green Truck of the Year finalists are the Chevrolet Colorado Duramax (pictured), Ford F-150, GMC Canyon Duramax, Nissan Titan XD, and Toyota Tacoma. The first three of those were on last year's list, but since they are completely new or upgraded for 2016 - Ford with its all-aluminum body, the General Motors twins with the new diesel Duramax engine - they qualify for entry again. The Ram 1500 EcoDiesel won last year. The Commercial Green Car finalists are the Chevrolet City Express, Ford Transit Connect, Mercedes-Benz Metris, Nissan NV200, and Ram ProMaster City. You can read more details in the presser below, and the awards will be announced in San Antonio sometime during the show from November 19-22. San Antonio Auto & Truck Show Announces 2016 Green Truck of the Year and Commercial Green Car of the Year Finalists SAN ANTONIO, Oct. 22, 2015 /PRNewswire/ -- Green Car Journal and the San Antonio Auto & Truck Show have announced finalists for the 2016 Green Truck of the Year™ and 2016 Commercial Green Car of the Year™ awards. The Green Truck of the Year™ nominees are the Chevrolet Colorado Duramax, Ford F-150, GMC Canyon Duramax, Nissan Titan XD, and Toyota Tacoma. Vying for the all-new 2016 Commercial Green Car of the Year™ award are the Chevrolet City Express, Ford Transit Connect, Mercedes-Benz Metris, Nissan NV200, and Ram ProMaster City. "Over the past few decades, new car models have benefitted from design and technology improvements that have brought higher fuel efficiency and greater levels of environmental compatibility," said Green Car Journal and CarsOfChange.com Editor and Publisher Ron Cogan. "With models like these ten deserving finalists, we're witnessing the pickup and light commercial vehicle field enjoying the same attention." The new Commercial Green Car of the Year™ award is part of an expanded awards program presented at this year's 2015 San Antonio Auto & Truck Show.

GM's Super Bowl ad puts Will Ferrell and EVs in Netflix shows

Tue, Feb 7 2023GM is kicking off the automotive Super Bowl commercial season with EVs and Will Ferrell. The ad highlights GM's new relationship with Netflix in which the automaker's many upcoming electric cars and trucks will appear. More specifically, the ad has Will Ferrell appearing in settings from major Netflix TV movies and shows such as "Army of the Dead" and "Squid Game," talking about how there's no reason not to have EVs there. And then he also appears with EVs in shows where they don't make sense, such as "Bridgerton" and "Stranger Things," but only to reassure people that Netflix won't be shoving new cars where they don't fit in. The GM lineup on display is pretty varied, with the GMC Sierra EV, Hummer EV, Chevy Blazer EV, and Cadillac Lyriq all making appearances. Most interesting is the Chevy Silverado EV Trail Boss in the "Stranger Things" part. Chevy hasn't said much about it beyond a teaser and saying it'll be a late addition to the line. It looks pretty much like the truck in the teaser with the black plastic front fascia and fender flares. But it gets different wheels, Trail Boss badges on the rear pillars, and a gloss black roof like the RST trim. Related video: 2024 Chevy Silverado EV | 2022 Chicago Auto Show

2017 Chevy Bolt EV arrives in late 2016 with 200-mile range

Wed, Jan 6 2016For those keeping track, the production 2017 Chevy Bolt that was just revealed at CES in Las Vegas is, well, pretty much just what we were expecting. As promised, GM claims the EV crossover-ish hatch will have a 200-mile range, and be "affordable." While pricing hasn't been announced, we've posited in the past that "affordable" is code for around $30,000 after incentives. The Bolt will use a couple of features, both novel and expected, to enhance range. The EV is expected to use information on the owner's driving history, the weather outside, the terrain, and even the time of day to help manage and predict range. The nav system will optimize routes to conserve range, if needed, and show nearby charging stations. That should ease, if not eliminate, range anxiety. Another range-conserving feature is a low-draw Bluetooth system. Speaking of charging stations, there's no word so far about how long it'll take to recharge a Bolt, or the capacity of the battery pack. Inside, the large center-mounted MyLink screen measures a full 10.2 inches, and provides a display for the wide-angle rear camera with a birds-eye view capability. OnStar provides 4G LTE and a wifi hotspot to occupants, and the sorts of efficiency and driving habit apps you'd expect will be available. It seems like remote start and cabin preconditioning will be standard. Interestingly, the Bolt will feature "Gamification" features intended to promote efficient driving by pitting Bolt drivers against each other for green driving awards or rankings. Details on are sparse on this feature, but then again, information on the Bolt in general is a little sparse right now. If you want to know things like detailed specs, the specifics of chassis componentry, or even trims and options, you'll have to wait. Check out our first quick spin of a prototype Bolt in Las Vegas for a preview of what GM's EV is like on the road. Chevrolet Introduces 2017 Bolt EV First long-range, affordable EV with customer-focused connectivity LAS VEGAS – Chevrolet is introducing the 2017 Bolt EV at the Consumer Electronics Show, fulfilling its promise to offer a long-range, affordable electric vehicle for the masses. The Bolt EV, which will go into production by the end of 2016, will offer more than 200 miles of range on a full charge. It also features advanced connectivity technologies designed to enhance and personalize the driving experience.