2003 Chevrolet Ssr Base Convertible 2-door 5.3l on 2040-cars

Sanborn, New York, United States

Body Type:Convertible

Engine:5.3L 325Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Year: 2003

Number of Cylinders: 8

Make: Chevrolet

Model: SSR

Trim: Base Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Options: Leather Seats, CD Player, Convertible

Mileage: 5,100

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Sub Model: SSR

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: Red

Interior Color: Black

|

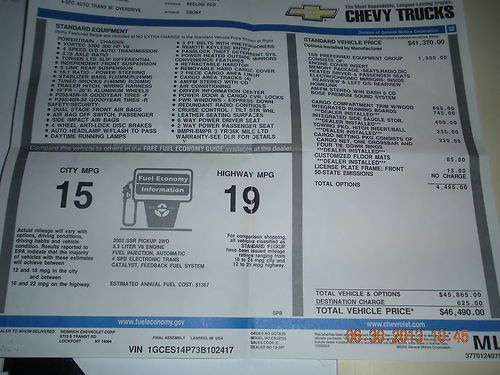

2003 SSR SUPER SPORT ROADSTER EXTERIOR: REDLINE RED INTERIOR: EBONY 4-SPD. AUTO TRANS W/OVERDRIVE VORTEC 5300 V-8 SFI ENGINE 5,100 MILES NO RAIN & SNOW NON-SMOKING HEATED STORAGE ANY QUESTIONS, PLEASE CALL DAVE @716-696-0722 BETWEEN 10A.M.-7P.M. EASTERN Terms of Sale: I reserve

the right to end this listing at any time, should the vehicle no longer be

available for sale. The following terms of sale apply: PAYMENT

TERMS Please,

if you do not intend to pay, please do not bid. All

bidders with less than 5 feedback's need to call us or their bid might be

canceled. The

successful high bidder will submit a $1000.00 NON-REFUNDABLE payment

deposit with PAYPAL within 24 hours of the close of the auction to secure the

vehicle.I do not take PAYPAL for final payment or balance. I take U.S bank

check, bank wire transfer or cash in person only for final payment no

exceptions. Buyer agrees to pay remaining balance due within 5 days of the

close of the auction. All financial transactions must be completed before

delivery of the vehicle. AS IS - NO Warranty: |

Chevrolet SSR for Sale

2003 chevrolet ssr base convertible 2-door 5.3l(US $23,995.00)

2003 chevrolet ssr base convertible 2-door 5.3l(US $23,995.00) 2004 chevrolet ssr base convertible 2-door 5.3l

2004 chevrolet ssr base convertible 2-door 5.3l 2005 chevrolet ssr base convertible 2-door 6.0l

2005 chevrolet ssr base convertible 2-door 6.0l 2003 chevrolet ssr convertible 2-door 5.3l

2003 chevrolet ssr convertible 2-door 5.3l 2006 chevrolet ssr final production run # 352

2006 chevrolet ssr final production run # 352 525 hp magna supercharged ls6 all the bells & whistles super low miles(US $34,995.00)

525 hp magna supercharged ls6 all the bells & whistles super low miles(US $34,995.00)

Auto Services in New York

X-Treme Auto Glass ★★★★★

Wheelright Auto Sale ★★★★★

Wheatley Hills Auto Service ★★★★★

Village Automotive Center ★★★★★

Tim Voorhees Auto Repair ★★★★★

Ted`s Body Shop ★★★★★

Auto blog

Camaro SS facelift and dune-riding the new Mercedes-Benz GLS | Autoblog Podcast #579

Fri, May 3 2019In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Reese Counts and Associate Editor Joel Stocksdale. First, they talk about the newly refreshed Chevy Camaro SS. Then they dish on the cars they've been driving, including the Lexus UX, Lexus GS F and Volvo V90, as well as riding in the new Mercedes-Benz GLS. After that, they ask the question, how many AMG cars is too many? Finally they turn to car buying, and suggest potential vehicles for a shopper on Reddit for the "Spend My Money" segment. Autoblog Podcast #579 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2020 Camaro SS facelift Cars we're driving: 2019 Lexus UX 2019 Lexus GS F 2019 Volvo V90 Cross Country 2020 Mercedes-Benz GLS ride How many AMGs is too many? Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video:

GM puts e-commerce shopping in car dashboards

Tue, Dec 5 2017DETROIT — General Motors on Tuesday said it will equip newer cars with in-dash e-commerce technology, betting it can profit as drivers order food, find fuel or reserve hotel rooms by tapping icons on the dashboard screen, instead of using smartphones while driving. GM's Marketplace technology, developed with IBM, will be uploaded automatically to about 1.9 million model-year 2017 and later vehicles starting immediately, with about 4 million vehicles across the Chevrolet, Buick, GMC and Cadillac brands equipped with the capability in the United States by the end of 2018, GM said. GM will get an undisclosed amount of revenue from merchants featured on its in-dash Marketplace, Santiago Chamorro, GM vice president for global connected customer experience, said during a briefing for reporters. Customers will not be charged for using the service or the data transmitted to and from the car while making transactions, he said. "This platform is financed by the merchants," Chamorro said. GM will get paid for placing a merchant's application on its screens, and "there's some level of revenue sharing" based on each transaction, he said. It is too soon to say how much revenue GM could realize from the Marketplace system, he said. The GM Marketplace will compete for customer clicks and revenue with hand-held smartphones, which offer a far richer array of applications than the GM system will at the outset. Amazon.com is partnering with other automakers, including Ford, to offer in-car e-commerce capability through Amazon's Alexa personal assistant system. For example, GM will launch Marketplace with just Shell and Exxon Mobil icons in the fuel category. The only restaurant available for in-car table reservations at launch is the chain TGI Fridays, GM said. In addition, there will be apps for parking, and ordering ahead at coffee shops and restaurants such as Starbucks, Dunkin' Donuts and Applebee's. "We will be adding more vendors," with some coming in the first quarter of 2018, Chamorro said. In addition, he said GM plans to expand integration into its vehicles of music, news and other information services. GM also hopes to use its in-car Marketplace connections to expand purchases of products and services, such as additional access to in-car wifi, from its own replacement parts business and dealer network. Customers can "expect to see more service promotions coming through the platform," Chamorro said. Reporting by Joe WhiteRelated Video:

Weekly Recap: The implications of strong new car sales

Sat, Jun 6 2015New car sales are on a roll in the United States this year, and analysts are optimistic the industry will maintain its torrid pace. Sales increased 1.6 percent in May and reached an eye-popping seasonally-adjusted selling rate of 17.8 million, the strongest pace since July 2005, according TrueCar research. That positions the industry for one of its strongest years ever, as consumer confidence, low interest rates, low fuel costs, and an influx of new products propel gains. In addition to the positive economic factors, May also featured warmer weather across much of the US, an extra weekend, and it came on the heels of relatively weak April sales. Analysts suggest income tax refunds and the promise of summer driving and vacations also traditionally help May sales. "While 2015 will be one of the best years in the history of the US industry, in some ways it may be the very best ever," IHS Automotive analyst Tom Libby wrote in a commentary. "Not only are new vehicle registration volumes approaching the record levels of the early 2000s, but now registrations and production capacity are much more closely aligned so the industry is much more healthy." Capacity, an indicator of the auto sector's health, is also expected to grow. Morgan Stanley predicts it will eventually hit at least 20 million units per year, as many companies, including General Motors, Ford, Tesla, and Volvo are investing in new or upgraded factories. "The best predictor of US auto sales is the growth in capacity, and frankly, we're losing count of all of the additions – there's literally something new and big every week," Morgan Stanley said in a research note. Transaction prices, another telling indicator, also continue to show strength. They rose four percent in May to $32,452 per vehicle, and incentives dropped $10 per vehicle to $2,661, TrueCar said. "New vehicle sector and segment preference indicates consumers are confident about the economy and their finances," TrueCar president John Krafcik said in a statement. Still, Morgan Stanley noted the robust sales did little to immediately impact automaker stock prices and suggested it might be a prime time to sell if sales reach the 18-million pace. "Perhaps the biggest reason may be that investors have seen this movie before," the firm wrote.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.051 s, 7974 u