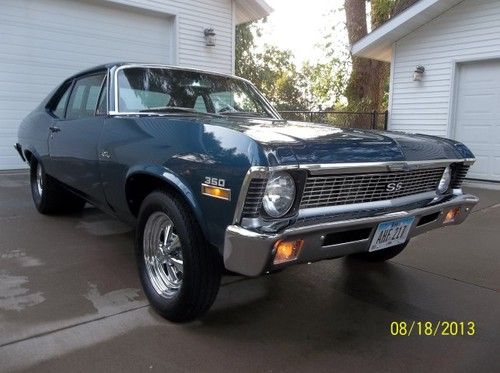

1971 Chevy Nova Pro Street 406 Small Block Automatic Orange on 2040-cars

Hoquiam, Washington, United States

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Nova

Mileage: 0

Sub Model: Pro Street

Exterior Color: Orange

Warranty: No

Interior Color: Black

Number of Doors: 2 Doors

Number of Cylinders: 8

Chevrolet Nova for Sale

1971 chevy nova ss clone with 454(US $21,000.00)

1971 chevy nova ss clone with 454(US $21,000.00) 1963 nova drag car / project(US $5,000.00)

1963 nova drag car / project(US $5,000.00) 1966 chevrolet nova ss~solid~327v8-auto-clean interior-runs & drives great(US $18,995.00)

1966 chevrolet nova ss~solid~327v8-auto-clean interior-runs & drives great(US $18,995.00) 67 nova pro touring(US $55,000.00)

67 nova pro touring(US $55,000.00) 1971 chevrolet nova 454 600+ horsepower muscle car

1971 chevrolet nova 454 600+ horsepower muscle car 1970 chevy pro street nova ss(US $21,500.00)

1970 chevy pro street nova ss(US $21,500.00)

Auto Services in Washington

Werner`s Crash Shop ★★★★★

Wayne`s Auto Repair ★★★★★

Washington Auto Credit ★★★★★

Universal Auto Body & Service ★★★★★

Tri-Cities Battery-Auto Repair ★★★★★

The Audio Experts with Discount Car Stereo ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Drivers buy new $300K McLaren 720S, 2019 Chevy Corvette, and wreck 'em

Tue, Jul 17 2018Two high-powered, high-priced sports cars, wrecked in their infancies. No doubt they were fun while they lasted. In Great Falls, Va., a tony suburb of Washington, D.C., that hugs the Potomac River, someone was out enjoying driving the McLaren 720S they had purchased only the day before on a leafy, two-lane road. Then, horror: In an instant, the car hit a tree, mangled and destroyed "because of speed," according to the Fairfax County Police Department. Purchased Friday. Totaled Saturday. This McLaren 720S, costing around $300,000, was destroyed today in Great Falls because of speed. The driver was taken to the hospital with thankfully only non-life threatening injuries. A reminder to slow down, or it could cost you. pic.twitter.com/XhC3LKRY1t — Fairfax County Police (@FairfaxCountyPD) July 14, 2018 Then on salvage auction site Copart, a brand-new orange 2019 Chevrolet Corvette Grand Sport lies in a warehouse in Lincoln, Neb., its front left corner crushed, wheel askew. It had just 15 miles on the odometer. We know nothing of the backstory, except for the obvious front-end damage and secondary damage to the undercarriage. The rear end and 6.2-liter V8 engine, which makes 460 horsepower and 465 pound-feet of torque, look OK. The most current bid as this was published was just north of $9,000. It's tempting in both cases to assign the blame to over-eager drivers who weren't quite yet able to corral all that power. In the case of the McLaren, the supercar makes 710 horsepower and 568 pound-feet of torque from its quad-cam, twin-turbo 4.0-liter V8. It goes from 0-62 miles per hour in 2.9 seconds and boasts a top speed of 212 mph. We're not saying the unidentified driver was a newbie, but this car is definitely not for newbies. Police write that the incident is "A reminder to slow down, or it could cost you." As in, $300,000. Or at least the depreciation for driving it off the lot. Related Video:

GM to idle car production at five factories as Americans continue CUV love affair

Mon, Dec 19 2016In case you needed another reminder that Americans have fallen out of love with sedans, General Motors today announced plans to idle five factories in January in a bid to cut its inventory to 70 days. Detroit-Hamtramck Assembly ( Buick LaCrosse, Cadillac CT6, Chevrolet Volt and Impala) and Fairfax Assembly in Kansas ( Chevy Malibu) will stop production for three weeks. Lansing Grand River ( Cadillac ATS and CTS, and Chevy Camaro) is going down for two weeks, while Lordstown, OH ( Chevy Cruze) and Bowling Green, KY ( Chevy Corvette) will go idle for a week each, Automotive News reports. GM's shutdown reflects a broader problem with the company's supply – at 847,000 vehicles, the company's supply increased unsteadily from a low of 629,000 units in January of 2016. That's more than a 25 percent increase in the past year. Citing information from Autodata, The Detroit News reports that at the end of November, GM had a 168-day supply of LaCrosses, 177 days' worth of Camaro, 170 days of Corvette, 121 days for Cruze, 119 days for ATS, 132 days for CTS, and 110 days of CT6. Meanwhile, inventory of the company's more popular vehicles is actually below the professionally accepted 60- to 70-day supply, The News reports. The Trax, Colorado pickup, and GM's full-size SUVs are sitting below 50 days and experiencing year-over-year sales increases. GM needs a rethink of its inventory levels, which is something that's apparently coming. "We're going to be responsible in managing our inventory levels," GM spokesman Jim Cain told The News. Another unnamed spokesman told Automotive News the company's day-to-day supplies would "fluctuate before moderating at year-end." But at least one analyst thinks this won't be the last time Detroit needs to stop production to level things out. "Incentives are elevated, residuals are declining, and rates are rising," Brian Johnson, an analyst with Barclays, told The News. "And while GM in particular may benefit in the months ahead from new product launches, it's important to recognize that GM's inventory is elevated at the moment, and it wouldn't surprise us if they need to announce another production cut – which could pressure the stock." Related Video: News Source: The Detroit News, Automotive News - sub. req.Image Credit: Paul Sancya / AP Plants/Manufacturing Buick Cadillac Chevrolet GM GMC Crossover SUV Sedan bowling green cadillac xt6 fairfax