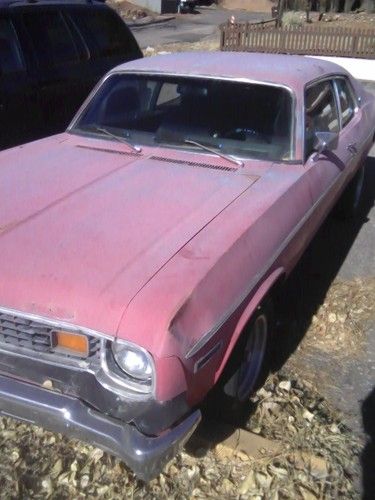

1966 Chevrolet Nova Ii Ss on 2040-cars

Tampa, Florida, United States

Engine:V8

Drive Type: FWD

Model: Nova

Mileage: 38,540

Trim: SS

Chevrolet Nova for Sale

1966 chevy ii nova!! red/black!! 327/4-speed!! rust free!! super nice!!

1966 chevy ii nova!! red/black!! 327/4-speed!! rust free!! super nice!! 1964 chevy nova resto mod **custom 350 v-8 by jgm motorsports** xlnt(US $18,000.00)

1964 chevy nova resto mod **custom 350 v-8 by jgm motorsports** xlnt(US $18,000.00) 1963 chevy 2 nova wagon(US $15,000.00)

1963 chevy 2 nova wagon(US $15,000.00) 1973 chevrolet nova custom hatchback 2-door 5.7l

1973 chevrolet nova custom hatchback 2-door 5.7l 1970 nova true ss car frame off restoration 350 with 350 auto triple black car!!

1970 nova true ss car frame off restoration 350 with 350 auto triple black car!! Chevy ii(US $5,500.00)

Chevy ii(US $5,500.00)

Auto Services in Florida

Z Tech ★★★★★

Vu Auto Body ★★★★★

Vertex Automotive ★★★★★

Velocity Factor ★★★★★

USA Automotive ★★★★★

Tropic Tint 3M Window Tinting ★★★★★

Auto blog

Recharge Wrap-up: Chevy bi-fuel Silverado 3500HD Chassis Cab, VW Car-Net works with Apple Watch

Fri, May 8 2015Volkswagen's Car-Net app will be compatible with the Apple Watch. Using the app, owners will be able to lock and unlock their car, check charging status or fuel level, locate their car, flash the lights, and honk the horn of their vehicle remotely from their wrist. E-Golf owners can begin or end charging or operate climate control through their Apple Watch. The app can also monitor other household drivers with speed and boundary alerts - perfect for the parent who lends their car to a teenager. Read more in the press release from Volkswagen. Chevrolet is launching the bi-fuel 2016 Silverado 3500HD Chassis Cab. The work truck will now offer a version that will run on both gasoline and compressed natural gas (CNG). "CNG burns cleaner and costs less at the pump than gasoline, making it an appealing option for fleets," says GM's Ed Peper. Companies like Southern California Gas Co. find that trucks like this meet their work needs and help them achieve their goals of greening up their fleets, GM says. Read more in the press release from GM. UPS has made a deal to buy renewable natural gas from Clean Energy Fuels. This make UPS the biggest user of natural gas in the shipping industry. Clean Energy Fuels, co-founded by T. Boone Pickens, will provide UPS with its Redeem brand natural gas, which uses methane captured from landfills. UPS hopes to log 1 billion miles with its alternative fuel and advanced technology fleet by 2020. "Our rolling laboratory approach provides a unique opportunity for UPS to test different fuels and technologies," says Mitch Nichols of UPS. "Today's RNG agreement will help mature the market for this promising alternative fuel." Read more in the press release below. UPS BECOMES NATION'S LARGEST USER OF RENEWABLE NATURAL GAS IN SHIPPING INDUSTRY New Agreement with Clean Energy Will Help Grow Market for Use of Methane Gas from Landfills as Fuel Atlanta, May 5, 2015 – UPS® (NYSE:UPS) today announced it has entered into an agreement to purchase renewable natural gas (RNG) for its delivery vehicle fleet from Clean Energy Fuels Corp. (NASDAQ: CLNE). The deal signifies UPS's plan to significantly expand its use of renewable natural gas for its alternative fuel and advanced technology fleet. The company has a goal of driving one billion miles using its alternative fuel and advanced technology fleet by the end of 2017. Clean Energy Fuels, co-founded by T.

GM's MPG overstatement could affect 2 million vehicles

Tue, May 17 2016Late last week, GM admitted that three of its large SUVs fuel economy window stickers did not match their actual efficiency ratings, and so the vehicles couldn't be sold. The stickers on the 2016 Chevy Traverse, GMC Acadia, and Buick Enclave said their ratings were one to two miles per gallon better than they should have been. Officially, the number of affected vehicles sits at about 60,000. But Consumer Reports makes a good point: what's up with all of the previous model year SUVs that are basically the same vehicle? To wit: the 2016 model year vehicles are not substantially different than the 2015 or the 2014, or even going all the way back to 2007. On the EPA's fuel economy website, all of these older models will "have better stated fuel economy numbers than the new vehicles in GM's dealerships," Consumer Reports noted. CR's best point, and the one that makes the 60,000 number potentially grow to 2 million if all of the vehicles built on this platform are affected, is that "[i]t seems unlikely that the company would change the powertrain on these carryover models so late in their model cycles in a way that would cause a dramatic, negative impact on fuel economy." GM says that earlier model year SUVs are not affected and the EPA did not respond to CR's question about the potential for more discrepancies. We've seen automakers reverse course before, so if GM has to come out with a mea culpa soon, don't be surprised. GM is rushing corrected stickers to dealers so that the SUVs can be sold again, but a fix for the already-sold vehicles could be trickier to solve. Related Video: Related Gallery 2013 GMC Acadia View 16 Photos News Source: Consumer Reports Government/Legal Green Buick Chevrolet GMC Fuel Efficiency mpg gmc acadia chevy traverse

Ford Mustang chief engineer, mid-engine Corvette | Autoblog Podcast #488

Fri, Sep 16 2016Note: There were some technical difficulties that prevented some of you from downloading this week's podcast. The player and link below should be working now, and the file has reached iTunes and other feeds as well. Thanks to everyone who wrote in to let us know of the issues! On the podcast this week, we have some questions for Ford Chief Engineer Carl Widman. Plus, Associate Editor Reese Counts joins Mike Austin to talk about the latest news, most notably the spy photos of the upcoming mid-engine Corvette. We also chat about the Jaguar F-Type Coupe, the Nissan Armada, and why 0-60 mph is a stupid performance figure. And, of course, we get into some Spend My Money advice, telling strangers what car to buy. And new this week is a cost-no-object what-cars-would-you-buy game. The rundown is below. And don't forget to send us your questions, money-spend or otherwise, to podcast at autoblog dot com. Autoblog Podcast #488 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Mid-engine Chevrolet Corvette spied Chevy Bolt EV comes with 238 miles of range Ford will sell self-driving cars by 2025 Jaguar F-Type Coupe 2017 Nissan Armada (yes, Mike knows it's not a Patrol) Ford Mustang Chief Engineer Carl Widman interview Spend My Money - we give purchase advice Why 0–60 mph is a stupid performance test Rundown Intro - 00:00 The news - 03:30 What we've been driving - 16:20 Carl Widman - 26:44 Spend my money - 37:03 New fun game - 51:48 0–60 mph is overrated - 56:50 Total Duration: 1:04:57 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Chevrolet Ford Jaguar Nissan Car Buying nissan armada mid-engine corvette jaguar f-type coupe