Monte Carlo Ss 83 on 2040-cars

Summerville, South Carolina, United States

|

RUN STRONG 400 SBC NEW HEADERS, UPPER AND LOWER BALL JOINTS AND BUSHINGS, ROTORS AND BRAKES, POWER STEERING PUMP, NEW 600 HOLLEY AND AIR BREATHER, NEW TIRES AND NEW HEADLINER. 1 OF ONLY 4600 PRODUCED. NEED LITTLE TLC SOME SMALL MINOR REPAIR SUCH AS A/C COMPRESS AND HEATER COIL NEED BE REPLACE AND FRONT SEAT NEED RESTORATION.

|

Chevrolet Monte Carlo for Sale

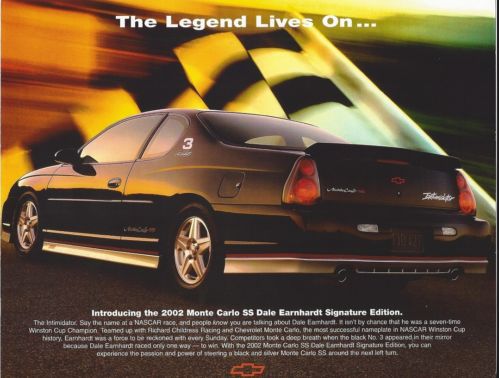

2002 chevrolet monte carlo ss coupe 2-door 3.8l(US $35,001.00)

2002 chevrolet monte carlo ss coupe 2-door 3.8l(US $35,001.00) 350 cid, 2-speed powerglide, factory-original paint color, classic 70's ride!(US $17,995.00)

350 cid, 2-speed powerglide, factory-original paint color, classic 70's ride!(US $17,995.00) 2000 chevy montecarlo

2000 chevy montecarlo 2003 jeff gordon monte carlo ss -2,641 miles

2003 jeff gordon monte carlo ss -2,641 miles No reserve 1972 chevrolet monte carlo 350 auto factory ac ps pb solid car

No reserve 1972 chevrolet monte carlo 350 auto factory ac ps pb solid car 2007 leather heated v6 flex fuel used preowned 146k miles

2007 leather heated v6 flex fuel used preowned 146k miles

Auto Services in South Carolina

Yellow Cab ★★★★★

Viking Imports Foreign Car Parts & Accessories Inc ★★★★★

Troy Gardner`s Paint & Body ★★★★★

Sterling`s Detail ★★★★★

Spiveys Wrecker Service ★★★★★

Randy`s Garage & Alignment ★★★★★

Auto blog

Recharge Wrap-up: meet the Luka EV project, VisibleTesla allows Model S hacking

Tue, May 12 2015Select Registry is partnering with Tesla to install chargers at many of its lodgings. More than 170 hotels, inns and bed & breakfasts will install Tesla High Power Wall Connectors for their guests to use. So far, 63 properties have installed the chargers. Eventually, Select Registry members in 34 states as well as Nova Scotia will offer charging on-site. Tesla's wall charger provides the Model S with 58 miles of range per hour. The hotels will rent you a room for the full night, as well. Read more in the press release below. Tesla Model S owners can hack their car with the VisibleTesla app. The free, open source app allows users to check on and control the status of the car and its subsystems, similar to Tesla's official apps. VisibleTesla can also be used to schedule certain automated commands. For example, its creator, Joe Pasqua, has his car send him a text message reminding him to bring his bags with him when he enters the grocery store parking lot. Other users have the car remind them if the car is not charging at a certain time, or schedule the car to turn on the heat before departure. Read more at TechWorm, or learn more at the VisibleTesla website. Georgia Power has added 32 Chevrolet Volts to its fleet. Employees, particularly the utility's energy efficiency experts, will use the cars to travel to customers' homes and businesses to conduct energy audits. "We are leading by example and demonstrating to our customers, and other Georgia businesses, that electric transportation works for all drivers," says Georgia Power Chairman, President & CEO Paul Bowers. Georgia Power also offers charger rebates and special rates for EV customers. Read more at Domestic Fuel. The Luka EV is a project to build an affordable, lightweight, retro-looking, road-legal electric car in one year. The team wants to get the car certified for use on EU roads by September 2015. They have goals of achieving a driving range of 300 kilometers (about 186 miles), keeping the cost under ˆ20,000 (about $22,280 US at current rates) and the weight under 750 kilograms (about 1,650 pounds). The builders recently completed their first range test of the working vehicle, which uses in-hub motors for propulsion. Learn more at the Luka EV project page on Hackaday. Select Registry Teams with Tesla Motors Both Tesla owners and their vehicles can recharge at more than 170 B&Bs, inns, and hotels throughout the U.S.

Big discounts on 2015 Chevy Volt before 2016 model arrives

Wed, Apr 22 2015Having not driven it yet, this writer thinks the 2016 Chevrolet Volt appears to be an excellent update to country's flagship hybrid. The current car, though, still has plenty to offer and can hold its Bowtie high. If you'd rather save money on a 2015 than have the latest technology, a Cars Direct rundown of incentives and lease deals on a 2015 Volt shows that fruit is ready to be plucked. With plenty of the current model year on dealer lots, Chevy has more than doubled the rebate to $2,500, and offers 2.9-percent financing for 48 months. If you want to lease, the signing payment is now only $500, down from $1,499. You can get that down to zero dollars if you're trading in a competitor. Payments for 39 months are reduced $50, to $249. So it's officially open season for hardcore Volt haggling. Admittedly, though, it will probably only get better as we get close to the 2016s rolling into dealerships, so you can start lining up a deal now but know your position will only strengthen as the weeks pass. Related Video:

Chevy Volt, Nissan Leaf go nearly the same all-electric miles a year

Sun, Nov 1 2015Range anxiety? What range anxiety? The concept is a foreign one to those driving Chevrolet Volt extended-range plug-ins, and as a result, that vehicle's all-electric driving miles are actually pretty close to that of the all-electric Nissan Leaf. Such were the findings of a study conducted by the Idaho National Laboratory (INL), which tracked about 8,700 cars during a three-year period, including a bunch of Volts, Leafs and Smart ED electric vehicles. In short, even though the Volt's all-electric range of about 38 miles is less than half that of the Leaf's, the Volts' collective all-electric driving was just six percent lower than the Leaf's (the next-generation Volt will be even more electro-generous, with a 50-mile range). The logic makes sense considering typical US driving habits, in which a vast majority of people commute less than 35 miles a day. Additionally, Volt drivers obviously have no fear of running out of electricity, so they were far more likely to max out on that range than some Leaf drivers. Overall, the average Leaf is driven about 15 percent less than the national average of about 11,300 miles a year for all vehicles, while Volts are driven about eight percent more. Of all those Volt miles, about 81 percent were in all-electric mode. Additionally, Volt drivers recharged about 1.5 times a day, while Leaf drivers recharged about once a day, and about 85 percent of that charging was at home. As for non-home charging, about 20 percent of the vehicles accounted for 75 percent of the station use, so folks are definitely creatures of habit. Check out the INL's 22-page report here for more interesting details. Related Video: Featured Gallery 2016 Chevrolet Volt: First Drive View 24 Photos Related Gallery 2016 Nissan Leaf View 30 Photos News Source: Idaho National Laboratory via Hybrid Cars Green Chevrolet Nissan Electric Hybrid extended-range plug-in