1986 Chevy Monte Carlo Ss Aero Coupe Rare Original Car - Low Miles on 2040-cars

Eastern States, United States

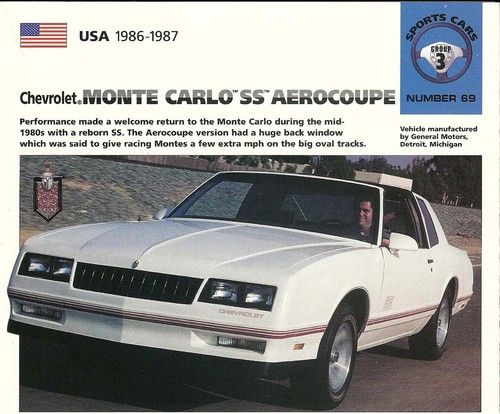

Body Type:Coupe

Engine:V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Model: Monte Carlo

Trim: SS Aero

Drive Type: automatic

Mileage: 49,155

Exterior Color: White

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Burgundy

Power Options: Air Conditioning, Power Windows

Chevrolet Monte Carlo for Sale

1972 monte carlo

1972 monte carlo 1987 chevrolet monte carlo ss coupe 2-door(US $2,500.00)

1987 chevrolet monte carlo ss coupe 2-door(US $2,500.00) 86 monte carlo ss, runs and drives strong great entry level muscle car.(US $4,995.00)

86 monte carlo ss, runs and drives strong great entry level muscle car.(US $4,995.00) 2000 monte carlo ss 1 owner 8,000 miles black(US $12,999.00)

2000 monte carlo ss 1 owner 8,000 miles black(US $12,999.00) 2000 monte carlo pace car

2000 monte carlo pace car 2004 chevy monte carlo ss dickies 500 pace car only 5k texas direct auto(US $23,980.00)

2004 chevy monte carlo ss dickies 500 pace car only 5k texas direct auto(US $23,980.00)

Auto blog

Chevy Sail 3 lands in China

Sun, Nov 23 2014Shanghai General Motors took 32 cars to this year's Guangzhou Motor Show, with its Chevrolet Sail 3 leading the way. After putting almost 1.4 million of them into Chinese hands, the third generation of the Bowtie's entry-level sedan wants to "take the nameplate and the segment to a new level." Its new architecture sporting a 1.4-inch longer wheelbase supports a growth spurt of two inches in length and 1.8 inches in width. The exterior also gets "eagle eye-shaped" headlights and "dual-c-element taillights." Under the hood will be either a 1.5-liter DVVT or a 1.3-liter VVT, each of them more powerful and more frugal than previous offerings. Both can be paired with a manual or an automatic transmission, and qualify for listing in China's National Energy-Saving and Eco-Friendly Vehicle Catalogue, as well as a 3,000 renminbi rebate ($490 US). You can read more about it in the press release below, and get more info on the Chevrolet Camaro RS Limited Edition, Corvette Stingray Coupe, Buick Regal GS and Excelle XT also introduced at the show. Chevrolet, Buick and Cadillac Take Center Stage at Guangzhou Auto Show - New Chevrolet Sail 3, Camaro RS Limited Edition and Corvette Stingray Coupe make China debut - Buick showcases customized Regal GS and Excelle XT - Shanghai GM announces new telematics strategy featured in upcoming Cadillac product GUANGZHOU, 2014-11-20 – Shanghai GM is displaying 32 vehicles from the Chevrolet, Buick and Cadillac brands at the 12th Guangzhou International Auto Show, which begins today and runs through November 29 in Guangzhou. Among the products that are making their China debut are the third-generation Chevrolet Sail 3, Chevrolet Camaro RS Limited Edition and Chevrolet Corvette Stingray Coupe. In addition, Buick is showcasing a customized Regal GS and Excelle XT, and Shanghai GM is announcing its new telematics strategy that will be featured in an upcoming Cadillac product next year. Chevrolet Sail 3 Entry-Level Family Car Since its introduction 15 years ago, the Sail has been a driving force in the entry-level family car segment. Nearly 1.4 million Sails have been sold across China. The third-generation Chevrolet Sail, named the Sail 3, will take the nameplate and the segment to a new level when it goes on sale nationwide by the end of this year. Built on Shanghai GM's new-generation small car architecture, the Sail 3 has adopted Chevrolet's new design language. It has a sculpted yet slim exterior with a youthful, dynamic feel.

Chevy Malibu will become 45-mpg strong hybrid with next update

Wed, Mar 25 2015Come next year there'll be no more mild hybrid pretensions for the Chevrolet Malibu - the next-generation sedan will borrow technology from the 2016 Volt and get a proper hybrid powertrain. A 1.8-liter four-cylinder engine gets help from a two-motor drive unit adapted from the Volt for 182 system horsepower, the motor drive powered by an 80-cell, 1.5-kWh lithium-ion battery. Chevrolet says that when combined with features like grille shutters and a lower ride height, it expects the Malibu Hybrid will post a combined fuel economy rating of more than 45 miles per gallon, which would best the hybrid trims of the Ford Fusion, Toyota Camry and Hyundai Sonata. Electric power alone can power the car up to 55 miles per hour, and The Bowtie's first use of exhaust gas heat recovery will help maintain high hybrid performance in cold weather and be used to heat the engine and cabin. The Malibu Hybrid should go on sale in the Spring of next year, for now there's a press release below. Chevrolet Malibu Hybrid Derives Technology from Volt GM estimates combined fuel economy ratings to exceed 45 mpg DETROIT, 2015-03-25 – Chevrolet's recent production announcement of its all-electric vehicle based on the Bolt EV concept, as well as the introduction of the 2016 Chevrolet Volt, will be joined by a strong hybrid version of the next-generation Malibu. Using technology from the 2016 Chevrolet Volt propulsion system, Malibu Hybrid will offer an estimated combined fuel economy rating exceeding 45 mpg, higher than the combined mileage ratings of the Ford Fusion, Toyota Camry and Hyundai Sonata hybrid variants. "The 2016 Malibu Hybrid will offer impressive fuel economy, exceptional driving characteristics and gorgeous styling," said Jesse Ortega, Chevrolet Malibu chief engineer. "Besides leveraging innovation from the Chevrolet Volt, the Malibu Hybrid also has unique features that help improve aerodynamics, like upper and lower grille air shutters to improve airflow and a reduced ride height, all of which help reduce fuel consumption," Ortega said. An all-new direct-injection 1.8L 4-cylinder engine mated to a two-motor drive unit slightly modified from the 2016 Chevrolet Volt drive unit powers the Malibu Hybrid. The drive unit provides additional power to assist the engine during acceleration, for 182 horsepower (136 kW) of total system power.

What's big at the Chicago show | Autoblog Podcast #503

Fri, Feb 10 2017On this week's podcast, Mike Austin and David Gluckman discuss the big debuts at the 2017 Chicago Auto Show. They also recap what they've all been driving lately, and the episode wraps up with Spend My Money buying advice to help you, our dear listeners. And there's an awful Dad Joke thrown in there for you to find. The rundown is below. Remember, if you have a car-related question you'd like us to answer or you want buying advice of your very own, send a message or a voice memo to podcast at autoblog dot com. (If you record audio of a question with your phone and get it to us, you could hear your very own voice on the podcast. Neat, right?) And if you have other questions or comments, please send those too. Autoblog Podcast #503 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Jaguar XE Volkswagen Golf R Toyota Highlander Hybrid Chicago Auto Show coverage Used cars! Rundown Intro - 00:00 What we're driving - 01:46 Chicago show preview - 22:58 Spend My Money - 35:36 Total Duration: 52:48 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show on iTunes Podcasts Chicago Auto Show Chevrolet Dodge Jaguar Toyota Volkswagen Truck Hatchback SUV Performance Sedan ford expedition jaguar xe volkswagen golf r 2017 Chicago Auto Show