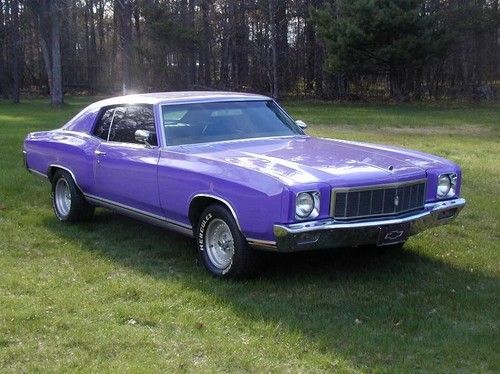

1971 Monte Carlo Show Car - Restored, Customized, Balanced & Blueprinted on 2040-cars

West Branch, Michigan, United States

Mileage: 51,995

Make: Chevrolet

Model: Monte Carlo

Chevrolet Monte Carlo for Sale

1997 chevrolet monte carlo z34 coupe 2-door 3.4l(US $1,500.00)

1997 chevrolet monte carlo z34 coupe 2-door 3.4l(US $1,500.00) 1987 chevrolet monte carlo ss coupe 2-door 5.0l(US $12,500.00)

1987 chevrolet monte carlo ss coupe 2-door 5.0l(US $12,500.00) 1986 chevrolet monte carlo ss,no rust ever,fresh engine & trans,all options

1986 chevrolet monte carlo ss,no rust ever,fresh engine & trans,all options 2000 chevy monte carlo ss pace edition

2000 chevy monte carlo ss pace edition 1971 low mileage monte carlo

1971 low mileage monte carlo We finance 03 ls sport cd stereo v6 alloy wheels warranty spoiler sunroof cruise(US $4,500.00)

We finance 03 ls sport cd stereo v6 alloy wheels warranty spoiler sunroof cruise(US $4,500.00)

Auto Services in Michigan

Xtreme Sound & Performance ★★★★★

Westborn Chrysler Jeep ★★★★★

Welt Auto Parts & Service Co ★★★★★

Valvoline Instant Oil Change ★★★★★

Trojan Auto Connection ★★★★★

Todd`s Towing ★★★★★

Auto blog

2023 Grand National Roadster Show Mega Photo Gallery | Hot rod heaven

Wed, Feb 8 2023POMONA, Calif. — From an outsider's perspective, it would be easy to assume that the Grand National Roadster Show has always been a Southern California institution. After all, it celebrates the diverse postwar car culture of the region — hot rods, lead sleds, lowriders, and more. However, the show had its roots in NorCal in 1950 when Al Slonaker and his hot rod club showed their custom cars at the Oakland Expo. The GNRS moved to Pomona, California, in 2004. By then it had grown exponentially and seen about a dozen more car customization trends come and go. However, the show and its centerpiece award, the America's Most Beautiful Roadster prize, celebrate what is perhaps the first of those trends: the American hot rod in its purest form. Today, in its 73rd year, the GNRS is the oldest indoor car show in America. Annually it welcomes 500-800 cars, gathered into special themes like Tri-Five Chevys or Volkswagen Bugs. At this year's show, which was last weekend, a special hall was dedicated to pickup trucks built between 1948-98, including mini-trucks, groovy camper bed conversions, and resto-mods. However, of all the vehicles presented, only nine are eligible for the America's Most Beautiful Roadster award. Winners get their names engraved on a 9-foot-tall perpetual trophy that was, according to The Ultimate Hot Rod Dictionary, the largest in the world when it debuted in 1950. Slonaker chose the word "roadster" initially because "hot rod" bore slightly negative outlaw connotations in 1950. Only American cars built before 1937 of certain body styles — roadsters, roadster pickups, phaetons, touring cars — are eligible, and they cannot have roll-down side windows. Cars in the running for the cup cannot have been shown anywhere else before their debut at the GNRS. Contestants for this accolade essentially build their cars to the a platonic ideal of a hot rod. This year the honors went to Jack Chisenhall of San Antonio, Texas, for his "Champ Deuce," a 1932 Ford Roadster. It's exactly what you picture when you think of a hot rod, but distilled to its absolute essence. Other standouts included "Green Eyes," a two-tone green 1959 Chevy El Camino with a heavily metal-flaked bed, "Blue Monday," a 1964 Buick Riviera lowrider, and a personal favorite, "Purple Reign," a purple and black 1951 Mercury. Cars may have started out as tools, but there aren't shows like this filled with custom refrigerators.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

With only 246 Volts sold in Australia, Holden not getting next-gen model

Tue, Apr 28 2015The Chevrolet Volt has not been the resounding success General Motors hoped for here in the United States. But it's fortunes in Chevy's home country are nothing compared to how poorly it's done down under. Only 246 Volts have been sold in Australia, where the car is branded as a Holden, since its debut in 2012. That's not just a bad showing – it's an absolute disaster. According to Motoring.com.au, it was the Volt's astonishing $60,000 price tag, combined with a lack of interest from Aussie drivers, that killed the car's chances. What's fascinating about this development, though, is that it doesn't necessarily seem to be Holden that's pulling the plug. Instead, it's the Volt's Hamtramck, MI factory, which is preparing to shift into production of the second-generation model that seems to be taking the blame. According to Motoring, the plant confirmed that it will only build the Gen 2 plug-in in left-hand-drive form, basically ruling out a model for Australia. "Electric and hybrid vehicles haven't taken off in Australia," Holden's director of communications, Sean Poppitt, told Motoring. "Considering the lack of infrastructure, the lack of government incentives, the large distances between cities, it's a tough sell." The death of the right-hand drive Volt won't be the only loss of business in Hamtramck. Opel has already confirmed that it will drop the plug-in's European fraternal twin, the Ampera, while the next-gen Chevy won't make the trip across the pond either. Related Video: