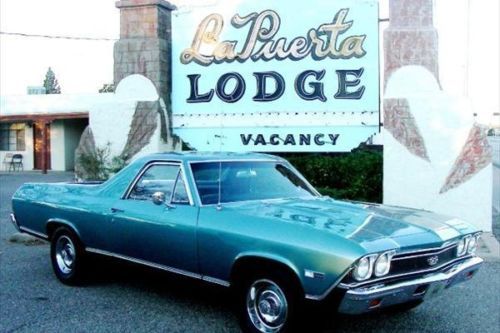

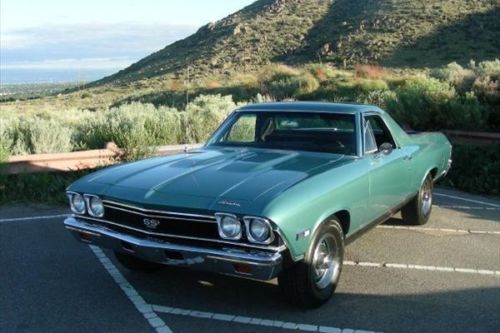

1968 Chevrolet El Camino Ss Classic on 2040-cars

Albuquerque, New Mexico, United States

Body Type:Other

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Year: 1968

Number of Cylinders: 8

Make: Chevrolet

Model: El Camino

Mileage: 87,232

Sub Model: SS

Exterior Color: Malachite

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Chevrolet El Camino for Sale

Auto Services in New Mexico

Valvoline Instant Oil Change ★★★★★

Super Sound ★★★★★

Stan`s Auto Service ★★★★★

Garage Auto Repair ★★★★★

Casa Collision Ctr ★★★★★

Car Parts Machine & Supply ★★★★★

Auto blog

Former Fisker CEO has some advice for Tesla Motors

Wed, Oct 22 2014Former Fisker Automotive CEO and ex-Chevrolet Volt vehicle-line director Tony Posawatz has some words of caution for Tesla Motors. The long-time automaker executive questions the California automaker's long-term viability – and gives some praise – in a talk with Benzinga, which you can listen to below. While the all-wheel-drive D that Tesla unveiled earlier this month in Southern California wowed a packed crowd, Posawatz (starting at around minute 4:45 in the interview) says Tesla would've been better off taking the resources it expended toward that Model S upgrade and directed them towards speeding up the development of a more affordable plug-in. Perhaps a number of investors agreed, since the company's stock fell the day after the D was announced. Posawatz says Tesla has been over-reliant on the sale of ZEV credits. Posawatz also says that Tesla has been over-reliant on the sale of zero-emissions vehicle credits in California for its earnings and questions whether the automaker will ever work at a large enough scale to sufficiently drive down costs and make consistent profits. Tesla CEO Elon Musk would take issue with this characterization. Posawatz first made his mark in the plug-in vehicle world when he was the vehicle-line director at General Motors for the Volt extended-range plug-in from 2006 to 2012. Later that year, he joined extended-range plug-in maker Fisker Automotive as its CEO, though quit that job during the summer of 2013 as the company was descending into insolvency. He joined the Electrification Coalition this past March. News Source: Benzinga Green Chevrolet Fisker Tesla Electric PHEV Tony Posawatz

IIHS Crash-tests Expose American Muscle Cars' Weaknesses | Autoblog Minute

Thu, Jun 2 2016Turns out American muscle cars aren?t that strong according to IIHS crash tests. The Insurance Institute for Highway Safety put three iconic American sports cars through a range of performance crash tests. Chevrolet Dodge Ford Autoblog Minute Videos Original Video crash test camaro challenger

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT — General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.047 s, 7947 u

1984 chevrolet el camino 5.0l big block 454

1984 chevrolet el camino 5.0l big block 454 1979 el camino

1979 el camino 1966 chevrolet el camino base standard cab pickup 2-door 6.5l

1966 chevrolet el camino base standard cab pickup 2-door 6.5l 1960 chevrolet el camino base standard 8cyl. 2-door 3.8l

1960 chevrolet el camino base standard 8cyl. 2-door 3.8l 1966 el camino chevelle pro street chevy

1966 el camino chevelle pro street chevy 1978 chevy el camino

1978 chevy el camino