2011 Chevrolet Corvette Zr1 Coupe 2-door 6.2l on 2040-cars

Fort Mill, South Carolina, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:6.2L 376Cu. In. V8 GAS OHV Supercharged

Fuel Type:GAS

For Sale By:Private Seller

Make: Chevrolet

Model: Corvette

Warranty: Vehicle has an existing warranty

Trim: ZR1 Coupe 2-Door

Options: Leather Seats

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 12,650

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: ZR1

Exterior Color: CRYSTAL RED METALIC

Interior Color: EBONY

Number of Doors: 2

Number of Cylinders: 8

CAR IS AS NEW, NO DAMAGE OR PROBLEMS, CAR HAS THE FACTORY CHROME WHEELS NAVIGATION ETC

Chevrolet Corvette for Sale

Corvette z06 coupe z16 405hp le mans commemorative 2004 c5 rare 11,328 miles(US $26,500.00)

Corvette z06 coupe z16 405hp le mans commemorative 2004 c5 rare 11,328 miles(US $26,500.00) 1992 chevy corvette convertible(US $10,000.00)

1992 chevy corvette convertible(US $10,000.00) 2001 corvette convert, 6 speed, rare color combination(US $24,999.00)

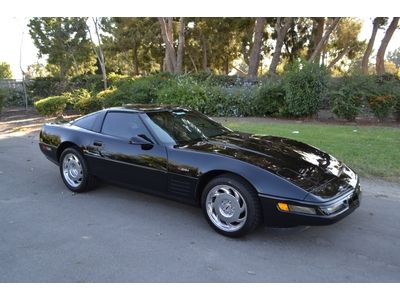

2001 corvette convert, 6 speed, rare color combination(US $24,999.00) 92 zr1 vette, black gray interior 350/375hp 6-speed excellent shape 25k miles

92 zr1 vette, black gray interior 350/375hp 6-speed excellent shape 25k miles 98 vette, 20k miles, auto,pwr sport seats, mem, 12 disk, climate control, ca car

98 vette, 20k miles, auto,pwr sport seats, mem, 12 disk, climate control, ca car 1959 corvette convertible

1959 corvette convertible

Auto Services in South Carolina

Vizible Changez Collision Center ★★★★★

Troy`s Muffler ★★★★★

Taylor Automotive Service & Repair Inc ★★★★★

Professional Tire and Radiator ★★★★★

Polaris Suzuki Go Powersports ★★★★★

Plyler Auto Sales ★★★★★

Auto blog

The future's electric — but the present is peak gasoline. Burn some rubber! Do donuts!

Wed, Jun 23 2021I vividly remember the year 1993 as a teenager looking forward to getting my driver’s license, longingly staring into Pontiac dealerships at every opportunity for a chance to see the brand-new fourth-generation Firebird and Trans Am. Back then, 275 horsepower, courtesy of GMÂ’s LT1 5.7-liter V8 engine, was breathtaking. A few years later, when Ram Air induction systems freed up enough fresh air to boost power over 300 ponies, I figured we were right back where my fatherÂ’s generation left off when the seminal muscle car era ended around the year 1974. It couldn't get any better than that. I was wrong. Horsepower continued climbing, prices remained within reach of the average new-car buyer looking for cheap performance, and a whole new level of muscular magnitude continued widening eyes of automotive enthusiasts all across the United States. It was all ushered in by cheap gasoline prices. And as much as petrolheads bemoan the coming wave of electric vehicles, perhaps instead now would be a good time for critics to sit back and enjoy the current and likely final wave of internal combustion. Today, itÂ’s easier than ever to park an overpowered rear-wheel-drive super coupe or sedan in your driveway. Your nearest Chevy dealership will happily sell you a Camaro with as much as 650 horsepower. Not enough? Take a gander at the Ford showroom and youÂ’ll find a herd of Mustangs up to 760 ponies. Or if nothing but the most powerful will do, waltz on over to the truly combustion-obsessed sales team of a Dodge dealer and relish in the glory of a 797-hp Charger or 807-hp Challenger. Want some more luxury to go with your overgrown stable of horses? Try Cadillac, where you'll find a 668-horsepower CT5-V Blackwing. You could instead choose to wrap that huffin' and chuggin' V8 in an SUV. Or go really off the rails and buy a Ram TRX or Jeep Wrangler Rubicon 392 and hit the dunes after a quick stop at the drag strip. Go pump some gas. Burn a little rubber. Do donuts! There is nothing but your pocketbook keeping you from buying the V8-powered car of your dreams. Yes, just about every major automaker in the world has halted development of future internal combustion engines in favor of gaining expertise in batteries and electric motors. No, that doesnÂ’t mean that gasoline is going extinct. There are going to be gas stations dotting American cities and highways for the rest of our lifetimes.

GM says EVs are the future — but trucks are going to take it there

Fri, Jan 11 2019In the PowerPoint deck for the General Motors Capital Markets Day presentation, one of the more disturbing things comes early on, during GM President Mark Reuss' initial remarks, in an area where he is discussing the company's overall strength in trucks. The point being made is that GM has a truck for all and sundry. And there it is, a phrase on a slide that should send chills up the spines of those who still pine for the old Bob Seger "Like a Rock" Silverado ads: "Little bit country. Little bit rock 'n' roll." That's right. Donny and Marie. Somehow the Denis Leary snark in the F-150 ads is all the more appealing. The Capital Markets Day presentation was chock full of observations about electrification and automation (Reuss and CEO Mary Barra both noted that the corporation's vision is one of "Zero Crashes. Zero Emissions. Zero Congestion." Dan Ammann talked about the progress being made at Cruise Automation; Reuss rolled out the plan for an array of electrified vehicles, with a luxury EV and a compact SUV being the "Centroid Entries" for the modular bases of many others). But it is worth noting that there is no getting away from the power of pickups in the U.S. market, as that was the central topic in Chief Financial Officer Dhivya Suryadevara's comments, with "Truck Franchise" being flanked by "Key Financial Priorities" and "Financial Outlook." Clearly, to gloss the old phrase, the truck segment is where the money is. Suryadevra enumerated how the truck segment is significantly different than other types of light vehicles. Among her points: GM, Ford and FCA have more than 90% of market share. The truck parc has been growing and aging over the past 10 years. Customers are fiercely loyal to the segment—as in 70% of truck buyers are truck buyers. A good number of the vehicles are for commercial use (40 percent). Trucks are "less prone to. . .mobility disruption." Trucks offer high margins. Translaton: The segment is one that they're solidly positioned in. There are lots of old trucks on the road that will need to be replaced by new ones. Perhaps buyers may switch from a Sierra to a Canyon, but it will be a truck. If your livelihood depends on that type of vehicle, even if gas prices go up or the economy begins to go south, you're going to stick with it. Most of the country isn't San Francisco, so trucks will continue to be essential. And, well, they're profitable in the extreme.

The UAW's 'record contract' hinges on pensions, battery plants

Thu, Oct 12 2023DETROIT - After nearly four weeks of disruptive strikes and hard bargaining, the United Auto Workers and the Detroit Three automakers have edged closer to a deal that could offer record-setting wage gains for nearly 150,000 U.S. workers. General Motors, Ford Motor and Chrysler parent Stellantis have all agreed to raise base wages by between 20% and 23% over a four-year deal, according to union and company statements. Ford and Stellantis have agreed to reinstate cost-of-living adjustments, or COLA. The companies have offered to boost pay for temporary workers and give them a faster path to full-time, full-wage status. All three have proposed slashing the time it takes a new hire to get to the top UAW pay rate. The progress in contract talks follows the first-ever simultaneous strike by the UAW against Detroit's Big Three automakers. The union began the strike on Sept. 15 in hopes of forcing a better deal from each major automaker. But coming close to a deal is not the same thing as reaching a deal. Big obstacles remain on at least two major UAW demands: restoring the retirement security provided by pre-2007 defined benefit pension plans, and covering present and future joint- venture electric vehicle battery plants under the union's master contracts with the automakers. On retirement, none of the automakers has agreed to restore pre-2007 defined-benefit pension plans for workers hired after 2007. Doing so could force the automakers to again burden their balance sheets with multibillion-dollar liabilities. GM and the former Chrysler unloaded most of those liabilities in their 2009 bankruptcies. The union and automakers have explored an approach to providing more income security by offering annuities as an investment option in their company-sponsored 401(k) savings plans, people familiar with the discussions said. Stellantis referred to an annuity option as part of a more generous 401(k) proposal on Sept. 22. Annuities or similar instruments could give UAW retirees assurance of fixed, predictable payouts less dependent on stock market ups and downs, experts said. Recent changes in federal law have removed obstacles to including annuities as a feature of corporate 401(k) plans, said Olivia Mitchell, a professor at the University of Pennsylvania Wharton School and an expert on pensions and retirement. "Retirees want a way to be assured they won't run out of money," Mitchell said.