1965 Corvette Coupe 327/250 Frame-off Restoration 2 Owner Car !!!! on 2040-cars

Exton, Pennsylvania, United States

Body Type:Coupe

Engine:327/250

Vehicle Title:Clear

Exterior Color: Rally Red

Make: Chevrolet

Interior Color: Black

Model: Corvette

Trim: Coupe

Drive Type: RWD

Warranty: Vehicle does NOT have an existing warranty

Mileage: 84,300

Chevrolet Corvette for Sale

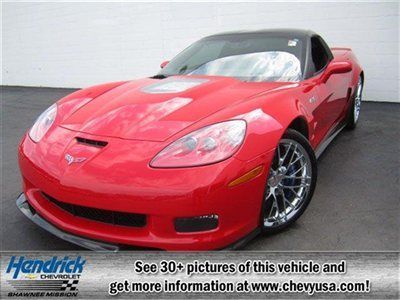

2007 chevrolet corvette low miles one owner

2007 chevrolet corvette low miles one owner Definetly has the appeal

Definetly has the appeal Vett roadster 4speed power steering restored five years 350hp bored .0060 over

Vett roadster 4speed power steering restored five years 350hp bored .0060 over Beautiful original 1974 corvette

Beautiful original 1974 corvette 2000 chevrolet corvette base convertible 2-door 5.7l(US $19,999.00)

2000 chevrolet corvette base convertible 2-door 5.7l(US $19,999.00) 2011 zr1, chevrolet certified, carfax 1-owner, low miles - 5,201! leather int

2011 zr1, chevrolet certified, carfax 1-owner, low miles - 5,201! leather int

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

West Shore Auto Care ★★★★★

Village Auto ★★★★★

Ulrich Sales & Svc ★★★★★

Trust Auto Sales ★★★★★

Steve`s Auto Body & Repair ★★★★★

Auto blog

Worldwide, Nissan Leaf has outsold next two competitors combined

Tue, Apr 28 2015Nissan may not be meeting some of the more optimistic prognostications with sales of its Leaf electric vehicle, but it's certainly kicking the competition's butt. EV Sales is tracking global sales of plug-in vehicle models and estimates that Nissan has sold almost 172,000 units of the Leaf worldwide. That's more than the two next-best-selling plug-ins combined. Globally, EV Sales estimates, the Chevrolet Volt extended-range plug-in has moved about 88,000 units, while Toyota has sold about 71,000 of its Prius Plug-in Hybrid vehicles worldwide. Fourth-place Tesla Model S is close behind at about 66,000 units. Among automakers, Nissan is also by far the lead dog, but Mitsubishi has leapfrogged Chevrolet among plug-in vehicle makers, as the Outlander Plug-in Hybrid continues to sell well. Impressively, the relatively new BMW i3 has moved almost 23,000 units since its debut in Germany last year. As for Nissan, company chief Carlos Ghosn said at the New York Auto Show earlier this month that the company could sell as many as 50,000 units a year of the Leaf in the US, provided that charging infrastructure throughout the country improves. Earlier this year, cumulative US Leaf sales moved past 75,000 units since its late-2010 launch. Related Videos: Featured Gallery 2013 Nissan Leaf View 55 Photos News Source: EV Sales Green Chevrolet Nissan Electric volt

Junkyard Gem: 1980 Chevrolet LUV Mikado

Sat, Oct 9 2021During the 1970s and into the 1980s, each member of the Detroit Big Three imported Japanese small pickups and sold them with Ford (Mazda Proceed), Dodge/Plymouth (Mitsubishi Forte), or Chevrolet (Isuzu Faster) badges here. Ford developed the Ranger and killed the Courier for 1983 (though Americans could still buy the Mazda-badged version all the way through 1993), while The General axed the LUV after the S-10 debuted in the 1982 model year. Isuzu sold the same truck as the P'up through 1987, though, and we might as well follow up our recent P'up Junkyard Gem with its LUV predecessor. LUV stood for Light Utility Vehicle, and I've managed to spot a handful in the boneyards over the years. This one now resides in a yard in northeastern Colorado. The Mikado trim package included striped seat upholstery and a sporty steering wheel, plus these cool dash badges. As far as I can tell, no LUV Mikado advertising featured any Gilbert and Sullivan tunes. This one is fairly rusty for Front Range Colorado, and it has endured a bed swap from some other small truck. The engine is the 75-horse Isuzu 1.8-liter. Members of this engine family went into everything from Chevy Chevettes to Isuzu Troopers in the United States. Very unusually for a small pickup during the Malaise Era, this one has a luxurious automatic transmission. Acceleration must have been a leisurely affair in this truck. Air conditioning? Unheard of! Someone stuck every one of their lunchtime apple stickers on the driver's door. After 41 years of work, this truck is done. Come on strong in a LUV of your own!

Nissan Leaf sells 1,553 in April, Volt climbs to 905

Fri, May 1 2015After three months in the 500 and 600 range, sales of the Chevy Volt climbed to 905 in April. That's up for the year so far – likely due to increasing discounts – but still down 41.5 percent from April 2014. As we've been saying every time the Volt turns in less-than-exciting monthly sales numbers, we suspect a large number of potential Volt buyers are waiting for the next-gen model to arrive in the second half of 2015. While the price for that car has not yet been announced, the updated tech specs show that it will probably be worth the wait for drivers who want the latest and greatest. Over on the Nissan Leaf side of things, April sales were 1,553 units this year. That's the second-best month of the year but down from the 2,088 units sold last April. After the Leaf finally climbed to the top of the cumulative best sellers list for plug-in vehicles last month, the difference between these two leaders is now 1,824 in favor of the Leaf. Nissan says that sales were influenced by the launch of its No Charge To Charge promotion in Indianapolis and Fresno, CA. This deal gives new Leaf buyers and lessees two years of no-cost quick charging in these markets. No Charge To Charge is not available in 15 US markets for (San Francisco, Sacramento, San Diego, Seattle, Portland, Nashville, Phoenix, Dallas-Ft. Worth, Houston, Washington, DC, Los Angeles, Chicago and Atlanta) and will expand to 10 more by the middle of this year. As we do every month, our full wrap-up of US green car sales is coming soon. For now, enjoy discussing these sales figures in the Comments below.