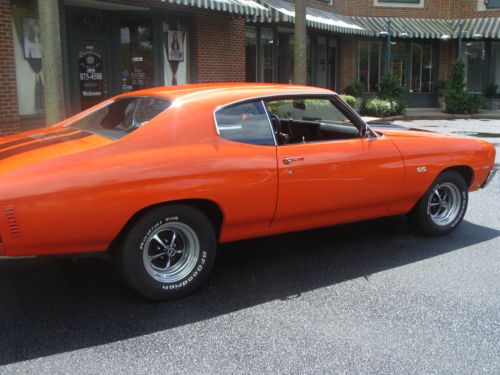

1970 Chevrolet Chevelle Ss 2-door 5.7l High Performance New Gm Create Motor on 2040-cars

Summerville, South Carolina, United States

| ||

Chevrolet Chevelle for Sale

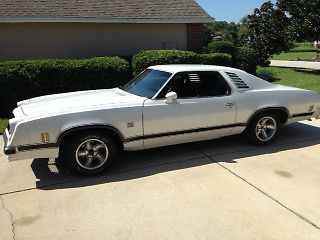

Malibu laguna s-3 with the nascar poly nose. swivel buckets seats just recovered

Malibu laguna s-3 with the nascar poly nose. swivel buckets seats just recovered 1972 chevelle ss clone(US $20,000.00)

1972 chevelle ss clone(US $20,000.00) 1964 chevrolet chevelle 300 base wagon 2-door 283 cu in(US $8,500.00)

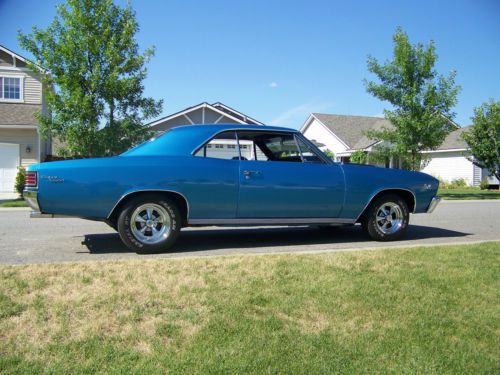

1964 chevrolet chevelle 300 base wagon 2-door 283 cu in(US $8,500.00) 1967 chevrolet chevelle ss 396(US $28,500.00)

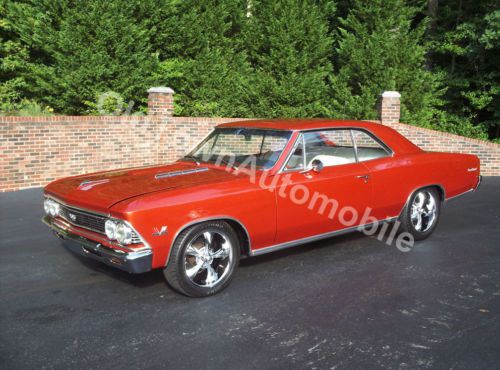

1967 chevrolet chevelle ss 396(US $28,500.00) Aztech bronze, posi, ps, pdb, bucket, console(US $32,900.00)

Aztech bronze, posi, ps, pdb, bucket, console(US $32,900.00) 67 chevelle 138 ss 4sp new 406 sbc(US $17,500.00)

67 chevelle 138 ss 4sp new 406 sbc(US $17,500.00)

Auto Services in South Carolina

Wilburn Auto Body Shop Mint St ★★★★★

Tire Kingdom ★★★★★

Super Lube And Brakes ★★★★★

S & M Auto Paint & Body Shop Inc ★★★★★

Richard Kay Chevrolet, Pontiac, Buick, GMC, Cadillac ★★★★★

QC Windshield Repair ★★★★★

Auto blog

Michael Jordan's cars showcased in 'The Last Dance' documentary

Sun, May 10 2020After the masses begged and pleaded for an early release, ESPN finally unlocked the doors to the biggest production in company history last month. Episodes 1 and 2 of The Last Dance, a 10-part documentary special about Michael Jordan, the Chicago Bulls, and the 1997-1998 season, was released at last on April 19, 2020. Each week since, two new episodes have aired on Sunday nights, and the next two, episodes 7 and 8 are scheduled to drop this weekend on May 10. With unprecedented video access to MJ, who became averse to the media during his playing days, a byproduct from The Last Dance is a look at some of Jordan's cars. The Goat's taste ranges across a number of brands, but they all had one thing in common: performance as a top priority. Below, we have listed the rides that have already appeared in the series, and each week, we will update with new car cameos. Chevrolet Corvette C4 The photo above somewhat epitomizes one of the themes of The Last Dance. Everybody, whether that was men, women, children, franchise owners, reporters, coaches, teammates, or opponents, wanted a piece of Jordan. If that meant stopping in the middle of the road to get an autograph, then so be it. Around town, MJ was fairly easy to spot due to his flashy cars that occasionally wore Bulls red. Jordan has driven numerous Corvettes throughout the years, but the C4 is unique in that it was Chevy's top ride when Jordan signed an endorsement deal with the American company during his rookie year in 1984. Two famous photos, one in front of the Chicago skyline, show him standing next to a C4 with the license plate "Jump 23." This exact car, however, came later, as indicated by the squared-off taillights. He went on to star in a number of Chevrolet commercials with vehicles such as the Blazer and S-10 pickup truck. Chevrolet Corvette C5 The most notable Corvette His Airness ever owned was likely the C4 40th Anniversary ZR-1, but he also drove a C5 coupe at one point. Roughly nine minutes into the first episode, Jordan is seen driving the chrome-wheeled targa top into the parking lot at the Berto Center, the Bulls old practice facility.  Ferrari 550 Maranello Roughly three minutes into episode four, viewers get a glimpse of Jordan's exotic taste in the form of a red Ferrari 550 Maranello.

Editors' Picks August 2021 | Honda Civic, Mercedes S-Class and more

Thu, Sep 9 2021This month of Editors' Picks saw us award the honor to a couple of redesigned stalwarts like the Honda Civic and Mercedes-Benz S-Class. Plus, a new crossover that splits the difference between the compact and subcompact class takes home the prize. On top of this, we'll introduce you to a new term: midcompact. We'll be using this to describe those in-between crossovers that are a tad too small to be considered compact, but too large to neatly fit into the subcompact class. For a few examples of these "midcompact" cars, we'll point you to the Ford Bronco Sport, Kia Seltos and VW Seltos. In case you missed our previous Editors' Picks posts, here’s a quick refresher on whatÂ’s going on here. We rate all the new cars we drive with a 1-10 score. Cars that are exemplary in their respective segments get EditorsÂ’ Pick status. Those are the ones weÂ’d recommend to our friends, family and anybody whoÂ’s curious and asks the question. The list that youÂ’ll find below consists of every car we rated in August that earned an EditorsÂ’ Pick. 2021 Genesis G70 2022 Genesis G70 View 26 Photos Quick take: Genesis hits all the right buttons with its G70. It's attractive, fun to drive and can be had for a fair price. Enthusiasts should give it a shot before taking home one of its German competitors. Score: 8 What it competes with: Alfa Romeo Giulia, Lexus IS, Acura TLX, Infiniti Q50, Audi A4, BMW 3 Series, Mercedes-Benz C-Class, Cadillac CT4, Volvo S60 Pros: Sharp handler, stunning exterior looks, strong engines Cons: Average interior, loses manual option, small backseat and trunk From the editors: News Editor Joel Stocksdale — "I was already a big fan of the Genesis G70. It has brilliant handling, and the twin-turbo V6 is a beast. It's even a bargain against the competition. And Genesis just made it look a lot better. I wish they'd done a bit more to update the interior, but it's still not a bad cabin. Besides, you won't think too much about it when you're hustling down a fun back road." Features Editor James Riswick — "Yes, it is small, but in a sport sedan segment where "sport" means increasingly less, the G70 still delivers (in part because of that smallness).

Travis Kvapil tells Twitter his Sprint Cup car was stolen

Fri, Feb 27 2015There's a bizarre story coming out of Atlanta today, as NASCAR racer Travis Kvapil is reporting that his Sprint Cup Car was stolen from a lot at the Drury Inn in Morrow, GA. Kvapil announced the theft, which included the black pickup that was hauling the trailer and the #44 Chevrolet SS Sprint Cup Car – shown above, with driver JJ Yeley at the wheel – on Twitter. According to Kvapil, the car wasn't going to be ready for the Thursday test session at Atlanta Motor Speedway, although forecasts of snow forced the team to dispatch their main trailer and tools to the track ahead of the car, which left for Atlanta later yesterday. According to ESPN, police in Morrow have video of the "incident," which happened at 5:34 AM Friday, with police investigating it as as criminal in nature. "Sometimes what happens when thieves see trailers, they might just assume there's something in the trailer they can go off and sell," Sgt. Larry Oglesby, of the Morrow PD, told USA Today. "Sometimes when things like this occur, they will drop off the items in a parking lot somewhere – like a Walmart parking lot – once they realize what they have." "All we know is it was a silver jeep," team owner John Cohen told USA Today. "One guy got out and they pulled off together." Earlier, Cohen told ESPN that the theft will force the team out of this weekend's race at the Folds of Honor QuikTrip 500, at Atlanta Motor Speedway. Kvapil, meanwhile, has taken to Twitter to appeal to his followers to be on the lookout for the truck, trailer and race car. Here's hoping it turns up all together. Check out the driver's tweets, below. Wow. Anyone near Atlanta find my stolen Cup car let me know! Unreal - Travis Kvapil (@TravisKvapil) February 27, 2015 I bet when whoever has it, opens the trailer and is going to be like 'oh snap' - Travis Kvapil (@TravisKvapil) February 27, 2015 Ok, to clarify. @Teamxtreme44 transporter is @amsupdates. The guys stayed and worked on the car Thursday at the shop in NC. They drove.... - Travis Kvapil (@TravisKvapil) February 27, 2015 down last night in a Ford dually and enclosed trailer with racecar inside. That was stolen out of hotel parking lot this am in Morrow, GA - Travis Kvapil (@TravisKvapil) February 27, 2015 Black Ford dually, white enclosed tag behind trailer. New Jersey plates - Travis Kvapil (@TravisKvapil) February 27, 2015 Dang.... I'm wishing we had LoJack or something on it!