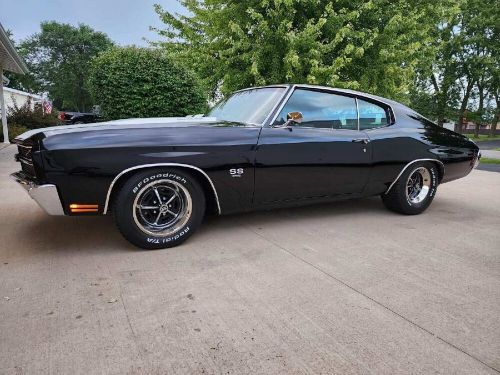

Transmission:Automatic

Vehicle Title:Clean

VIN (Vehicle Identification Number): 136370A115026

Mileage: 88

Model: Chevelle

Make: Chevrolet

Chevrolet Chevelle for Sale

1966 chevrolet chevelle pro-touring(US $20,000.00)

1966 chevrolet chevelle pro-touring(US $20,000.00) 1972 chevrolet chevelle ss - 402 #s match - ac(US $49,900.00)

1972 chevrolet chevelle ss - 402 #s match - ac(US $49,900.00) 1968 chevrolet chevelle ss396(US $69,900.00)

1968 chevrolet chevelle ss396(US $69,900.00) 1970 chevrolet chevelle(US $54,900.00)

1970 chevrolet chevelle(US $54,900.00) 1970 chevrolet chevelle(US $119,500.00)

1970 chevrolet chevelle(US $119,500.00) 1970 chevelle ss396(US $79,900.00)

1970 chevelle ss396(US $79,900.00)

Auto blog

2021 GMC Canyon trims overhauled, SL and SLT disappear

Sun, Feb 2 2020Until this year, the GMC Canyon has offered six trims in two drivetrains: SL, a base model simply called Canyon, SLE, All Terrain, SLT, and Denali, with all but the SL available in either 2WD or 4WD. GM Authority credits "dealer sources" for news that the 2021 Canyon has had its trim steps overhauled. According to the chart in the report, the SL and SLT are no more, the base Canyon gets replaced by a trim called Elevation Standard, and SLE turns into Elevation. We already know that All Terrain has given way to AT4, while Denali remains in the top spot. Trim content doesn't change with the names, but there's no equivalent for the SLT trim in terms of spec. The GMC site lists the 2020 SLE and SLT on the same page, and a shopper must burrow into the spec comparison page to figure out the differences. The SLT only comes with the 3.6-liter V6 and eight-speed transmission, and makes features like remote start, climate control, heated mirrors, heated seats, hitch guidance, and a spare tire standard equipment. It also chromes the exterior door handles, and offers a Cocoa/Dune leather interior that can't be had on the SLE. It's possible the SLT's $4,700 premium over the SLE led more buyers to start with the SLE and add the engine and options they wanted. Â We have a number of questions that we'll need to wait for GMC's official announcement to answer. The 2020 Canyon offers an Elevation Edition package for $650 that adds a black grille with body-colored surround, and 18-inch Satin Graphite wheels in all-terrain rubber. There's also a California Elevation Special Edition for $1,195 with all-weather floor liners, assist steps, and mud flaps. They could be optioned on the SLE but not the SLT. With the addition of two Elevation trims, we'll find out if the packages get renamed or go away. Separately, CarBuzz spotted a 2021 GM Fleet Order Guide that mentions a leveling kit option, LPO Code SQS, for the Canyon and the Chevrolet Colorado. We noted the inclusion of a leveling kit in the coming Canyon AT4 Off-Road Performance Package. According to the order guide, the option can be ordered only for the Canyon AT4 trim, but it's not clear if that's an a la carte choice or if buyers must order the Off-Road Performance Package. On the Chevy, the rake-removal equipment can be had with the Colorado 4x2 Z71 or the 4x4 Work Truck, LT, and Z71. Related Video:

Kia Seltos, electric Cadillac and a looming Bronco | Autoblog Podcast #615

Fri, Feb 21 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder, and Associate Editor Byron Hurd makes his ABP debut. This week, they start with the cars they've been driving: the Jaguar XE, Kia Seltos, Hyundai Venue and Ford Escape. Then they dig into the news, including an upcoming Cadillac EV, Lincoln and Chevy sedans and the Ford Bronco. Finally, they help a listener replace his Jeep Patriot in the Spend My Money segment. Autoblog Podcast #615 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: Jaguar XE 300 R-Dynamic S Kia Seltos Hyundai Venue Ford Escape Cadillac bringing EV to New York Auto Show Chevy and Lincoln dealers say they still want sedans Ford tells dealers the Bronco is weeks away from its global debut Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: 2020 Ford Escape 2.0T #POV drive

GM says over 40% of new China launches in next five years will be EVs

Wed, Aug 19 2020SHANGHAI — General Motors is planning an electric car offensive in China with more than 40% of its new launches in the country over the next five years set to be electric vehicles (EVs), the U.S. carmaker said on Wednesday. GM's electric vehicles, many of which will be all-electric battery cars, will be manufactured in China with almost all parts coming from local suppliers, the company said in a statement released at its Tech Day event in Shanghai. Reuters reported earlier on Wednesday that GM was planning to overhaul its Chinese line-up to stem a slide of sales after more than two decades of growth in a country that contributes nearly a fifth of its profit. GM's new China boss Julian Blissett told Reuters that new technologies, such as EVs and cars with near hands-free driving for highways, would play a key role in GM's China initiatives, which are part of a push to get annual sales in the country back to the 4 million peak it hit in 2017. GM did not say in its statement how many new or significantly redesigned models it was planning to launch in China over the next five years. "China will play a crucial role in making our vision a reality," GM CEO Mary Barra said in the statement, referring to its initiative to create what it describes as a future of "zero crashes, zero emissions and zero congestion" through electrification and smart-driving technologies. GM has said it plans to invest more than $20 billion in electric and automated vehicles globally by 2025. It was not clear how much of that investment will be spent in China. (Reporting by Norihiko Shirouzu in Shanghai; Editing by David Clarke) Related Video: Green Buick Cadillac Chevrolet GM Electric China