1970 Chevelle Big Block 4 Speed Power Brakes Bucket Seats Console on 2040-cars

Sherman, Texas, United States

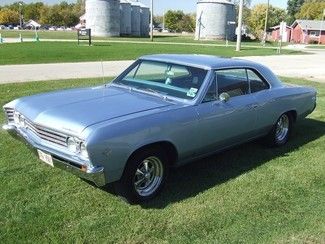

Body Type:Coupe

Engine:402

Vehicle Title:Clear

For Sale By:Dealer

Year: 1970

Interior Color: Black

Make: Chevrolet

Number of Cylinders: 8

Model: Chevelle

Trim: SS Clone

Warranty: Vehicle does NOT have an existing warranty

Drive Type: RWD

Mileage: 75,500

Options: console, buckets, 4 speed, power brakes

Exterior Color: White

Chevrolet Chevelle for Sale

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

How two-state Chevy Spark EV outsold 50-state Volt last month

Mon, May 4 2015Is it really just about price? Last month, the Chevy Spark EV got a sizable price drop of $1,500 alongside a lowered lease price of $139 a month (down from $199). Those numbers, particularly that cheap lease, had a tremendous impact on how many all-electric Sparks GM sold last month. There were 920 Spark EVs sold in April, and the Spark EV is available in only two states: California and Oregon. Sales will start in Maryland in the third quarter of 2015, but there are no pre-orders taking place there, so all 920 were West Coast sales. To be more precise, there were about 864 Spark EV leases signed last month, since 94 percent of those 920 sales were retail leases. As Annalisa Bluhm from Chevrolet communications told AutoblogGreen, that level was, "simply insane." "In those states which offer Spark EV, you can get a 1LT Spark EV for less than a 1LT Spark, with more features" Bluhm said. "Factor in that you will save approximately $82 per month by abstaining from gas, and it's easy to see why people went crazy for the Spark." Let's put 920 into perspective. For one thing, it's crazy up from the 151 Spark EVs sold in March 2015 and the 97 sold in April 2014. It's also almost as many as GM sold all last year, and way more than two years ago. The General sold 653 Spark EVs in 2013 and 1,146 in 2014. To throw in a comparison with GM's longstanding plug-in champion, the aging Volt, the Spark EV came out ahead in the monthly tally for the first time ever. In April, the Volt sold 905 units. The plug-in hybrid's best-ever sales month was August 2013, when it sold 3,351 units. Counting all models and powertrains, Chevy sold 3,743 Sparks in April. So, does this success mean that Chevy is looking to bring the Spark EV to more markets? Bluhm said that GM is considering other states and is always looking at the business case, but has "nothing to announce yet." Related Video: The video meant to be presented here is no longer available. Sorry for the inconvenience.

Plug In 2014: VIA makes the case for 'free' plug-in hybrid work vans, trucks

Fri, Aug 1 2014If you're a fleet manager who's been waiting anxiously for the chance to buy a plug-in hybrid van from Via Motors, your wait is almost over. If you work for the right fleet, anyway. David West, the chief marketing efficer for VIA Motors, took AutoblogGreen for a ride around the San Jose Convention Center in a Via van sporting an Electric Blue paint job as part of the Plug In 2014 Conference this week and gave us an update on how things are coming along. The big news is that the Via PHEV van production is going to start by the end of September. Via can currently build two vans an hour at its production plant in Mexico, or about 16 a day and could easily double that. "That would get us to 20,000 a year with two full lines running," West said. "We have the capacity." "There is no way gas can compete with electric." – David West, Via Motors But they can't sell that many quite yet. By the end of December, around 350 Vans will be made, mostly for a $20-million program from the Department of Energy (DOE) and the South Coast Air Quality Management District that will see the vehicles used by fleets that will report energy data to the Idaho National Lab. Via is also finishing up CARB certification for both the van and the company's plug-in hybrid pick-up truck. About 50 percent of Via's technology in the truck will not need to be tested again, since it's the same as what's in the van, but things like crash tests will need to be done twice. Despite the progress, this is not where Via hoped it would be today. The bankruptcy of battery supplier A123, "took about a year off our timeline," West said. "It's been getting a little slow getting it to market, there have been some challenges, particuarly since we had the country's worst recession right in the middle of this wrap up, but it's inevitable in my mind. There is no way gas can compete with electric." Maybe that's why FedEx has expressed an interest in buying around 5,000 units, West said. FedEx already has some pilot vehicles, just like Verizon does, and PG&E wants to replace all of their gas trucks with electric vehicles, which would be another 3,000 sales, he said. Besides the fuel savings, vehicles like these, with easy on-site power generation, could also work wonders in post-disaster situations, he said, since they could replace the need for generators.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.031 s, 7923 u

65 chevrolet chevelle pro street leather seats and custom wheels

65 chevrolet chevelle pro street leather seats and custom wheels 1966 chevy chevelle

1966 chevy chevelle 1969 chevrolet chevelle ss pro-street

1969 chevrolet chevelle ss pro-street Barn find survivor 1970 ss chevelle 396

Barn find survivor 1970 ss chevelle 396 1967 chevelle malibu 327 4-speed

1967 chevelle malibu 327 4-speed 1972 chevrolet chevelle 396 big block automtatic ps pb console dual exhaust

1972 chevrolet chevelle 396 big block automtatic ps pb console dual exhaust