1968 Chevrolet Chevelle Ss 396 Convertible 138 Code Factory Ss Convertible Red on 2040-cars

Bronx, New York, United States

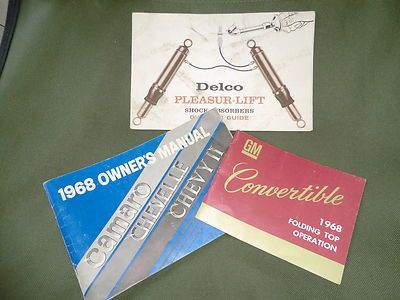

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Model: Chevelle

Mileage: 79,490

Warranty: Unspecified

Sub Model: SS 396

Exterior Color: Red

Options: Convertible

Interior Color: Black

Number of Cylinders: 8

Chevrolet Chevelle for Sale

1970 chevrolet chevelle ss with documentation

1970 chevrolet chevelle ss with documentation 1970 chevrolet chevelle ss hardtop 2-door with build sheet

1970 chevrolet chevelle ss hardtop 2-door with build sheet 1969 ss396 pro touring restomod 540 efi 5 speed a/c fathom green chevelle(US $49,000.00)

1969 ss396 pro touring restomod 540 efi 5 speed a/c fathom green chevelle(US $49,000.00) 1972 chevrolet chevelle (ss clone)

1972 chevrolet chevelle (ss clone) 1970 chevelle ss 454 coupe

1970 chevelle ss 454 coupe 1970 ss chevelle conv. ls-5 big block 4-speed $66 delivery financing trades

1970 ss chevelle conv. ls-5 big block 4-speed $66 delivery financing trades

Auto Services in New York

West Herr Chrysler Jeep ★★★★★

Top Edge Inc ★★★★★

The Garage ★★★★★

Star Transmission Company Incorporated ★★★★★

South Street Collision ★★★★★

Safelite AutoGlass - Syracuse ★★★★★

Auto blog

Best-selling vehicles by state

Wed, Dec 1 2021America loves trucks. According to Edmunds, which has tracked the best-selling vehicles by state based on new vehicle registrations, 40 out of 50 U.S. statesí best-selling vehicle is a pickup. Most often, that¬ís the Ford F-Series, but occasional Chevy, Ram and even Toyota top the lists. Here, we¬íve compiled the best-selling vehicles by state, including the four runners-up for each state. Interestingly enough, only one EV shows up in a state¬ís top five (Tesla Model 3 in California). Read on below to see what¬ís most popular in your state.

First privately owned Corvette Stingray blitzes 1/4 mile in 12.23 at 114.88 mph

Tue, 01 Oct 2013Chevrolet's latest road rocket, the Corvette Stingray, is a very quick car. If one needs further proof of that, we recommend they take a look at this video from Hennessey of what is claimed to be the first privately owned C7 Corvette to make a pass down the quarter mile. Not just any quarter mile, mind, this black C7 blitzed its way down the tuner's primary testing dragstrip. The Chevrolet ran the quarter in just 12.23 seconds at 114.88 miles per hour. That is a very quick time for a stock car.

Equipped with the Z51 package and a six-speed automatic transmission, not only does the C7 run a solid time, but it does so with little to no drama. That won't last though, as Hennessey will likely return it to its owner with far more power - we just hope they show a drag run of the completed product. Take a look below to watch the C7's 12.23-second run on video.

UAW rejects GM contract proposal but makes a counter offer

Tue, Oct 1 2019The United Auto Workers union said a new comprehensive offer made by General Motors Co late Monday to end a two-week-old strike was not acceptable and said it had made a new counterproposal. UAW¬†vice president Terry Dittes said in a letter to members "there are many important issues that remain unresolved." The union is awaiting GM's next proposal. He said GM's offer came up short on many issues.¬† Dittes said GM made a "comprehensive proposal" at 9:40 p.m. Monday. "This proposal that the company provided to us on day 15 of the strike did not satisfy your contract demands or needs. There were many areas that came up short like health care, wages, temporary employees, skilled trades and job security to name a few." Dittes is the union's vice president for GM relations and the UAW's lead negotiator in these contract talks. "We have responded today with a counterproposal and are awaiting GM's next proposal to the union," he wrote. "Regardless of what is publicized in print or social media, etc., there are still many important issues that remain unresolved." The strike, in its third week, has cost GM more than $1 billion, according to J.P. Morgan analyst Ryan Brickman. He said the cost per day in potential profit is $82 million. However, another analysis, by East Lansing-based consultant Anderson Economic Group, put the losses at $25 million a day. And the effects of the strike are expanding. GM said Tuesday the strike has created a parts shortage that forced the automaker to halt production at its pickup and transmission plants in Silao, Mexico, temporarily laying off 6,000 workers. Silao is where GM builds its highly profitable four-door crew cab Chevy Silverado and GMC Sierra pickups. The strike has also forced GM to idle some Canadian workers, and many suppliers have been forced to halt operations. About 48,000¬†UAW¬†members went on strike on Sept. 16 seeking higher pay, greater job security, a bigger share of the leading U.S. automakerís profit and protection of their healthcare.¬†