1968 Chevrolet Chevelle Ss on 2040-cars

Fallbrook, California, United States

I am always available by mail at: cartervasallo@netzero.net .

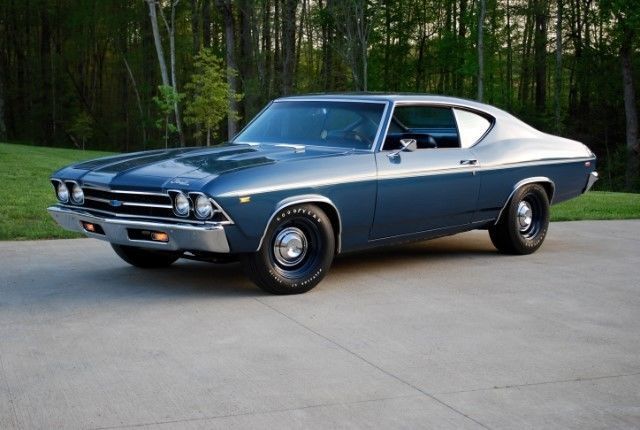

True SS 138 Code Chevelle Convertible. Factory Black Car (Paint Code A1) with untouched trim tag that is original to the car. Numbers matching 350 HP 396 Big Block. The stamp pad on the block is original with correct broach marks and never re-stamped. Factory A/C, factory tachometer (works), power steering and power brakes. Four speed manual transmission. Solid and Rust Free. All original floor and trunk pans. The paint is beautiful and the interior is very clean and looks fresh. Many original and correct parts on this rare beauty. If you are looking for a very correct and well optioned Chevelle SS Convertible, then this is the car for you. The electric top is black with no tears and works and functions as it is supposed to.

Chevrolet Chevelle for Sale

1970 chevrolet chevelle(US $30,200.00)

1970 chevrolet chevelle(US $30,200.00) 1969 chevrolet chevelle copo(US $19,500.00)

1969 chevrolet chevelle copo(US $19,500.00) 1972 chevrolet chevelle(US $20,100.00)

1972 chevrolet chevelle(US $20,100.00) Chevrolet: chevelle malibu ss(US $2,000.00)

Chevrolet: chevelle malibu ss(US $2,000.00) 1967 chevrolet chevelle(US $19,500.00)

1967 chevrolet chevelle(US $19,500.00) 1967 chevrolet chevelle(US $12,100.00)

1967 chevrolet chevelle(US $12,100.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

2021 Chevy Colorado and GMC Canyon facelift spied

Fri, Sep 20 2019The Chevy Colorado and its GMC Canyon twin have been on sale for a good long time now, and while things move a little more slowly on the truck side when it comes to facelifts and model changeovers, it seems like itís about time. So it¬ís no surprise to see some lightly camouflaged trucks running around ahead of what appears to be a minor refresh for the 2021 model year. Starting with the Colorado, it appears to have a bowtie hiding behind some camo in the center of the grille, which otherwise looks like the no-bowtie option you can get on 2019-and-up trucks. It could be that Chevy is keeping the no-bowtie grille design but allowing a bowtie to grace it, or it could be misdirection. Either way, the grille pattern adds a bit of flair to the otherwise staid front end design. There also appears to be a bit more shape to the lower air inlet, with echoes of some of the lower fascias of its bigger Silverado stablemate. The Canyon, on the other hand, shows more extensive front-end changes. At first glance, it looks to emulate some variants of the GMC Sierra, which would make sense given those models¬í changes for the 2020 model year. In particular, this Canyon has hints of Sierra HD, being more square and monolithic than the regular Sierra 1500s, although it¬ís a little hard to tell with the camo covering the edges of the grille. It could certainly also adopt more rounded corners like the 1500s. Either way, it¬ís more vertical and there¬ís less differentiation between the upper grille and lower opening. There¬ís nothing in the way of changes around the sides or back, and while there may be some minor changes inside, we aren¬ít expecting any. The word around town is that this isn¬ít a full facelift, but rather a minor front end tweak that¬íll just be a regular part of the model-year changeover.¬†

Recharge Wrap-up: Free chargers for Canadian ELR buyers, Renovo gets funding for EV supercar

Thu, Sep 18 2014Chevrolet offers versions of its Express passenger van with B20 biodiesel and E85 capability. Customers can buy the van with the Duramax turbodiesel V8, which is compatible with the 20-percent biodiesel blend. There is also a FlexFuel V8, which can use the 85-percent ethanol gasoline blend. It's a great option for shuttling the whole soccer team to practice using renewable fuels. Read more at Domestic Fuels. Early buyers of the Cadillac ELR in Canada will get a 240-volt charger installed at their home for free. It should help convince some buyers to adopt the range extended luxury EV. Cadillac's Chief Marketing Officer Uwe Ellinghaus says, "Professional installation of the fastest home-charging unit is a natural way to mark the introduction of ELR to the luxury market." Read more in the press release below. Renovo has received venture capital funding from California-based True Ventures to build its Coupe electric supercar. The impressive EV, with its 500 horsepower and 1,000 pound-feet of torque, is an inspiring vehicle built by a promising company, according to its financial backers. Toni Schneider of True Ventures says that Renovo has "created incredibly advanced technology and a beautiful machine that is well positioned to disrupt the automotive market." Read more in the press release below. Renault says it will build its Fluence ZE electric car in China for an unnamed brand, pending government approval. Chief Executive Carlos Ghosn announced the plan at a test drive event in France on Monday. Renault has a partnership with Dongfeng Motors to build and sell its cars in China. Read more at Reuters. Germany has lifted its ban on Uber. While the German court believes the ride-hailing service is operating illegally without proper licensing for drivers, it says Taxi Deutschland waited too long to file the case against Uber. The taxi association plans to appeal the decision soon. See more in the video below, and read more at The New York Times. A new report from UC Davis claims that a global expansion of public transit could save 1,700 megatons of carbon dioxide yearly and over $100 trillion by 2050. A "high-shift scenario" would be necessary, wherein governments invest in rail and clean buses, expand biking and walking infrastructure and shift focus away from projects that encourage car use. This shift to public transit would especially be important in the US, China and India. Read more in the press release below.

Most of the US won't get 2016 Chevy Volt

Tue, Sep 8 2015Every major plug-in vehicle launch in the US has been a patchwork operation, with automakers focusing their initial efforts on targeted locations like California where they expect to sell the most units. Today, we learned that even five years into the plug-in car project, the game remains the same. According to GM, the second-gen Chevy Volt is going to be rolled out in the same manner. In fact, GM is limiting availability of the 2016 model year Volt so much that most of the US will not have access to the car at all. For 39 states, the second-gen Volt will first be available as a 2017 model year vehicle at some point in the spring of 2016. When GM announced the buying process for the new Volt, it made it clear that dealers in California would be the first to place their orders. Hybrid Cars now reports that the first deliveries will be also limited to California and 10 other states that follow the California Air Resourced Board (CARB) rules: Connecticut, Massachusetts, Maryland , Maine, New Hampshire, New Jersey, New York, Oregon, Rhode Island, and Vermont. GM spokesman Kevin Kelly told AutoblogGreen that this is all according to plan. "Chevrolet has a shortened model year for the 2016 Chevy Volt that will have a limited distribution network," he said. "The 2016 Volt will be sold in our strongest EREV markets. The 2017 Chevrolet Volt will begin production early this spring and will be available throughout the country." It appears that non-CARB state Volt customers will be able to order their Volts starting October 1, according to documents posted on Hybrid Cars, where we also learn that 2016 Volt production for California started in August, will begin in late October for the other 10 CARB states, and in early 2016 for the rest of the US. Unsurprisingly, dealers outside of the 11 CARB states have been complaining that they can't order the much-anticipated new Volt for their customers just yet. Related Video: