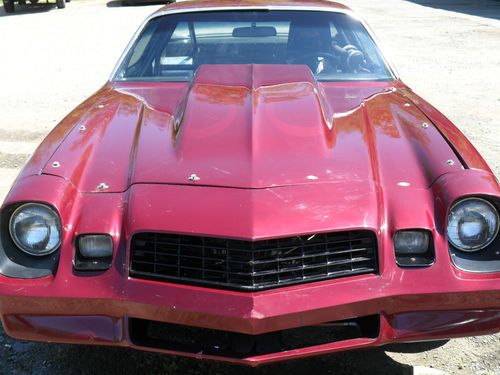

Pro Street Or Strip on 2040-cars

Owego, New York, United States

Body Type:Coupe

Engine:none

Vehicle Title:Clear

For Sale By:Private Seller

Number of Cylinders: N/A

Model: Camaro

Trim: 2 door

Drive Type: Rolling Chassis

Mileage: 0

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: Maroon W/ Ghost Flames

Sub Model: Camaro

Interior Color: Black

This vehicle is a rolling chassis. It is equipped for pro street or strip. It has rear disc brakes, 9" rear differential with 456 gears. It has Mark Williams 35 spline axles, coil over rear shocks, ladder bar suspension, and 10.5 rear slicks. It is mini- tubbed, has a 2 speed B&M shifter, quick disconnect steering wheel, monster gauges and a line lock. It has a fiberglass hood.

Chevrolet Camaro for Sale

1969 chevrolet camaro 427 500 hp(US $20,000.00)

1969 chevrolet camaro 427 500 hp(US $20,000.00) 1998 chevy camaro convertible - mechanic / body man / sanitation man special

1998 chevy camaro convertible - mechanic / body man / sanitation man special 1983 camaro z28 pro street / drag / show car

1983 camaro z28 pro street / drag / show car Camaro z28 lambo doors replica like maserati ferrari no reserve lo mils leather

Camaro z28 lambo doors replica like maserati ferrari no reserve lo mils leather Camaro ss2 2010 fully loaded

Camaro ss2 2010 fully loaded 68 camaro super sport clone

68 camaro super sport clone

Auto Services in New York

X-Treme Auto Glass ★★★★★

Wheelright Auto Sale ★★★★★

Wheatley Hills Auto Service ★★★★★

Village Automotive Center ★★★★★

Tim Voorhees Auto Repair ★★★★★

Ted`s Body Shop ★★★★★

Auto blog

Meet the mother-daughter team that's worked on almost every Chevy Volt

Sun, May 11 2014It's Mother's Day, and we're soft enough we love our mothers enough to share a new video from General Motors with you. In it, we meet Monique Watson (left) and Evetta Osbourne, a mother-daughter team that works at the Detroit-Hamtramck Assembly where GM makes the Chevy Volt (along with all of GM's other plug-in hybrids: the Opel Ampera, Holden Volt and Cadillac ELR). The two work side-by-side and have installed the lithium-ion battery pack on almost all of those vehicles - nearly 80,000 of them - since GM started making the pre-production Volts in 2009. In a prepared statement, Watson said that she likes working next to her mom, day in and day out, and they the two are totally in sync when it comes to putting the 400-pound, 16.5-kWh packs into the vehicle undersides. They two can also share stories throughout the day, and Watson said, "The arrangement has absolutely improved our relationship." Osborne started working at Detroit-Hamtramck in 1999, Watson since 2006. If you're driving a Volt today, you probably have them to thank for doing a bit of the work putting your car together. See a short video of them in action below. It's Always Mother's Day for Detroit-Hamtramck Duo Mother, daughter install lithium-ion battery pack in nearly all GM electric vehicles 2014-05-08 DETROIT – For Detroit resident Evetta Osborne, every day is Mother's Day. That's because she literally works side by side with her daughter, Monique Watson, at General Motors' Detroit-Hamtramck assembly plant. They have installed the lithium-ion battery pack on nearly every Chevrolet Volt, Opel Ampera, Holden Volt, and Cadillac ELR since production began. In fact, apart from vacation days and an occasional sick day, the mother-daughter duo has installed almost every battery pack since the Volt was in pre-production in 2009. The ELR launched earlier this year. All told – including Ampera – that's more than 80,000 electric vehicles. "We're a good team and our relationship is secondary when it comes to performing our jobs – but it's great to work alongside my daughter, said Osborne, a mother of five. Because the battery packs weigh more than 400 pounds each, automatic guided vehicles – robotic carts that use sensors to follow a path through the plant – deliver them just as the vehicle body structures glide into position overhead. The carts then lift the T-shaped packs, and Osborne and Watson guide them into the chassis and secure each one with 24 fasteners.

Tesla Cybertruck is here, Jeep Renegade is gone | Autoblog Podcast #810

Fri, Dec 8 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Electric, John Beltz Snyder. They start the show by talking about the new cars they'd buy for $24,000 if it were 1995. In the news, Tesla delivered the first production Cybertrucks, the Jeep Renegade has been discontinued for 2024, we've received specs and pricing for the Fiat 500e, the Chevy Bolt's return is confirmed for 2025 and Honda's gona show some future EVs at CES. For reviews, our hosts have been driving the Toyota bZ4X, Kia EV9 and Audi SQ5 Sportback. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #810 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Here's $24,000. Buy something new in 1995 Tesla Cybertruck price, specs, features finally revealed — plus, Cyberbeast 2024 Fiat 500e U.S. specs and pricing revealed Chevy Bolt second generation confirmed for 2025 debut Honda will show its new global EV lineup at CES Cars we're driving: 2023 Toyota bZ4X 2024 Kia EV9 2024 Audi SQ5 Sportback Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Audi Chevrolet Fiat Honda Jeep Kia Tesla Toyota

Recharge Wrap-up: Toyota FCV Rally Car To Compete, Barra bullish on Chevy Volt

Fri, Oct 31 2014The Toyota FCV will compete in the last stage of the 2014 Japanese Rally Championship. The sport-tuned hydrogen-powered car will tackle the 177-mile Shinshiro Rally on November 1 and 2, emitting no greenhouse gases in the process. The rally course will help prove the safety of the vehicle before it goes on sale in Japan in the next several months. The Toyota FCV, rumored to be called "Mirai" in Japan, will begin sales there before April, according to Toyota, and in the summer in the US and Europe. Read more in the press release below. Carsharing is becoming more popular, and more visible, throughout the world, including the US. According to WardsAuto columnist John McElroy, 18 percent of US drivers have used some sort of carsharing service. Additionally, he says 60 percent of Americans are familiar with Zipcar and Uber. Mercedes' Harald Kroeger says promotions like free parking for carshares in Stuttgart are encouraging growth for Daimler's carsharing service, Car2go. Read more at WardsAuto. Ethanol is being help up by rail transport, according to ethanol producer Green Plains. More and more stations are carrying E15 blend gasoline, but grain producers have complained that crude oil is given higher priority by the rail lines shipping it, which rail companies deny. Union Pacific and BNSF Railway say they are stepping up service to make sure that ethanol can be shipped reliably to customers. Read more at Omaha World-Herald. General Motors "has placed a significant bet [on] the electrification of the automobile," says CEO Mary Barra. In a speech to the Detroit Economic Club this week, she spoke about the Chevrolet Volt, and its importance to GM's future. While Barra admits the Volt's success has been "not everything we wanted," it has provided experience, and shows that EVs have "an important role in the future of GM." The new Volt is more refined, stores more energy, has longer range, uses less fuel and is a big investment for Michigan. She announced that the new Volt's electric drive system will be built in Warren, and that all of its major components will be made in Michigan. "Silicon Valley doesn't have a corner on the market for innovation, creativity and drive," says Barra. "These qualities exist here – in this region – as well." See the speech's highlight video and read more in the transcript below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.