1994 Chevrolet Z28 Camaro Convertible ~ 5.7 ~ 6 Speed Manual !!!! on 2040-cars

Fairless Hills, Pennsylvania, United States

|

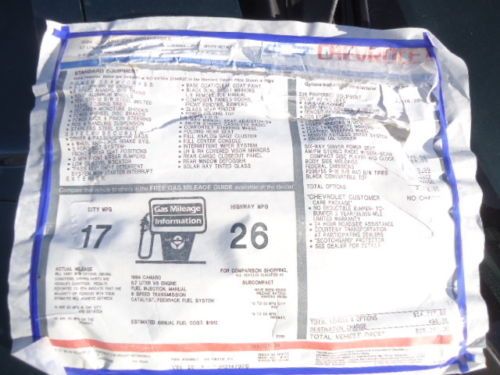

You are bidding on a rare 6 speed 1994 Chevrolet Z28 Camaro Convertible . Car is in good condition and ready to go !! Runs great ! Looks Great !! Car is green with a tan interior ( very clean ) . Car has 117802 miles and runs and drives like new . Car does have some minor issues . Top has one seam near rear window that is hanging a bit ( see photo ) and some previous paint work on car was done and has some minor flaws and crack on dash top ( sun ) . Please call with any questions prior to bidding . Selling for a friend . Please call John for any questions you may have or to set up viewing . John 215 651 2032 Thank you !

|

Chevrolet Camaro for Sale

1981 camaro z28 all original unrestored survior 56k original paint spotless

1981 camaro z28 all original unrestored survior 56k original paint spotless 2000 chevy camaro ss turbo 6 speed

2000 chevy camaro ss turbo 6 speed 1999 berger camaro, gmmg, hugger orange, stage ii, 435 horse, only 99' built

1999 berger camaro, gmmg, hugger orange, stage ii, 435 horse, only 99' built 2010 chevy camaro lt v6 automatic synergy green 60k mi texas direct auto(US $19,980.00)

2010 chevy camaro lt v6 automatic synergy green 60k mi texas direct auto(US $19,980.00) 1997 chevrolet camaro ss white 5.7 lt1 6-speed

1997 chevrolet camaro ss white 5.7 lt1 6-speed 1994 camaro z28

1994 camaro z28

Auto Services in Pennsylvania

West Penn Collision ★★★★★

Wallace Towing & Repair ★★★★★

Truck Accessories by TruckAmmo ★★★★★

Town Service Center ★★★★★

Tom`s Automotive Repair ★★★★★

Stottsville Automotive ★★★★★

Auto blog

Suzuki recalls 2 million cars globally

Wed, Apr 22 2015Suzuki is recalling two million vehicles across the globe, including a number of Chevrolet Cruze sedans that it builds for General Motors, because the ignition switches may begin to smoke. None of the Cruzes being recalled were sold in the US, though. This recall is limited to the Japanese, European and Australian markets. In Suzuki's home market, 1,873,000 vehicles are being recalled, including the Cruze and a number kei cars built for Mazda (the Carol and AZ-Wagon), as well as the automaker's own Alto, Wagon R and Swift. Affected vehicles were built between 1998 and 2009. The remaining 133,000 vehicles include Cruzes and other Suzuki products sold in Europe and Australia. There have been no reports of injuries or accidents due to the 67 reported incidents, all of which come from the Japanese market, a Suzuki spokesperson told Automotive News. Related Video:

GM announces $7 billion Michigan factory investment, most going to EVs

Tue, Jan 25 2022GM announced a $7 billion investment in Michigan manufacturing, much of which is earmarked for EV production. Four sites are included, but the key elements are a new battery cell plant in Lansing and the conversion of GM's existing Orion Township facility to expand production of the forthcoming Chevrolet Silverado EV and its GMC Sierra sibling. GM says it is the largest investment announcement in company history and that it will create 4,000 new jobs. It also says 1,000 jobs will be retained. "We are building on the positive consumer response and reservations for our recent EV launches and debuts, including the GMC Hummer EV, Cadillac Lyriq, Chevrolet Equinox EV and Chevrolet Silverado EV," said GM CEO Mary Barra. GM says the Orion expansion and new battery plant will support an increase in full-size electric truck production capacity to 600,000 units. This is in addition to the Factory ZERO facility in Detroit that will also be constructing the electric Silverado and Sierra. The Orion Township factory current builds the Chevrolet Bolt EV and EUV, and will continue to do so during the plant's conversion. GM did not indicate what will happen with the Bolts once that conversion is complete or whether all will continue to be built at Orion. They do not use the Ultium vehicle architecture. GM will build other EV models at three other factories that are under construction or being converted. They are located in Spring Hill, Tennessee, Ingersoll, Ontario, and Ramos Arizpe, Mexico. GM says that it will have the ability to produce 1 million electric vehicles by 2025. The Ultium Cells Lansing facility is a $2.6 billion joint investment by GM and LG Energy Solution. GM says it alone will create 1,700 jobs once fully operational by late 2024. It will join two other GM Ultium Cells battery factories currently under construction in the United States, one in Ohio and the other in Tennessee. Not all of the $7 billion investment will be for EVs. It also announced $510 million of the total will go toward upgrading the Lansing Delta Township Assembly to produce the next-generation Chevrolet Traverse and Buick Enclave. Money will also go to upgrading Lansing Grand River Assembly.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.