1969 Chevrolet Camaro Rs Z/28 302 Restored Original 3 Owner on 2040-cars

Ellsworth, Wisconsin, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:DZ 302 4 BBL

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chevrolet

Model: Camaro

Trim: RS Z/28

Power Options: FRONT POWER DISC BRAKES, Power Windows

Drive Type: 4 SPEED

Mileage: 80,690

Disability Equipped: No

Exterior Color: Lemans Blue

Number of Doors: 2

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 8

Chevrolet Camaro for Sale

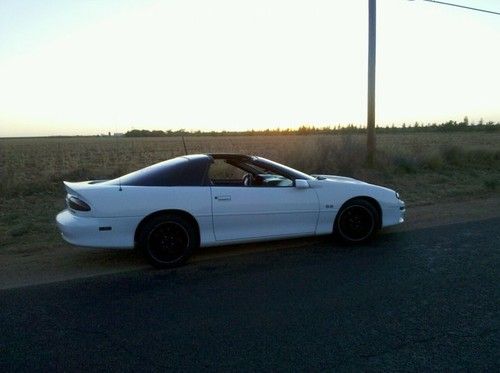

2002 chevrolet camaro z28 ss coupe 2-door 5.7l ls1(US $12,500.00)

2002 chevrolet camaro z28 ss coupe 2-door 5.7l ls1(US $12,500.00) 1991 chevrolet camaro rs convertible v8 only 31k miles original paint(US $11,900.00)

1991 chevrolet camaro rs convertible v8 only 31k miles original paint(US $11,900.00) Automatic - leather - factory warranty

Automatic - leather - factory warranty 2000 camaro ss...aftermarket ms3, great condition but needs attention!(US $8,000.00)

2000 camaro ss...aftermarket ms3, great condition but needs attention!(US $8,000.00) 1969 camaro coupe

1969 camaro coupe Chevrolet camaro

Chevrolet camaro

Auto Services in Wisconsin

Witt Ford Lincoln ★★★★★

Waukehas Best Used Cars ★★★★★

Truck & Auto Elegance ★★★★★

The Muffler Shop ★★★★★

Swant Graber Motors ★★★★★

Stolze`s Wausau Auto Repair ★★★★★

Auto blog

First privately owned Corvette Stingray blitzes 1/4 mile in 12.23 at 114.88 mph

Tue, 01 Oct 2013Chevrolet's latest road rocket, the Corvette Stingray, is a very quick car. If one needs further proof of that, we recommend they take a look at this video from Hennessey of what is claimed to be the first privately owned C7 Corvette to make a pass down the quarter mile. Not just any quarter mile, mind, this black C7 blitzed its way down the tuner's primary testing dragstrip. The Chevrolet ran the quarter in just 12.23 seconds at 114.88 miles per hour. That is a very quick time for a stock car.

Equipped with the Z51 package and a six-speed automatic transmission, not only does the C7 run a solid time, but it does so with little to no drama. That won't last though, as Hennessey will likely return it to its owner with far more power - we just hope they show a drag run of the completed product. Take a look below to watch the C7's 12.23-second run on video.

This is your 2014 Chevrolet SS

Sat, 16 Feb 2013Think you've waited long enough for this? If so, then you'll want to savor the high-res photos we've so far been given of the 2014 Chevrolet SS, the first rear-wheel-drive performance sedan from The Bowtie in 17 years.

We all know its our version of the brand new VF-model Holden Commodore, but what's under the hood that earns the appellation "performance?" A 6.2-liter LS3 V8 engine producing 415 horsepower and 415 pound-feet of torque. That's 35 hp and lb-ft less than the same engine is expected to produce in the 2014 Chevrolet Corvette. Chevrolet says the sedan will get from 0-to-60 miles per hour "in about five seconds."

Shifting comes courtesy of a six-speed automatic with paddles on the steering wheel, while stopping arrive via four-piston Brembo calipers up front, a single sliding piston in back. The forged aluminum wheels are 19-inchers all around, each set supporting right around 50 percent of the sedan's weight, and the aluminum hood and trunk are meant to keep the center of gravity low.

GM won't sell 2014 Chevrolet SS in Canada

Thu, 21 Feb 2013Allow us to be the first to extend our condolences to our friends to the north. General Motors has announced the 2014 Chevrolet SS will not be available in Canada. The Globe and Mail reports the automaker has confirmed the high-performance sedan won't hit Canadian dealers, though GM hasn't offered up any reasoning as to why that is.

Buyers here in the US of A, meanwhile, can look forward to getting their hands on the 415-horspower, rear-wheel drive SS by late summer. Something tells us it won't be long after that before Canadian officials start seeing individually imported 6.2-liter V8 four-doors in their neighborhoods. Fortunately, Canadian buyers will still be able to take home the 2014 Chevrolet Corvette. The C7 bowed at the Canadian International Auto Show last week, reportedly drawing sizable crowds and interest.