1969 Camaro on 2040-cars

Harvey, Illinois, United States

Body Type:Coupe

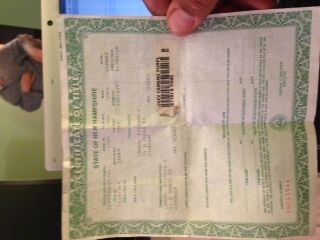

Vehicle Title:Clear

Engine:V 8

Model: Camaro

Trim: Z28

Warranty: Unspecified

Mileage: 132

Drive Type: REAR WHEEL DRIVE

Exterior Color: Burgundy

Sub Model: Z28

Interior Color: White

Power Options: Air Conditioning

Number of Cylinders: 8

1969 CAMARO ,,,VERY NICE PROJECT CAR I OWN IT FOR 3 YEARS AND NEVER START ON IT ,,,SO I WILL LET IT GO ,,,,, THE CAR IS PROJECT SO NO MOTOR I HVE 2 DOORS FOR IT ,,,THEY WILL COME WITH THE CAR ,,,,,,WHAT U SEE IS WHAT U GET ,,,,,,,,ITS A VERY RARE CAR TO FIND AND ITS WORTH A LOT FOR SOMEONE IS LOOKING TO OWN A 69 CAMARO ,,

Chevrolet Camaro for Sale

Auto Services in Illinois

Zeigler Fiat ★★★★★

Wagner`s Auto Svc ★★★★★

US AUTO PARTS ★★★★★

Triple D Automotive INC ★★★★★

Terry`s Ford of Peotone ★★★★★

Rx Auto Care ★★★★★

Auto blog

2020 Chevy and GMC HD truck spy shots reveal LED lighting

Mon, Aug 20 2018With Chevy and GMC's 1500 series pickups just starting to roll into dealerships, our attention naturally turns to the Heavy Duty 2500 and 3500 series trucks. We've seen these HD trucks testing already, but thes latest spy photos give us our first good glimpse of the two HD trucks' headlights through some translucent camouflage, and their designs appear very interesting and quite different from each other. The 2020 Chevrolet Silverado HD looks to be getting a striking set of LED lights that flank the grille. A previously released teaser image of the truck shows that the front lighting elements are split by a bulky wing that branches out from a big, upright chrome face, and both top and bottom units seem to incorporate LED slashes. If you look closely at the images, you can easily make out the Chevrolet script cut into the grille's top edge. Amidst a bevy of Chevy test trucks was one lone GMC model in a dually configuration, and the Sierra HD also appears to have some LED accent lighting up front. Unlike the boomerang-shaped Chevy LEDs, GMC's version sports a shoulder-like right angle of light bars. Assuming these are production-level lighting units, it seems the Sierra HD will stick pretty close to the face of GMC's latest light-duty pickup truck. We're still waiting for confirmation on what range of powertrains will be available in GM's next-gen HD trucks, but we're sure there will be both gasoline- and diesel-burning engines on the ordering sheet. We expect to hear official details on the trucks sometime soon. Related Video: Featured Gallery 2020 GM Heavy Duty Pickup Spy Photos View 18 Photos Image Credit: KGP Spy Photography Spy Photos Chevrolet GMC Truck gmc sierra hd chevy silverado hd

Autoblog Minute: 2017 Ford F-Series Super Duty truck reveal

Thu, Sep 24 2015Competition in the heavy duty truck segment heats up as we get our first look at the 2017 Ford F-Series Super Duty lineup. Autoblog's Adam Morath reports on this edition of Autoblog Minute. With commentary from Autoblog's senior editor Greg Migliore and an interview with Doug Scott of Ford Motor Company. Update: This post has been updated to reflect that the entire Ford F-Series Super Duty lineup is new for 2017, not just the F-250 model. Show full video transcript text [00:00:00] Competition in the heavy duty truck segment heats up as we get our first look at the 2017 Ford F-Series Super Duty trucks. I'm Adam Morath and this is your Autoblog Minute. As Ford prepares to release its new Super Duty line to the American worker, we spoke with Doug Scott of Ford's Truck Group to find out what customers can expect from this latest super duty offering: [00:00:30] [Doug Scott Interview] For more on what the changes to Super Duty mean for the segment we go to Autoblog's Greg Migliore: [00:01:30] [Greg Migliore Interview] Will a larger cabin and increased towing capacity help these heavy duty trucks take off like the smaller F150? And, how will the other HD giants, Chevy, GMC, and Ram respond? Truck fans, be sure to sound off in the comments below. For Autoblog, I'm Adam Morath. [00:02:00] Show Logo Autoblog Minute is a short-form video news series reporting on all things automotive. Each segment offers a quick and clear picture of what's happening in the automotive industry from the perspective of Autoblog's expert editorial staff, auto executives, and industry professionals. Chevrolet Ford GMC RAM Truck Autoblog Minute Videos Original Video ford f-250 f-250 super duty

Chevy Volt has worst sales month since August 2011, Nissan Leaf also down

Tue, Feb 3 2015January is traditionally a time when new car shoppers take a break. For the last few years, if we isolate our focus to just the first two major plug-in cars in the US market, we see that the first month of the year was lower – often dramatically lower – than the 11 that followed. So, when you see the Chevy Volt dropped and Nissan Leaf sales figures for January 2015, don't be too surprised. The Volt sold only 542 units last month, that model's lowest since August 2011. That also represents a 41 percent drop from January 2014, and it reinforces the thought that if anyone out there is interested in a new Volt, they're going to be waiting for the new model to drop later this year. While we do expect sales to climb in February and into spring, we won't be surprised if the general Volt trend remains quiet until the second-generation arrives. On the Leaf side of the ledger, January's low sales numbers were still about twice as high as the Volt's – the Leaf sold 1,070 units last month, the lowest since February 2013 – but it did break a streak for the Japanese automaker. Usually, each month represents at least an increase over the same month a year ago, but that wasn't the case this time. In January 2014, Nissan sold 1,252 Leafs. Still, Brendan Jones, Nissan's director of electric vehicle sales and infrastructure, issued an upbeat statement: "We saw a significant increase in demand in December from Nissan Leaf customers looking to take advantage of federal and state incentives at the end of the tax year, which pulled some sales ahead. We're confident that EV sales will continue to rise over time due to increasing emission regulations and other reasons for purchase of EVs such as lower operating costs, reducing dependence on foreign energy sources, environmental concerns and a great driving experience." The numbers will tell us soon enough. News Source: General Motors, Nissan Green Chevrolet Nissan Electric Hybrid ev sales brendan jones

Chevrolet camaro v8 6.2 liter 2ss rs 22" wheels 2010 racing stripes custom sound

Chevrolet camaro v8 6.2 liter 2ss rs 22" wheels 2010 racing stripes custom sound 1995 chevy camaro, no reserve

1995 chevy camaro, no reserve 1969 chevrolet camaro z28

1969 chevrolet camaro z28 1967 chevrolet camaro rs

1967 chevrolet camaro rs 1969 chevrolet camaro rs ss 396 big block

1969 chevrolet camaro rs ss 396 big block 1968 camaro

1968 camaro