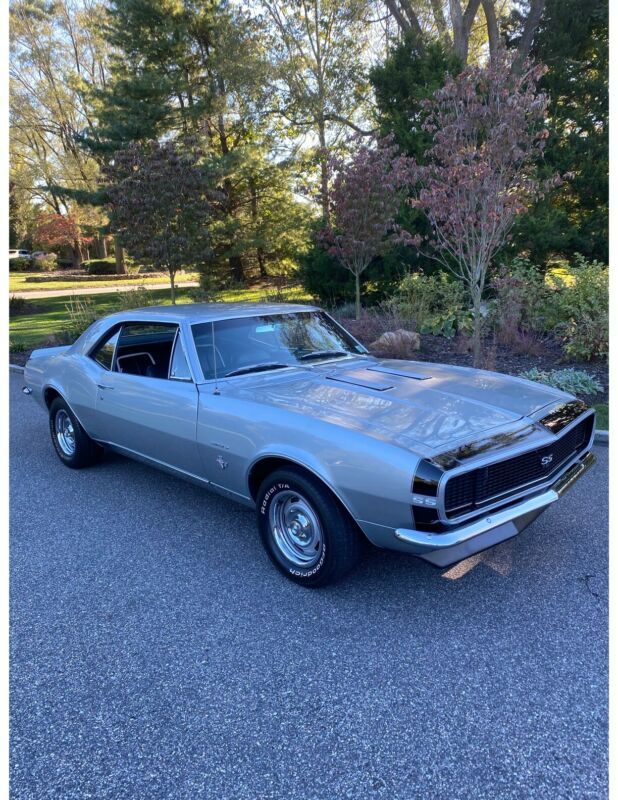

1967 Chevrolet Camaro Custom Rs on 2040-cars

Imperial Beach, California, United States

A beautiful 1967 Chevrolet Camaro RS LS3 for sale. This car runs beautifully and has a ton of power with the LS3

engine in it. There have been A TON of upgrades, but the goal was to build a restomod style car (a classic that

runs dependably and has some modern amenities) while still keeping the look of a classic on the interior and

exterior.

Here is a list of the updates:

1. LS3 Engine Swap

2. Perfect Launch rear differntial cover

3. M/T Drag Radials

4. Hotchkis Front Springs & Hotchkis Fox Rear Shocks

5. Holley LS Swap Oil Pan

6. CPP Tubular Crossmember

7. Competition Engineering Subframe Connectors

8. Auto Meter Phantom Gages

9. Tachometer

9. Power Steering

10. Dual Exhaust

11. Tubular Upper & Lower Control Arms

12. Front & Rear Sway Bars

13. Front & Rear Spoilers

14. Cowl Induction Hood

15. Chevrolet Rally Wheels

16. Ceramic Coated Long Tube Headers

17. Caltrac Traction Bars

18. Bilstein Front Shocks

19. Aftermarket Sound System

20. Aluminum Radiator w/ Electric Fan

21. 4 Wheel Wilwood Disc Brakes

22. Vintage AC System

23. Front & Rear power windows

24. Power Locks

25. Viper Alarm System

26. Electric Brakes for great stoping power with the LS3 engine

27. Updated steering wheel, sun visors, windshield wipers, parking brake, parking medal & Rearview mirror

28. Battery and kill switch located in trunk to prevent battery from draining

29. New door sill plates

30. Dynamat installed in doors and engine compartment

31. New trunk upholstery and weather stripping

The car starts every time and is a perfect ride. Daily driver. Easily puts out around 500hp with current set-up. Paint is in great condition and I get a ton of compliments on it. It isn't show level paint, but most certainly better than driver paint. Hideaway lights function as they should and

AC runs super cold. All work was done professionally and done right.

Chevrolet Camaro for Sale

1972 chevrolet camaro(US $16,800.00)

1972 chevrolet camaro(US $16,800.00) 1967 chevrolet camaro rsss(US $22,120.00)

1967 chevrolet camaro rsss(US $22,120.00) 1969 chevrolet camaro(US $16,800.00)

1969 chevrolet camaro(US $16,800.00) 1969 chevrolet camaro z28(US $21,000.00)

1969 chevrolet camaro z28(US $21,000.00) 1969 chevrolet camaro(US $19,600.00)

1969 chevrolet camaro(US $19,600.00) 1969 chevrolet camaro(US $16,800.00)

1969 chevrolet camaro(US $16,800.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Z D Motorsports ★★★★★

Young Automotive ★★★★★

XACT WINDOW TINTING & 3M CLEAR BRA PAINT PROTECTION ★★★★★

Woodland Hills Honda ★★★★★

West Valley Machine Shop ★★★★★

Auto blog

Pure Vision Design TT Camaro has 1,400 reasons to want it

Wed, 06 Nov 2013We've talked about Pure Vision Design before, a California-based company that made waves at last year's SEMA show with its Martini-liveried, Indy-car-powered Ford Mustang. That same car later starred in a Petrolicious video we showed you just a few weeks back. The company's latest creation is a menacing car it calls the Pure Vision Design TT Camaro. Based on a 1972 model, this car shares the Martini Mustang's clean styling and obsession with details.

Unlike the Mustang, which draws its power from a mid-60s Lotus-Ford Indycar engine, the "TT" in this Camaro's name implies something far more potent. The Nelson Racing Engines 427-cubic-inch V8 has been fitted with a pair of turbochargers, with a claimed output of 1,400 horsepower. That's almost 1,000 more than the Martini Mustang.

A six-speed Magnum transmission dispatches that power to the ground, while Pirelli PZero tires are tasked with (somehow) trying to grip the road. Baer brakes hide behind those HRE rims, while JRI coilovers and HyperTech springs bless the Camaro with some degree of competency in the bends.

Hertz and GM team up to put 175,000 rental EVs on the road

Tue, Sep 20 2022Hertz and General Motors have announced a significant partnership that will send up to 175,000 electric vehicles into rental fleets across the country. The deal will unfold over the next five years and include vehicles from all GM brands. Â The partnership will run through 2027. Hertz estimates that the electric fleet can save as many as 8 billion gasoline-powered miles, removing 1.8 million metric tons of carbon dioxide-equivalent emissions from the air. Hertz says it will invest in becoming the largest renter of EVs in North America and notes that it already has tens of thousands available at 500 locations in 38 states. By the end of 2024, it plans to electrify a quarter of its fleet. Electric rental cars are a great way for travelers wanting to avoid gas, and they make excellent urban commuter cars. Hertz will also likely save a few dollars by avoiding oil changes and other routine maintenance that gas engines need. However, a hidden societal benefit of this deal may come when Hertz’s EV rental customers begin shopping for new cars. Many people are skeptical of EVs for various reasons, including range, charging, ease of operation, and cost. Giving people a low-risk introduction to EVs and the ability to test-drive one without a pressuring salesperson could drive more people to electrics. At the same time, there's also the risk that renters wanting to take their Hertz-GM EV on a road trip into sparsely populated areas may return with charging and range-related horror stories. Hertz currently doesnÂ’t ask what youÂ’re planning to do with your rental, but it does offer a chat service for questions, and range information is presented clearly on each vehicle. Related video: 2023 Cadillac Lyriq walkaround

2016 Tech of the Year | Autoblog Minute

Thu, Oct 29 2015Deliberation on the winners of Autoblog's Tech of the Year Award is under way. Nominees for best car in 2016 are: the Tesla Model S, the Chevy Volt and the BMW 7 series. Nominees for best tech in 2016 are: Apple CarPlay, Android Auto, VW's MiB II with AppConnect, Ford Sync 3, Audi Virtual Cockpit, the Smart Cross Connect App, and Volvo Sensus. Autoblog's Chris McGraw reports on this edition of Autoblog Minute. Audi BMW Chevrolet Ford smart Tesla Volvo Technology of the Year Autoblog Minute Videos Original Video volt android auto ford sync 3