1978 Chevrolet Scottsdale 4 Wd on 2040-cars

Delmont, Pennsylvania, United States

|

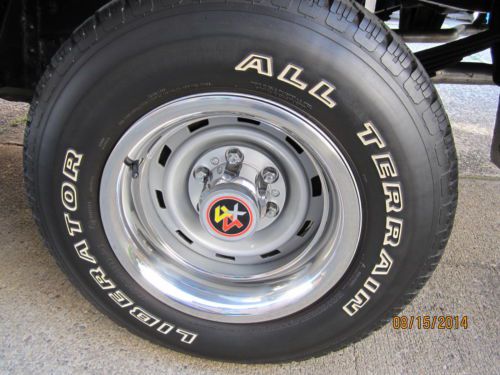

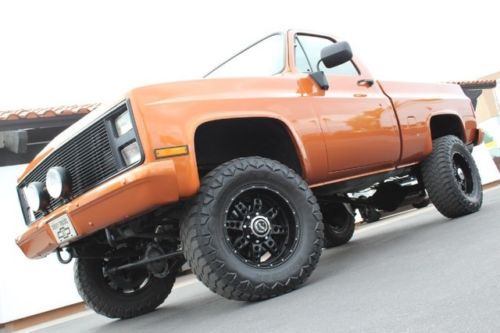

1978 Chevrolet Scottsdale 4 wd with 92,000 original miles in good condition. Original drivetrain, 350 engine. 4 speed. RE-stored about 12 years ago. New fenders, inner fenders, doors, bumpers. Bed came from the south. Square headlights replaced the original round ones

I am listing this truck for the owner, Bob, any questions, email me and I will ask Bob and get back to you. |

Chevrolet C/K Pickup 1500 for Sale

1994 chevrolet pickup

1994 chevrolet pickup 1990 chevroletc/k pickup 1500 77,000 original miles running(US $2,500.00)

1990 chevroletc/k pickup 1500 77,000 original miles running(US $2,500.00) Chevrolet silverado 1500 extended cab lt silver 2 door pick-up(US $26,500.00)

Chevrolet silverado 1500 extended cab lt silver 2 door pick-up(US $26,500.00) 87 chevy k10 4wd auto. 5.7l injected. 35 in tires. lifted and more. gorgeous.

87 chevy k10 4wd auto. 5.7l injected. 35 in tires. lifted and more. gorgeous. 1994 chevy automatic, 4 wheel drive, new engine w/ 25k miles, truck 142k miles(US $6,000.00)

1994 chevy automatic, 4 wheel drive, new engine w/ 25k miles, truck 142k miles(US $6,000.00) Very rare one of a kind 1984 chevrolet ex cab pickup

Very rare one of a kind 1984 chevrolet ex cab pickup

Auto Services in Pennsylvania

Zuk Service Station ★★★★★

york transmissions & auto center ★★★★★

Wyoming Valley Motors Volkswagen ★★★★★

Workman Auto Inc ★★★★★

Wells Auto Wreckers ★★★★★

Weeping Willow Garage ★★★★★

Auto blog

Auto Show Notebook: Legendary Continental name inspired Lincoln's designers

Thu, Apr 2 2015What's in a name? A lot for the Continental concept, and it gave Lincoln designers a sense of purpose as they styled the brand's upcoming flagship sedan. "The moment that we told them, it was amazing," Lincoln president Kumar Galhotra said. "They totally got it." "It" is cutting-edge technology wrapped in stately, large-sedan design. It's a nod to Lincoln's storied past, but a signpost for where the brand is heading. Though the Continental name dates to the late 1930s, Lincoln designers avoided making the concept overtly retro. "You can't let it pull yourself back too far in history, but you've got to design a car that lives up to the name," Galhotra said. Speaking to Autoblog on the floor of the New York Auto Show where the Continental formally debuted Wednesday, the Lincoln president reiterated that the car is on track to launch in 2016. It will compete against the Audi A6, Lexus GS, BMW 5 Series and other large luxury sedans. After its debut, the concept in New York will fly to China – another critical market for Lincoln – for display there. It will be replaced in New York by a prototype without an interior. The Continental is the latest high profile play by Lincoln to raise its image with consumers, who have either ignored or forgotten about it amid steep competition in the luxury sector from German and Japanese brands and a potentially resilient Cadillac. Lincoln sales are essentially flat compared with 2014 through the first quarter of this year, with total volume of 21,478 units. The middling start to 2015 comes on the heels of nearly 16-percent sales growth last year spurred by the launch of the MKC and the prominent signing of Matthew McConaughey to star in Lincoln advertisements. Other News, Notes & Quotes Speaking of names, Chevrolet did its homework before deciding to proceed with "Malibu" for its new generation of midsize cars. "We went out and researched it," said Alan Batey, president of General Motors North America. "People actually like the name 'Malibu,'" he said. Admittedly, the current Malibu has struggled in the marketplace against entrenched competitors, Batey said, but he's optimistic its awareness and historical value are assets to the dramatically redesigned sedan."The name's strong," he said. Meanwhile, in other Chevy news, the brand kicked off a new marketing campaign, "Real People, Not Actors" Wednesday. It will show consumers interacting with Chevys and their spontaneous reactions to the vehicles.

Ford GT dominates Le Mans qualifying, gets slapped with performance adjustment

Fri, Jun 17 2016Fifty years after Bruce McLaren and Chris Amon drove the Ford GT40 to victory at the 24 Hours of Le Mans, Ford is poised for a historic return to the Circuit de la Sarthe. The new Ford GT took the top two qualifying positions in the LMGTE Pro class, and four of the top five. Ferrari's 488 filled in the rest of the spots in the top seven, the first two from AF Corse. In other words, we're primed for a reboot of the classic Ford-Ferrari feud at this year's race. Or not, as the ACO, which organizes the 24 Hours of Le Mans, announced sweeping pre-race Balance of Performance (BOP) adjustments this morning that make this year's GT class anybody's race. In LMP1, last year's overall winner Porsche locked up the top two spots with the 919 Hybrid and will lead the entire field at race start. Toyota's two-car factory effort followed with qualifying times 1.004 and 2.170 seconds behind the pole lap. Audi rounds out the manufacturer-backed LMP1 class in fifth and sixth. Full qualifying results can be found here. The storyline for the GT cars is perfect - some say too perfect. Ford's class-leading times came after BOP adjustment to the Corvette Racing C7.R before qualifying. BOP is intended to level the playing field in the class by adjusting power, ballast, and fuel capacity. (Check out this explainer video for more, or even just if you love French accents.) But the process is riddled with unknowns and ripe for accusations of sandbagging. That is, if the Ford cars were intentionally slow in practice they could hope for BOP adjustment to improve their race chances. On the Corvette side, last year's GTE Pro winner went from the top of the field to the bottom, barely improving from practice to qualifying. If you think Le Mans is as rigged at the NBA Playoffs, well, it's not that simple. Because if Ford and Ferrari held back until qualifying - the eighth-place Porsche 911 RSR is three-and-a-half seconds off the class pole time - it was a pretty dumb strategy. This morning, the ACO tried to put things back in order by limiting the boost in the Ford GT's twin-turbo V6 and adding 11 pounds of ballast. Ferrari was also given extra weight but allowed more fuel capacity. The Corvette and Aston Martin teams were both given breaks on their air restrictors, which will allow their engines to make more power. Both Ford and Porsche also received extra fuel capacity.

Nissan Leaf, Chevy Volt have best sales month of 2015

Tue, Jun 2 2015Things are trending upwards for the two best-selling plug-in vehicles in the US. Both the Chevy Volt and the Nissan Leaf had their best sales month of 2015 in May, with the Volt selling 1,618 units and the Leaf moving 2,104. The upward swings come at an interesting time, with lots of excess first-gen Volts waiting for buyers and some buyers already ordering their second-gen Volts. So far in 2015, the Leaf has outsold the Volt 7,742 to 4,397. While 7,700 Leafs is respectable, it's nowhere near the numbers that Nissan will have to hit to reach the 50,000 annual sales that CEO Carlos Ghosn says is possible in the US. Still, the Leaf had its best sales month since December 2014 (when it sold 3,102 units) in May, but last month was still down 32.5 percent compared to May 2014. Despite the smaller overall number, May represents a big positive for Chevy, which has seen sluggish sales for the Volt for a long while now. The 1,618 Volts sold last month are only 3.9 percent lower than the 1,684 sold in May 2014 and May 2015 was the best month for Volt sales since August 2014. Perhaps salesmen are ready to make deals, what with thousands sitting around on dealer lots right now. The next-gen Volt is due this fall, and the order books (in California, at least) opened up this week. Like every month, our full wrap-up of green car sales in the US is coming soon (the VW e-Golf, for example, hit a best-ever high of 410 sales). Until then, feel free to discuss the Volt and Leaf sales figures in the Comments. Green Chevrolet Nissan Electric Hybrid ev sales hybrid sales