Transmission:Automatic

Vehicle Title:Clean

Engine:5.0L Gas V8

Fuel Type:Gasoline

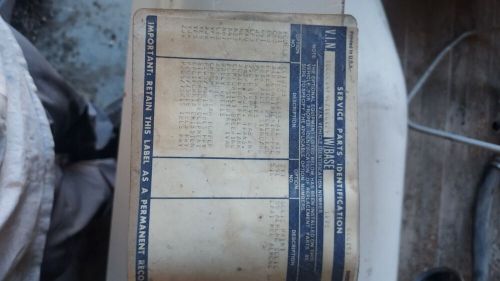

VIN (Vehicle Identification Number): 1GCDC14F4CZ100129

Mileage: 100000

Number of Cylinders: 8

Model: C-10

Exterior Color: Brown

Make: Chevrolet

Drive Type: RWD

Chevrolet C-10 for Sale

1987 chevrolet c-10 restomod(US $29,995.00)

1987 chevrolet c-10 restomod(US $29,995.00) 1972 chevrolet c-10 stepside(US $12,400.00)

1972 chevrolet c-10 stepside(US $12,400.00) 1971 chevrolet c-10(US $10,200.00)

1971 chevrolet c-10(US $10,200.00) 1972 chevrolet c-10(US $6,100.00)

1972 chevrolet c-10(US $6,100.00) 1962 chevrolet c-10(US $12,000.00)

1962 chevrolet c-10(US $12,000.00) 1968 chevrolet c-10(US $79,995.00)

1968 chevrolet c-10(US $79,995.00)

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

Plug In 2014: VIA makes the case for 'free' plug-in hybrid work vans, trucks

Fri, Aug 1 2014If you're a fleet manager who's been waiting anxiously for the chance to buy a plug-in hybrid van from Via Motors, your wait is almost over. If you work for the right fleet, anyway. David West, the chief marketing efficer for VIA Motors, took AutoblogGreen for a ride around the San Jose Convention Center in a Via van sporting an Electric Blue paint job as part of the Plug In 2014 Conference this week and gave us an update on how things are coming along. The big news is that the Via PHEV van production is going to start by the end of September. Via can currently build two vans an hour at its production plant in Mexico, or about 16 a day and could easily double that. "That would get us to 20,000 a year with two full lines running," West said. "We have the capacity." "There is no way gas can compete with electric." – David West, Via Motors But they can't sell that many quite yet. By the end of December, around 350 Vans will be made, mostly for a $20-million program from the Department of Energy (DOE) and the South Coast Air Quality Management District that will see the vehicles used by fleets that will report energy data to the Idaho National Lab. Via is also finishing up CARB certification for both the van and the company's plug-in hybrid pick-up truck. About 50 percent of Via's technology in the truck will not need to be tested again, since it's the same as what's in the van, but things like crash tests will need to be done twice. Despite the progress, this is not where Via hoped it would be today. The bankruptcy of battery supplier A123, "took about a year off our timeline," West said. "It's been getting a little slow getting it to market, there have been some challenges, particuarly since we had the country's worst recession right in the middle of this wrap up, but it's inevitable in my mind. There is no way gas can compete with electric." Maybe that's why FedEx has expressed an interest in buying around 5,000 units, West said. FedEx already has some pilot vehicles, just like Verizon does, and PG&E wants to replace all of their gas trucks with electric vehicles, which would be another 3,000 sales, he said. Besides the fuel savings, vehicles like these, with easy on-site power generation, could also work wonders in post-disaster situations, he said, since they could replace the need for generators.

GM says EVs are the future — but trucks are going to take it there

Fri, Jan 11 2019In the PowerPoint deck for the General Motors Capital Markets Day presentation, one of the more disturbing things comes early on, during GM President Mark Reuss' initial remarks, in an area where he is discussing the company's overall strength in trucks. The point being made is that GM has a truck for all and sundry. And there it is, a phrase on a slide that should send chills up the spines of those who still pine for the old Bob Seger "Like a Rock" Silverado ads: "Little bit country. Little bit rock 'n' roll." That's right. Donny and Marie. Somehow the Denis Leary snark in the F-150 ads is all the more appealing. The Capital Markets Day presentation was chock full of observations about electrification and automation (Reuss and CEO Mary Barra both noted that the corporation's vision is one of "Zero Crashes. Zero Emissions. Zero Congestion." Dan Ammann talked about the progress being made at Cruise Automation; Reuss rolled out the plan for an array of electrified vehicles, with a luxury EV and a compact SUV being the "Centroid Entries" for the modular bases of many others). But it is worth noting that there is no getting away from the power of pickups in the U.S. market, as that was the central topic in Chief Financial Officer Dhivya Suryadevara's comments, with "Truck Franchise" being flanked by "Key Financial Priorities" and "Financial Outlook." Clearly, to gloss the old phrase, the truck segment is where the money is. Suryadevra enumerated how the truck segment is significantly different than other types of light vehicles. Among her points: GM, Ford and FCA have more than 90% of market share. The truck parc has been growing and aging over the past 10 years. Customers are fiercely loyal to the segment—as in 70% of truck buyers are truck buyers. A good number of the vehicles are for commercial use (40 percent). Trucks are "less prone to. . .mobility disruption." Trucks offer high margins. Translaton: The segment is one that they're solidly positioned in. There are lots of old trucks on the road that will need to be replaced by new ones. Perhaps buyers may switch from a Sierra to a Canyon, but it will be a truck. If your livelihood depends on that type of vehicle, even if gas prices go up or the economy begins to go south, you're going to stick with it. Most of the country isn't San Francisco, so trucks will continue to be essential. And, well, they're profitable in the extreme.