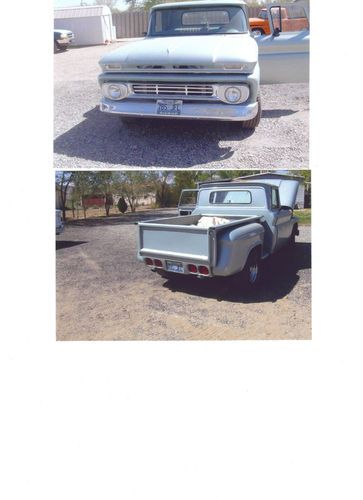

1962 Chevy Pickup Stepside on 2040-cars

Silver Springs, Nevada, United States

Body Type:stepside

Engine:350/485 HP

Vehicle Title:Clear

For Sale By:owner

Interior Color: lt green

Make: Chevrolet

Number of Cylinders: 8

Model: C-10

Trim: 2 door

Drive Type: 2 WD

Power Options: Power Windows

Mileage: 1,000

Exterior Color: seafoam green

Warranty: as is

1962 Chevy Stepside, 350/485HP, 350 B&M automatic trans, power windows, digital dash ,power steering , shaved door handles, new wood bed, new interior, corvette tail lights, good paint job, MUST SEE to appreciate, over $30.000 invested

Chevrolet C-10 for Sale

1965 chevy c10 short bed stepside v8 auto p/s p/b apache 3100 hotrod street rod

1965 chevy c10 short bed stepside v8 auto p/s p/b apache 3100 hotrod street rod 1971 chevrolet truck for sale!!!

1971 chevrolet truck for sale!!! 1964 chevy pick-up truck(US $10,500.00)

1964 chevy pick-up truck(US $10,500.00) 1970 chevrolet c10 pickup 350 1/2 ton truck long box(US $7,500.00)

1970 chevrolet c10 pickup 350 1/2 ton truck long box(US $7,500.00) 1964 chevy c-10 stepside 350 v8 400 turbo new paint lots of new parts installed

1964 chevy c-10 stepside 350 v8 400 turbo new paint lots of new parts installed Frame off restored c10 custom cab pickup 283 v8 th350(US $49,900.00)

Frame off restored c10 custom cab pickup 283 v8 th350(US $49,900.00)

Auto Services in Nevada

Vince`s Automotive ★★★★★

Used Cars For Sale ★★★★★

Toyota Auto Repair ★★★★★

The Body Shop of Reno Sparks Collision Repair Specialists ★★★★★

Team Acme Inc. ★★★★★

Superior Tire ★★★★★

Auto blog

2015 Chevy Tahoe gets Police Patrol Vehicle treatment

Thu, 07 Nov 2013That was fast. Mere days after showing a Police Concept based on the 2015 Tahoe at the SEMA Show, Chevrolet has announced that it will build a PPV model based on the SUV to do battle with the Ford Police Interceptor Utility (Explorer) and Dodge Durango Special Service.

You'll recall that the Tahoe has been police staple for several years, predating both the Explorer and Durango police variants, so the fact that the new model would spawn a police variant is hardly surprising. Like the civilian model, the 2015 PPV benefits from a more efficient 5.3-liter, direct-injection V8 that pumps out 355 horsepower and 383 pound-feet of torque. It also features more high-strength steel, offering better crash protection, on top of optional safety items like lane departure warning, forward collision alert and a Safety Alert Seat.

The press release is rather light on police-specific items, aside from the auxiliary battery, which keeps the myriad of electronics in a modern police car running even when the engine isn't. Lightbars, 17-inch steel wheels on Goodyear Eagle RS-A tires and a push bar round out the mods for the Tahoe PPV. The cabin features a revised center console and room for laptop and other equipment mounts.

How easy is it to rebuild a Chevy small block V8?

Sat, Mar 21 2015Chevrolet's famous small block V8 stands as one of the workhorse engines in American auto history, with its variants going into vehicles from hot rods to pickup trucks. But do you know that you can fully disassemble and completely restore one of these mills in just under four minutes? Well, as long as there's some assistance from time-lapse photography, that is. Hagerty created this short clip showing a dirt-covered small block turning from a frog into a prince. Thankfully, the time-lapse doesn't speed the process up too much, and it's still easy to see how all of the principal parts fit together. With all sorts of sensors and software helping to drive the modern automobile, viewing the internal combustion engine in its purely mechanical form is still fascinating. Related Video:

Hoons off-road in a lowrider Monte Carlo in latest Roadkill video

Wed, May 6 2015Specialization keeps the automotive world interesting because it creates all sorts of fun niches. For example, if you like hot rods, you can dive deep into the world of rat rods or just focus on cars with a more traditional look. In some cases the myriad styles don't mix very well, of course, and the folks at Roadkill are proving that on video by attempting to take a lowrider Chevrolet Monte Carlo from Los Angeles to Las Vegas on dirt. As you might expect, forcing a lowrider off-road doesn't go well, but the stunt makes for a great chronicle of dumb, automotive fun. Other than some repairs to get the Monte Carlo roadworthy, the only modification here is a set of knobby tires to achieve at least a modicum of traction on the loose rocks. Although, no matter what they do, at the even lowest speeds the hosts inside are still bounced around like they're in an inflatable castle at a kid's birthday party. Still, the guys are clearly amused by it all.