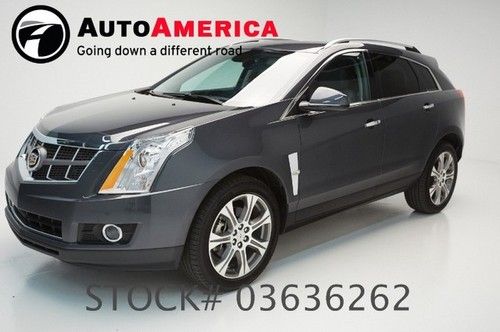

2013 New Gray Flannel Metallic Awd Dual Pane Sunroof Heated/vented Leather!! on 2040-cars

Kellogg, Idaho, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:3.6L 217Cu. In. V6 FLEX DOHC Naturally Aspirated

Body Type:Sport Utility

Fuel Type:FLEX

Make: Cadillac

Model: SRX

Trim: Premium Sport Utility 4-Door

Disability Equipped: No

Doors: 4

Drive Type: AWD

Cab Type: Other

Mileage: 10

Drivetrain: All Wheel Drive

Sub Model: Premium Collection

Exterior Color: Gray

Number of Cylinders: 6

Interior Color: Other

Cadillac SRX for Sale

We finance !! luxury collection suv 3.6l cd memory wood trim package spoiler(US $34,501.00)

We finance !! luxury collection suv 3.6l cd memory wood trim package spoiler(US $34,501.00) 15k low miles 1 one owner nav leather navigation sunroof loaded autoamerica(US $37,850.00)

15k low miles 1 one owner nav leather navigation sunroof loaded autoamerica(US $37,850.00) Luxury colle 3.0l 265 hp horsepower 4 doors 4-wheel abs brakes chrome grill

Luxury colle 3.0l 265 hp horsepower 4 doors 4-wheel abs brakes chrome grill 2013 cadillac srx pano sunroof nav rear cam 18's 4k mi texas direct auto(US $39,480.00)

2013 cadillac srx pano sunroof nav rear cam 18's 4k mi texas direct auto(US $39,480.00) Luxury collection 3.0l cd satellite radio panorama sunroof push button start(US $27,900.00)

Luxury collection 3.0l cd satellite radio panorama sunroof push button start(US $27,900.00) 2012 cadillac srx/ no reserve/ back up camera/ panoroof/ leather/ low mile

2012 cadillac srx/ no reserve/ back up camera/ panoroof/ leather/ low mile

Auto Services in Idaho

Wright Service & Repair ★★★★★

Windshield Rescue Inc ★★★★★

Westside Body Works ★★★★★

Valley Transmission ★★★★★

Perfection Tire & Auto Repair ★★★★★

Panhandle Towing and Recovery, LLC ★★★★★

Auto blog

GM 8-speed transmission lawsuit granted class action certification

Tue, Mar 21 2023A story on Autoblog about potentially faulty 8-speed automatic transmissions from General Motors in 2019 has, as of the day this was published, 166 comments, mostly from owners of cars and trucks who say they are experiencing "a hesitation, followed by a significant shake, shudder, jerk, clunk, or 'hard shift' when the vehicle's automatic transmission changes gears." At the time, lawyers were seeking statewide classes in at least six states. As of today, the Detroit Free Press reports that a judge has granted class action status to a lawsuit brought by 39 plaintiffs across 26 states covering the transmission issue. The lawsuit specifically applies to vehicles that are equipped with GM's 8L90 or 8L45 8-speed automatic transmissions made between 2015 and March 1, 2019. Both of these transmissions are similar units, the 8L45 being slightly lighter version used in fewer vehicles than the beefier 8L90, and are designed for front-engine, rear- or all-wheel drive applications. The lawsuit alleges that the erratic transmission behavior makes some vehicles unsafe to drive. Ted Leopold, partner at Cohen Milstein and the court-appointed lead counsel for the case, said in a statement, "General Motors knowingly sold over 800,000 eight-speed transmission vehicles, which they knew to be defective for years, and yet made the business decision not to tell its customers before purchase." He added, "Dealers were directed to tell the customers that harsh shifts were ‘normal' or ‘characteristic.Â’ Such decision making is both highly irresponsible and emblematic of what GM believes it can get away with." The vehicles included in the court order with potentially faulty transmissions includes: 2015-2019 Chevrolet Silverado 2017-2019 Chevrolet Colorado 2015-2019 Chevrolet Corvette 2016-2019 Chevrolet Camaro 2015-2019 Cadillac Escalade and Escalade ESV 2016-2019 Cadillac ATS, ATS-V, CTS, CT6, and CTS-V 2015-2019 GMC Sierra, Yukon, Yukon XL, and Yukon Denali XL 2017-2019 GMC Canyon Some additional details of the lawsuit can be found at the Cohen Milstein site, including claims that "since 2015, GM has issued thirteen versions of a “technical service bulletin,” or “TSB,” related to this shifting issue alone." The statement from Cohen Milstein says that a "second action regarding GM vehicles with 8L transmissions is also underway in Battle v. General Motors, LLC, 2:22-cv-108783.

Weekly Recap: GM scales back as Russian auto market teeters

Sat, Mar 21 2015General Motors' extensive plans to scale back its Russian operations are the latest sign the automotive market in the former superpower is collapsing – and there are few signs of recovery. GM said Wednesday it will stop selling mainstream Chevrolets and shutter the entire Opel brand in Russia. The moves leave GM with a luxury-focused presence consisting of Cadillac and Chevrolet's Corvette, Camaro and Tahoe. The cutbacks will be completed by the end of the year. The automaker will also idle its factory in St. Petersburg and end a contract-assembly agreement with Russian manufacturer GAZ. "We had to take decisive action in Russia to protect our business," Opel Group CEO Karl-Thomas Neumann said in a statement. "We confirm our outlook to return the European business to profitability in 2016 and stick to our long-term goals." GM is the latest automaker to scale back in Russia as the economic conditions, volatile currency and uncertainty over the conflict in the Ukraine all have sandbagged new car sales. Last month, vehicle sales collapsed 38 percent in Russia to 128,298 units, according to the Association of European Business, which records sales. Joerg Schreiber, chairman of the AEB automobile manufacturers committee, didn't even feign optimism in a statement announcing the figures. "The market is entering a very difficult phase now, and February is only the beginning," he said. "Industry sentiment is the next few months will be extremely difficult and the market bottom has yet to be found." The dovetails with industry experts, who predict the Russian auto sector will remain in the doldrums. IHS said earlier this year it expects Russia's sales to slip to just 1.8 million units in 2015, which is a 40-percent drop from 2012. Other News & Notes Chief leads Jeep's Easter Safari stable Jeep is bringing seven attention-getting concepts to Moab for its annual Easter Safari off-roading celebration in Utah, but the Chief is perhaps the standout of the group. It salutes the 1970s Cherokee with a throwback appearance and surfer styling cues. The Chief has a custom modified razor grille made famous by the Wagoneer, and it rolls on 17-inch slotted mag wheels. The surf theme comes in with ocean blue paint, floral cloth and leather seats and a tiki-style shifter handle. Based on the Jeep Wrangler, the Chief has removable sides, a 3.6-liter V6 engine and a six-speed manual gearbox.

GM to cut production at 5 plants in North America, kill several models

Mon, Nov 26 2018DETROIT/WASHINGTON — General Motors Co said on Monday it will cut production of slow-selling models and slash its North American workforce in the face of a stagnant market for traditional gas-powered sedans, shifting more investment to electric and autonomous vehicles. The announcement is the biggest restructuring in North America for the U.S. No. 1 carmaker since its bankruptcy a decade ago. GM said it will take pre-tax charges of $3 billion to $3.8 billion to pay for the cutbacks, but expects the actions to improve annual free cash flow by $6 billion by the end of 2020. GM plans to halt production next year at three assembly plants: Lordstown, Ohio, Hamtramck, Michigan, and Oshawa, Ontario. The company also plans to stop building several models now assembled at those plants, including the Chevrolet Cruze, the Cadillac CT6 and the Buick LaCrosse, the sources said. Sources said the Chevrolet Volt, Impala and Cadillac XTS would also be discontinued. Signs of the demise of six passenger-car models have been swirling since July. Plants in Baltimore, Maryland, and Warren, Michigan, that assemble powertrain components have no products assigned to them after 2019 and thus are at risk of closure, the company said. It will also close two factories outside North America, but did not identify those plants. The AP reported that 14,700 jobs would be affected. Some 8,100 of those would be white-collar jobs reduced through buyouts or layoffs. The No. 1 U.S. automaker signaled the latest belt-tightening in late October when it offered buyouts to 50,000 salaried employees in North America. The company also said it will cut executive ranks by 25 per cent to "streamline decision making." Some 6,000 factory workers could lose their jobs or be transferred to other plants. Its shares were last up 6.2 percent at $38.16. Tariff 'headwinds' and cost-cutting GM Chief Executive Officer Mary Barra told reporters on Monday the company can reduce annual capital spending by $1.5 billion and increase investment in electric and autonomous vehicles and connected vehicle technology because it has largely completed investing in new generations of trucks and sport utility vehicles. Some 75 percent of its global sales will come from just five vehicle architectures by early in the 2020s. It plans to reduce annual capital spending to $7 billion by 2020 from an average of $8.5 billion a year during the 2017-2019 period.