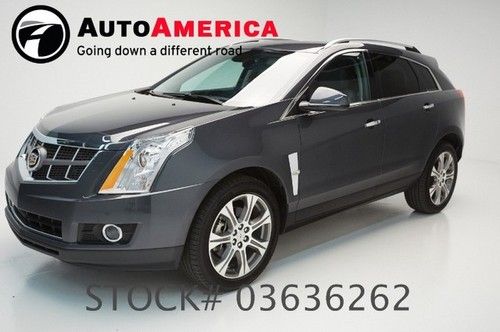

15k Low Miles 1 One Owner Nav Leather Navigation Sunroof Loaded Autoamerica on 2040-cars

Grand Prairie, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:3.6L 217Cu. In. V6 FLEX DOHC Naturally Aspirated

Body Type:Sport Utility

Fuel Type:FLEX

Year: 2012

Make: Cadillac

Model: SRX

Trim: Performance Sport Utility 4-Door

Disability Equipped: No

Doors: 4

Drive Type: FWD

Drivetrain: Front Wheel Drive

Mileage: 16,025

Sub Model: Performance Collection WE FINANCE!

Number of Cylinders: 6

Exterior Color: Gray

Interior Color: Gray

Cadillac SRX for Sale

Awd,thirdseat, sunroof,(US $16,498.00)

Awd,thirdseat, sunroof,(US $16,498.00) Sharp (( awd..panaramic roof..3rd seat..3.6l v6 )) no reserve

Sharp (( awd..panaramic roof..3rd seat..3.6l v6 )) no reserve 04 cadillac srx v8, navigation, pwr 3rd row, dvd, salvage title

04 cadillac srx v8, navigation, pwr 3rd row, dvd, salvage title 2010 cadillac srx performance pano sunroof nav 20's 42k texas direct auto(US $28,780.00)

2010 cadillac srx performance pano sunroof nav 20's 42k texas direct auto(US $28,780.00) 08 srx 4 awd 3.6l v6 suv *heated front & rear leather seats *remote start *fl

08 srx 4 awd 3.6l v6 suv *heated front & rear leather seats *remote start *fl We finance!! 2011 cadillac srx awd performance pano roof nav leather texas auto(US $31,998.00)

We finance!! 2011 cadillac srx awd performance pano roof nav leather texas auto(US $31,998.00)

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

GM delivers best Q3 sales since 1980, 2.4M vehicles sold

Wed, 15 Oct 2014People are a weird sort. Even after registering over 70 recalls through the first three-quarters of 2014, General Motors saw its best Q3 results since Jimmy Carter was in the White House, registering over 2.4 million global sales between June and September on the back of strong results in the US and China.

US sales were marshaled by good results for GM's pickups, the Chevrolet Silverado and GMC Sierra, which bumped the manufacturer's truck market share to 35.6 percent, up nearly three points from Q1 2014. Buick has seen healthy growth as well, with the Encore dominating its segment for the sixth month running.

It was China, though, that really bolstered GM's sales, as the company's efforts to top last year's record-setting 3.16 million units continued apace. Small SUV sales saw massive growth, with Encore, Chevrolet Trax and Captiva figures jumping 90 percent in Q3. Brand-wise, Chevrolet, Cadillac and Buick all saw sales gains in the PRC, with each recording double-digit year-over-year jumps. Cadillac sales alone were up 63 percent compared to the first nine months of 2013.

Cadillac Live virtual showroom is open for business in the U.S.

Sun, Dec 15 2019Cadillac launched the streaming showroom known as Cadillac Live in Canada earlier this year. The program places a Cadillac product specialist in an open studio laid out similar to a dealership. Equipped with an iPhone X on an Osmo Mobile gimbal and a Bluetooth headset, the specialist conducts one-way video chats with car buyers shopping for Cadillacs and owners who have questions about their cars. Now Cadillac Live has arrived in the United States. Described as "part personal shopper and part interactive digital showroom," it's aimed at converting luxury shoppers into Wreath and Crest buyers by making the research experience simpler. The automaker says it has data showing that "71% of customers report switching to a competitorís product after finding their selection process easier." As well as being able to show and demonstrate 10 physical vehicles and their features, product specialists will be able to use a tablet app interface to run through color and accessory options. Shoppers and buyers with questions can reach a Cadillac Live agent from 9 a.m. to 1 a.m. ET Monday to Thursday, 9 a.m.-9 p.m. ET on Friday, and 11 a.m.-7 p.m. ET Saturday and Sunday. Calls can be taken on demand or scheduled at the Cadillac Live site, call appointments can be made for times outside of the traditional opening hours, and multiple callers can participate. U.S. customers in California, Illinois, New Jersey, and New York who like what they discover can automatically be connected to a local dealer to move on to the next phase. And video calls are one-way, so work-from-home types need not worry about broadcasting their coffee-stained "Beast Mode" workwear.¬†

7 major automakers to build open EV charging network

Wed, Jul 26 2023A new joint venture established by BMW, GM, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis will build a new North American electric vehicle charging network on a scale designed to compete with Tesla's industry-benchmark Supercharger network. The 30,000-plus planned new chargers will accommodate both Tesla's almost-standard North American Charging System (NACS) and existing automakers' Combined Charging System (CCS) options, effectively guaranteeing compatibility with the vast majority of current and upcoming electric models ó whether they're from one of the involved automakers or not.¬† "With the generational investments in public charging being implemented on the Federal and State level, the joint venture will leverage public and private funds to accelerate the installation of high-powered charging for customers. The new charging stations will be accessible to all battery-powered electric vehicles from any automaker using Combined Charging System (CCS) or North American Charging Standard (NACS) and are expected to meet or exceed the spirit and requirements of the U.S. National Electric Vehicle Infrastructure (NEVI) program." Critically, the automakers involved will have a say in how the charging tech is implemented, guaranteeing that the hardware will play nicely with each automaker's in-house charging systems. Hyundai and Kia, for example, were hesitant to jump on board the Tesla NACS bandwagon earlier this year over concerns that the Supercharger network is insufficient for powering the two automakers' 800-volt charging systems; similar tech is used by Volkswagen and Porsche.¬† In addition to providing much-needed capacity and high-output charging for America's growing fleet of electric cars and trucks, the new network will integrate seamlessly with each automaker's in-app and in-vehicle features, rather than forcing customers to use third-party tools and payment systems, as is the case with some existing public charging infrastructure.¬† "The functions and services of the network will allow for seamless integration with participating automakers¬í in-vehicle and in-app experiences, including reservations, intelligent route planning and navigation, payment applications, transparent energy management and more. In addition, the network will leverage Plug & Charge technology to further enhance the customer experience," the announcement said.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.033 s, 7928 u