1958 Cadillac 62 Series. Most Documented 58 In The Country Since New! One Owner1 on 2040-cars

Carmel, Indiana, United States

|

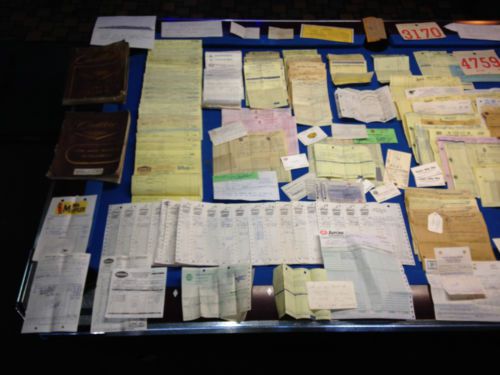

1958 CADILLAC 62 SERIES *** 1 OWNER *** ***MOST DOCUMENTED 58 IN COUNTRY*** ***OVER 200 INVOICES*** *** ORIGINAL BOOKS & DOCUMENTS*** *** ALL ORIGINAL INTERIOR*** *** NO RUST OR SURFACE RUST*** *** # MATCHING*** TRUELY A BEAUTIFUL "RARE FIND". ALL ORIGINAL 58 CADILLAC! A CODE CORRECT CAR. VERY EXCEPTIONAL ORIGINAL QUALITY. ONE RESPRAY WITH SOME TOUCH UP. CHROME HAS SOME BLEMISHES AND DENTS. HIGH OPTION CAR WITH POWER EVERYTHING. ***NOT A SHOW CAR*** MOST EVERYTHING WORKS. EXCEPT CLOCK, A FEW LIGHTS AND THE GAS GAUGE. CAR RUNS AND STOPS GREAT. *** STRIPPED GAS TANK*** ***OVERHAULED BRAKES*** INTERIOR IS WRAPPED IN THE ORIGINAL CORRECT INTERIOR VERY MINIMAL WEAR. THE SEATS SHOW ORIGINAL MATERIAL WITH ONLY WEAR ON DRIVERS SEAT. THE CARPET LOOKS GOOD. HEADLINER HAS A SMALL TEAR. UNDERCARRIAGE IS UNBELIEVABLE. EVERYTHING IS VERY CLEAN. NO RUST WHAT SO EVER. YOU HAVE TO SEE IT TO BELIEVE IT. ***CAR WAS NEVER UNDERCOATED*** MECHANICALLY THIS 58 RUNS GREAT, NO SMOKING AND DRIVES THE WAY IT SHOULD. I HAVEN'T BEEN ON ANY LONG ROAD TRIPS. I BELIEVE THIS CAR COULD BE DRIVIN CAREFULLY BARRING ANY PROBLEMS UNKNOWN AT A FAIR DISTANCE. REPLACED POINTS,PLUGS OIL FILTER AND OIL CAR IS BEING SOLD AS-IS WHERE IS AND HIGHLY RECOMMENDED TO COME AND INSPECT THE VEHICLE IN PERSON. PLEASE ASK ANY QUESTIONS YOU WOULD LIKE. THIS IS THE PERFECT CAR SHOWING ITS GREAT "ORIGINALITY". PLEASE CALL 303-880-6791 NO BUY IT NOW. RESERVE WILL NOT BE ANNOUNCED!! THE RESERVE IS VERY REASONABLE!! I DO HAVE THE ORIGINAL AIR CLEANER!! |

Cadillac Fleetwood for Sale

1973 cadillac fleetwood 60 special brougham 7.7l nr !!! no reserve !!!

1973 cadillac fleetwood 60 special brougham 7.7l nr !!! no reserve !!! 58 cadillac fleetwood custom - shaved door handles - lowered -beautiful big fins(US $21,900.00)

58 cadillac fleetwood custom - shaved door handles - lowered -beautiful big fins(US $21,900.00) 1980 cadillac hearse

1980 cadillac hearse 1941 cadillac fleetwood sixty special(US $8,995.00)

1941 cadillac fleetwood sixty special(US $8,995.00) 1988 cadillac brougham rwd(US $5,000.00)

1988 cadillac brougham rwd(US $5,000.00) 1996 cadillac fleetwood brougham sedan 4-door 5.7l

1996 cadillac fleetwood brougham sedan 4-door 5.7l

Auto Services in Indiana

Webbs Auto Center ★★★★★

Webb Ford ★★★★★

Tire Grading Co ★★★★★

Sun Tech Auto Glass ★★★★★

S & S Automotive ★★★★★

Prestige Auto Sales Inc ★★★★★

Auto blog

2020 Cadillac CT6 losing the 3.0-liter TT V6?

Mon, May 20 2019In April we learned Cadillac would no longer offer the 2.0-liter four-cylinder on the CT6. The same day we heard the news, the CT6 configurator showed that engine option gone, leaving three engines on the menu. That menu could lose another option come 2020, according to a report in AutoVerdict. The site says it got an order guide for the 2020 CT6, and the 3.0-liter twin-turbo V6 won't make it to the new year. That engine was once the top-tier choice, since eclipsed by the detuned 4.2-liter twin-turbo Blackwing V8 imminently available on the Platinum trim. AutoVerdict also read in the order guide that the horsepower figures haven't been finalized for next year's model. As it stands, the entry-level 3.6-liter six-cylinder makes 335 horsepower and 284 pound-feet of torque, the 3.0-liter twin-turbo V6 produces 404 hp and 400 lb-ft, and the 4.2-liter V8 ginning up 500 hp and 574 lb-ft when it arrives. Retiring the middle option ostensibly puts a big ol' gap in output and pricing between the two models left. Right now $24,200 separates the entry-level Premium Luxury from the Platinum. However, since the present Platinum uses the 3.0-liter, it's safe to guess that the 4.2-liter V8 will cost more, creating a larger gap. The Sport model in between uses the 3.0-liter, too. Perhaps that goes away, or maybe it stays and gets further cosmetic upgrades to give it more edge and a higher price. Another change coming to the 2020 CT6 is its induction into Cadillac's metric-unit torque-based badging system. This, remember, converts pound-foot torque into Newton-meters, then rounds up to the nearest 50. That means the 3.0-liter V6 will wear a 400 badge, the 4.2-liter V8 gets an 800T badge - the T standing for turbo. The year's been full of engine rationalizations at General Motors. Theories about the CT6 dropping the 2.0-liter figured it might have been about making space above the CT5, or guaranteeing supply for other GM models that use the engine, like the Cadillac XT4. The folks at AutoVerdict suspect the 3.0-liter TTV6 could be making the move to the CT5, and to the hot-headed CT4-V we'll be getting a look at come the end of this month. Related Video:

J.D. Power study sees new car dependability problems increase for first time since 1998

Wed, 12 Feb 2014For the first time since 1998, J.D. Power and Associates says its data shows that the average number of problems per 100 cars has increased. The finding is the result of the firm's much-touted annual Vehicle Dependability Study, which charts incidents of problems in new vehicle purchases over three years from 41,000 respondents.

Looking at first-owner cars from the 2011 model year, the study found an average of 133 problems per 100 cars (PP100, for short), up 6 percent from 126 PP100 in last year's study, which covered 2010 model-year vehicles. Disturbingly, the bulk of the increase is being attributed to engine and transmission problems, with a 6 PP100 boost.

Interestingly, JDP notes that "the decline in quality is particularly acute for vehicles with four-cylinder engines, where problem levels increase by nearly 10 PP100." Its findings also noticed that large diesel engines also tended to be more problematic than most five- and six-cylinder engines.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.