Cadillac Convertible on 2040-cars

Eden, Utah, United States

Body Type:Convertible

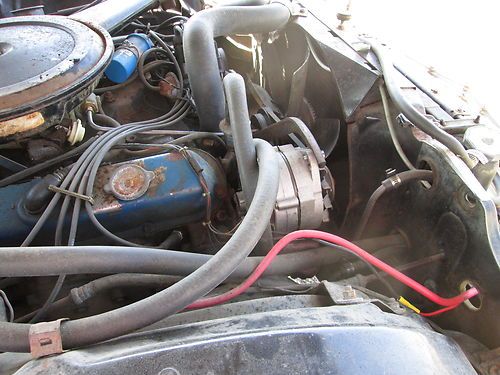

Engine:472 V8 Original

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Interior Color: Blue and White

Make: Cadillac

Number of Cylinders: 8

Model: DeVille

Trim: Convertible

Drive Type: Rear Wheel Drive

Options: Leather Seats, Convertible

Mileage: 94,397

Power Options: Power Windows, Power Seats

Sub Model: DeVille Convertible

Exterior Color: Blue

1969 Cadillac Deville Convertible. This is a good running car and I have a clear Original Utah title in my name. If you have any questions, please give me a call. My home phone number is (801) 745-0599. I will be glad to talk to you about my Cadillac, and I'm not a car dealer. The car performs very well. The engine runs good and has no unusual noise or exhaust. The Cadillac shifts smoothly and stops well. The power steering and power brakes work as they should. You can currently drive this car, but remember, the top needs help.

Cadillac DeVille for Sale

Dts luxury clean carfax nav sunroof heated/cooled memory seats 41k clean(US $25,883.00)

Dts luxury clean carfax nav sunroof heated/cooled memory seats 41k clean(US $25,883.00) Clean carfax, chrome wheels, leather, heated & cooled seats, heated rear seats

Clean carfax, chrome wheels, leather, heated & cooled seats, heated rear seats 1976 cadillac sedan deville

1976 cadillac sedan deville 1969 coupe deville convertible(US $18,500.00)

1969 coupe deville convertible(US $18,500.00)

1975 cadillac deville base sedan 4-door 8.2l with 26 inch wheels(US $10,000.00)

1975 cadillac deville base sedan 4-door 8.2l with 26 inch wheels(US $10,000.00)

Auto Services in Utah

Toyota & Lexus Repair Speclsts ★★★★★

Rand`s Auto Sales ★★★★★

No Crack Glass & Mirror ★★★★★

Montella`s Repair ★★★★★

Labrum Chevrolet Buick Inc. ★★★★★

Labrum Chevrolet Buick Inc. ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM recalling 54k Cadillac SRX, HD pickup models

Thu, 01 May 2014There are more recalls to report General Motors, but these latest actions pertain to newer examples of the Cadillac SRX, Chevrolet Silverado HD and GMC Sierra HD. With so much scrutiny on the company's recall strategy, GM is under increasing pressure to call in defective models more quickly, and it appears to be doing so here.

Here in the US, the automaker is recalling 50,571 Cadillac SRX crossovers from the 2013 model year fitted with the 3.6-liter V6 because the transmission control module programming can cause a three- or four-second lag in acceleration at low speeds. The explanation filed with the National Highway Traffic Safety Administration states, "if the following sequence occurs within two seconds: during an upshift from first to second gear (8-10 mph), the driver then brakes the vehicle to less than 5 mph, and then accelerates again," the delay can occur. According to Automotive News, the recall effects 56,400 vehicles worldwide, and the company is not aware of any crashes caused by the problem. The fix consists of a transmission control module (TCM) reflash.

In a separate recall, GM is repairing 51 Chevrolet Silverado HD and GMC Sierra HD pickups from the 2015 model year in the US. In vehicles with diesel engines and dual fuel tanks, the nuts that connect the fuel pipe to each side of the transfer pump between the tanks may be improperly torqued, which could cause a fuel leak. Obviously, this could be a fire hazard. The remedy is simply tightening the hardware. According to GM spokesperson Alan Adler, there have been no fires actually caused by the potential leak. "Only 21 of the trucks are in customer possession and they can be fixed anytime because there are no parts involved. The others are being fixed at dealerships," Adler said in an email to Autoblog.

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT — General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.