1957 Cadillac Coupe Deville on 2040-cars

Accord, New York, United States

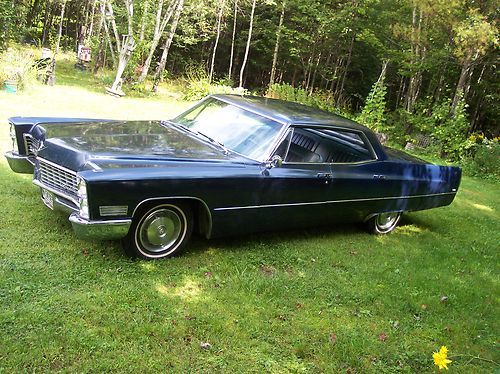

Body Type:Coupe

Engine:tbd

Vehicle Title:Clear

For Sale By:Private Seller

Exterior Color: Green

Make: Cadillac

Number of Cylinders: 8

Model: DeVille

Trim: chrome

Drive Type: tbd

Mileage: 79,670

Warranty: Vehicle does NOT have an existing warranty

See Condition Description

Cadillac DeVille for Sale

1959 cadillac coupe deville 50k orig. mi. rust free original! 100 pics

1959 cadillac coupe deville 50k orig. mi. rust free original! 100 pics 1966 cadillac deville base 7.0l(US $32,500.00)

1966 cadillac deville base 7.0l(US $32,500.00) Elegant original two owner survivor -1973 cadillac coupe de ville -27k orig mi

Elegant original two owner survivor -1973 cadillac coupe de ville -27k orig mi 1967 cadillac calais(US $5,000.00)

1967 cadillac calais(US $5,000.00) 06 dts sedan luxury 3 pkg bose heated ac leather chrome power shade one owner(US $10,995.00)

06 dts sedan luxury 3 pkg bose heated ac leather chrome power shade one owner(US $10,995.00) 1972 cadillac coupe deville green with black interior - good condition(US $6,500.00)

1972 cadillac coupe deville green with black interior - good condition(US $6,500.00)

Auto Services in New York

YMK Collision ★★★★★

Valu Auto Center (ORCHARD PARK) ★★★★★

Tuftrucks and Finecars ★★★★★

Total Auto Glass ★★★★★

Tallman`s Tire & Auto Service ★★★★★

T & C Auto Sales ★★★★★

Auto blog

2014 Cadillac ELR leases for $699 a month

Mon, Jan 20 2014Most Autoblog readers thought the $75,000 price tag on the 2014 Cadillac ELR was too high. If you can't swing the MSRP all in one go, how does a lease price of $699 a month sound? That's the amount that Cadillac is offering on the official ELR website, with some caveats, of course. First off, it appears that this lease price is for just for "current owners and lessees of all 1999 or newer GM vehicles." They will also have to pony up $4,999 at signing (all others will need $5,999). Second, the $699-a-month price is for a 39-month lease. Then, of course, "tax, title, license, dealer fees and optional equipment [are] extra" and "each dealer sets own price." Also, it appears that this lease deal is only good until the end of January. Cadillac started shipping the ELR plug-in hybrid coupe to dealers last month. There are two things to note in the fine print. The most surprising is that the payments are based on "a 2014 Cadillac ELR with an MSRP of $76,000." That's $1,000 more than the official MSRP announced in October. Then we get to the real kicker: The lease limits you to a mere 32,500 miles, which is just 833.3 miles a month. Well, 'limit' isn't the exact word, since you can certainly drive more. All you have to do is pay 25 cents per mile for each mile over 32,500. Drive the national average of 13,476 miles in a year? That comes to 43,797 miles over 39 months, which is 11,297 extra miles and an extra $2,824.25.

Cadillac launching crossover-heavy product offensive

Fri, 06 Sep 2013Utilizing information provided by Cadillac suppliers, Reuters says that Cadillac is preparing two more crossovers that will bow after its current product initiative is complete. According to the report, a year after the next SRX arrives in 2016, a pair of CUVs will be unveiled that will bracket it in size, and they'll be headed for the US and Chinese markets.

That is years away, though. For now, the company's attentions are on the nearly here CTS and ELR range-extended coupe, the next Escalade SUV (shown above), an ATS coupe, and the range-topper that will sit above the XTS. That, and possibly an even more impressive range-topper that promises to be the mean and majestic super-luxe unicorn Cadillac we've been dreaming about for more than a decade now.

In response to the issue of how German crossovers might be having an impact on Cadillac's future plans, a company source said - rightly, we think - "we don't need to duplicate the Germans." That doesn't mean, however, that it can't wade deeper into a market segment that the Germans are making a ton of money in. In fact, and since everyone is doing it, we'd be surprised if Cadillac didn't, even if it won't happen for another four years.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.