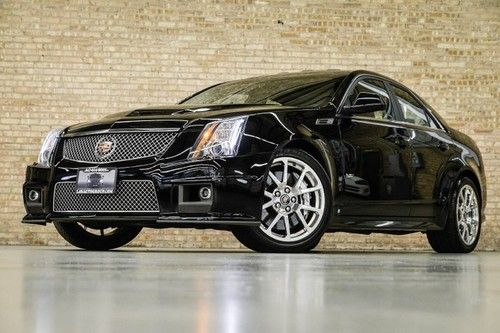

2007 Cadillac Cts-v, 500+ Hp, 6-speed Manual, Done Right!! ** Only 27k Miles ** on 2040-cars

Easton, Pennsylvania, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:6.0L 5967CC 364Cu. In. V8 GAS OHV Naturally Aspirated

Body Type:Sedan

Fuel Type:GAS

Make: Cadillac

Model: CTS

Trim: V Sedan 4-Door

Disability Equipped: No

Doors: 4

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 27,890

Number of Doors: 4

Sub Model: 6-Speed

Exterior Color: Black

Number of Cylinders: 8

Interior Color: Black

Cadillac CTS for Sale

03 cadillac cts

03 cadillac cts 08 red cts w/ sunroof, navigation, heated/cooled seats, leather and remote start(US $15,500.00)

08 red cts w/ sunroof, navigation, heated/cooled seats, leather and remote start(US $15,500.00) 2011 cadillac cts performance pano sunroof nav only 16k texas direct auto(US $29,980.00)

2011 cadillac cts performance pano sunroof nav only 16k texas direct auto(US $29,980.00) 2010 cadillac cts 3.6 performance sedan auto nav 14k mi texas direct auto(US $27,980.00)

2010 cadillac cts 3.6 performance sedan auto nav 14k mi texas direct auto(US $27,980.00) 2010 cadillac cts4 premium awd recaro seats nav 49k mi texas direct auto(US $26,980.00)

2010 cadillac cts4 premium awd recaro seats nav 49k mi texas direct auto(US $26,980.00) 2009 cadillac cts-v! navigation! pano roof! auto! polished whls! clean!(US $37,900.00)

2009 cadillac cts-v! navigation! pano roof! auto! polished whls! clean!(US $37,900.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

World Class Transmission Svc ★★★★★

Wood`s Locksmithing ★★★★★

Trust Auto Sales ★★★★★

Steele`s Truck & Auto Repair ★★★★★

South Hills Lincoln Mercury ★★★★★

Auto blog

Here are a few of our automotive guilty pleasures

Tue, Jun 23 2020It goes without saying, but I'll say it anyway. The world is full of cars, and just about as many of them are bad as are good. It's pretty easy to pick which fall into each category after giving them a thorough walkaround and, more important, driving them. But every once in a while, an automobile straddles the line somehow between good and bad ó it may be hideously overpriced and therefore a marketplace failure, it may be stupid quick in a straight line but handles like a drunken noodle, or it may have an interior that looks like it was made of a mess of injection-molded Legos. Heck, maybe all three. Yet there's something special about some bad cars that actually makes them likable. The idea for this list came to me while I was browsing classified ads for cars within a few hundred miles of my house. I ran across a few oddballs and shared them with the rest of the team in our online chat room. It turns out several of us have a few automotive guilty pleasures that we're willing to admit to. We'll call a few of 'em out here. Feel free to share some of your own in the comments below. Dodge Neon SRT4 and Caliber SRT4: The Neon was a passably good and plucky little city car when it debuted for the 1995 model year. The Caliber, which replaced the aging Neon and sought to replace its friendly marketing campaign with something more sinister, was panned from the very outset for its cheap interior furnishings, but at least offered some decent utility with its hatchback shape. What the two little front-wheel-drive Dodge models have in common are their rip-roarin' SRT variants, each powered by turbocharged 2.4-liter four-cylinder engines. Known for their propensity to light up their front tires under hard acceleration, the duo were legitimately quick and fun to drive with a fantastic turbo whoosh that called to mind the early days of turbo technology. ¬ó Consumer Editor Jeremy Korzeniewski¬† Chevrolet HHR SS: Chevy's HHR SS came out early in my automotive journalism career, and I have fond memories of the press launch (and having dinner with Bob Lutz) that included plenty of tire-smoking hard launches and demonstrations of the manual transmission's no-lift shift feature. The 260-horsepower turbocharged four-cylinder was and still is a spunky little engine that makes the retro-inspired HHR a fun little hot rod that works quite well as a fun little daily driver.

Cadillac ELR, Nissan Resonance and Ford Atlas win Eyes on Design awards

Fri, 18 Jan 2013This year's annual Eyes on Design awards were presented at the end of press days for the Detroit Auto Show on Tuesday. Given out for the best production and concept car designs that debuted at the show, and voted on by an esteemed panel of actual car designers, this year's award for best production vehicle design went to the 2014 Cadillac ELR. The 2014 Chevrolet Corvette, which was the show favorite among Autoblog editors, apparently did not impress the Eyes on Design judges enough with its all-new vent-festooned design.

The award for best concept design was actually split as a tie among the Nissan Resonance and Ford Atlas concepts. Last year's winners were the 2013 Ford Fusion and the Lexus LF-LC concept.

The Eyes on Design organization also presented a new honor this year called the Catalyst Award to Bob Lutz, former Vice Chairman of General Motors. Lutz is reported to have given a defense of design in his acceptance speech, arguing that advancements in quality across the industry as a whole have made good design a key differentiator for buyers.

Cadillac ELR getting massive discounts, some up to $14,000

Mon, Jul 14 2014Well, that didn't go as planned. General Motors had marketed the Cadillac ELR extended-range plug-in as a premium version of the Chevrolet Volt with some Caddy refinements. Now, it looks like that premium, at least from a price standpoint, is shrinking. Shoppers in a number of states are reporting that GM and its dealers are discounting the ELR in order to move more off dealer lots. The issue is that few people are biting at the official price tag of about $76,000, so GM has started offering as much as $8,000 worth of dealer and customer incentives, Transport Evolved reports. More recently, dealers in states such as Florida, Texas and Maryland are offering discounts in the $12,000-to-$14,000 range, and that's before any federal and state plug-in incentives kick in. It's not difficult to guess why. Through the first half of the year, GM sold fewer than 400 ELRs. Last month, Caddy moved just 97 units, or about as many as Tesla sells of its Model S in a day. Perpahs recent spy shots that reveal a test ELR that appears to up the sportiness quotient, with touches such as larger wheels and brakes, will also help sales. Check out Autoblog's "First Drive" impressions of the ELR here.