2004 Cadillac Cts Automatic Leather Moonroof on 2040-cars

Alexandria, Virginia, United States

Fuel Type:Gasoline

For Sale By:Dealer

Transmission:Automatic

Body Type:Sedan

Warranty: Unspecified

Make: Cadillac

Model: CTS

Options: Leather, Cassette, Compact Disc

Mileage: 92,973

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Sub Model: 4dr Sdn

Power Options: Air Conditioning, Cruise Control, Power Windows

Exterior Color: Light Platinum

Interior Color: Black

Number of Cylinders: 6

Doors: 4 doors

Engine Description: 3.2L DOHC V6 SFI (220 HP

Cadillac CTS for Sale

Manual leather bose stereo heated seats smoke free v6 satellite xm radio cd

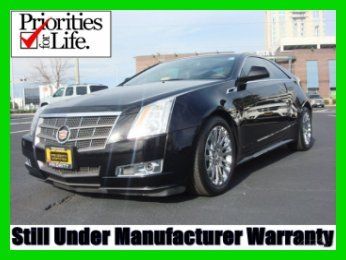

Manual leather bose stereo heated seats smoke free v6 satellite xm radio cd 2011 cadillac cts performance coupe 2-door 3.6l 316hp 1 owner!!hid motion(US $28,000.00)

2011 cadillac cts performance coupe 2-door 3.6l 316hp 1 owner!!hid motion(US $28,000.00) 2005 cadillac cts-v ls6 6speed leather added performance parts(US $14,000.00)

2005 cadillac cts-v ls6 6speed leather added performance parts(US $14,000.00) 2010(10)cts awd fact w-ty only 33k blk/blk bose heat-sts lthr $22495

2010(10)cts awd fact w-ty only 33k blk/blk bose heat-sts lthr $22495 We finance! ultraview roof nav hard drive 1owner non smoker carfax certified!(US $16,495.00)

We finance! ultraview roof nav hard drive 1owner non smoker carfax certified!(US $16,495.00) 2011 premium midsize coupe bose onstar traction

2011 premium midsize coupe bose onstar traction

Auto Services in Virginia

Williamsburg Honda-Hyundai ★★★★★

Webb`s Auto Body ★★★★★

Twins Auto Repair ★★★★★

Transmissions Inc. ★★★★★

Sweden Automotive Inc ★★★★★

Surratt Tire & Auto Center ★★★★★

Auto blog

Cadillac still planning for big things in China

Sat, 20 Apr 2013Despite some hiccups, China remains the auto industry's great hope for new vehicle sales, with significant sales gains and a huge upside. Nowhere is that hope more fervent than at General Motors, which offers eight different marques in the Asian nation. China has been GM's single biggest market the last three years running, and is unlikely to give up that title anytime soon. Yet its premiere brand, Cadillac, has remained essentially stagnant, selling just 30,000 units in China last year. That's in a segment where sales of luxury vehicles has outpaced that of the larger Chinese market. So what gives?

According to Cadillac officials Autoblog spoke with in China this week at the Shanghai Motor Show, it's been a problem of product - they haven't had the right ones. Displacement taxation issues, import tariffs and currency fluctuations have all conspired to make the brand's products less appealing than they might otherwise have been. But GM is stepping on the gas with Cadillac, and executives are eyeballing 100,000 sales by 2016 - more than triple the Wreath and Crest's current volume. And the expectations for the brand only get more ambitious from there - they're shooting for 10 percent of the luxury market by 2020. Bob Socia, President of GM China, promises that there will be a new Caddy launched in the market each year from now through 2016 and most will be built in China. Characterizing the company's efforts to revive the brand's fortunes as a "relaunch" of sorts, Cadillac also figures to gain dealers as GM expands its sales outlet footprint westward.

New products like a made-in-China XTS sedan (with a market-specific 2.0-liter four-cylinder to avoid heavy displacement taxes) will help, and Socia hinted that the ATS sport sedan could be next in line for in-country production. The SRX crossover - currently the brand's best-selling model in China - will also likely get a long look for future local production when the next-generation model is introduced. In the meantime, Cadillac unveiled the Escalade ESV Hybrid (shown above) as its latest model addition to capitalize on the market's white-hot luxury SUV segment.

Cadillac Escalade driven by Tony Soprano for sale

Fri, Nov 6 2015If you're a fan of The Sopranos imagining a trip to the Bada Bing, then check out this white 2003 Cadillac Escalade ESV for sale by RR Auction. James Gandolfini drove this luxury SUV in the role of Tony Soprano for the last three seasons of the mafia-themed series. Gandolfini also signed the interior to give you something to show off to your buddies. If you've ever watched the show, you've almost certainly seen this white SUV before. According to the auction listing, the series featured two Escalades, and this one was used for exterior shots. The Caddy even starred in an action scene in season 5 when Tony chased after Phil Leotardo. Gandolfini's signature appears inside twice: once with "Thanks for the truck, James Gandolfini" and again with just his name. The auction also includes a letter of authenticity that's signed by the actor, and a second document asserts the SUV's use in the series. Apparently, Gandolfini had a habit of signing messages in his vehicles from the show – at one point he wrote a threatening "Be nice to my car" message in a red Chevrolet Suburban from earlier episodes. The auction for Tony's Escalade runs from November 12-19, which still leaves plenty of time for a meeting of the families to decide to buy it. Bidding starts at $5,000, and according to The Drive, the consignor estimates a final price between $30,000 and $50,000. This sale should at least come to a more definitive end than The Sopranos did. Related Video:

Cadillac confirms 420-hp twin-turbo V6 for 2014 CTS [w/videos]

Mon, 18 Mar 2013The 2014 CTS will break cover next week at the New York Auto Show, but Cadillac has released a few details of what we can expect to find under the car's hood. As we saw in some spy shots back in January, the biggest news for the midsize Caddy will be a twin-turbocharged V6 producing a whopping 420 horsepower and 430 pound-feet of torque.

This LF3 engine will be paired to a new eight-speed automatic transmission, which will help balance performance and fuel economy. We still don't know how much the 2014 CTS has grown in terms of size and weight, but General Motors says that new sedan will return 17 miles per gallon in the city and 25 mpg highway with the new engine to go with a 0-60 mile per hour time of 4.6 seconds - that means the new CTS will have the fuel economy close to the current base model sedan and acceleration not too far from the current CTS-V. General Motors also confirmed that this twin-turbo V6 will be available in the 2014 XTS this fall.

The next-generation CTS will carry over the 3.6-liter V6 from the current car (likely as a base engine) and also add the 2.0-liter turbo four-cylinder from the ATS. Check out all the details on this new engine and watch a few videos (including GM's nifty tilt rig) by scrolling below.