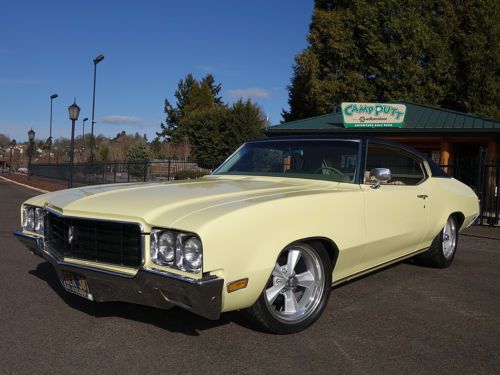

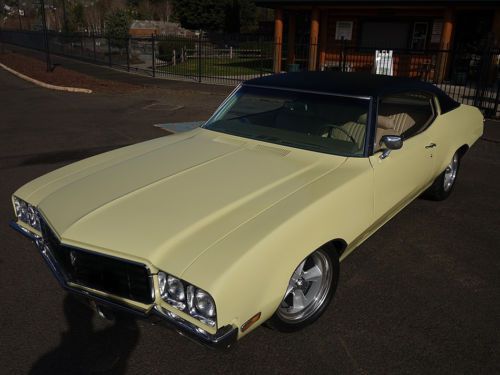

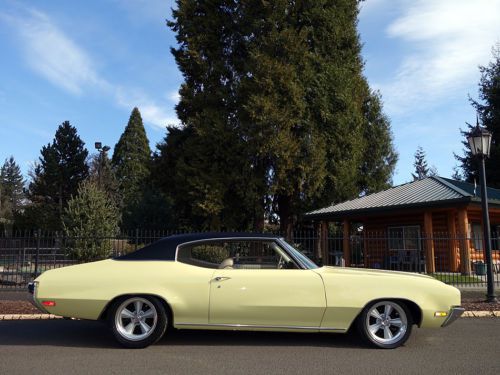

1970 Buick Skylark 350 V8 Automatic Ps Pb Butternut Yellow W/ Tan Interior on 2040-cars

Eugene, Oregon, United States

Buick Skylark for Sale

1971 buick skylark convertible brown with black interior

1971 buick skylark convertible brown with black interior 1972 buick skylark gs 350 restoration(US $5,000.00)

1972 buick skylark gs 350 restoration(US $5,000.00) 1967 buick skylark conv. lipstick red(US $8,500.00)

1967 buick skylark conv. lipstick red(US $8,500.00) 1970 buick skylark gs 455 gsx clone(US $18,500.00)

1970 buick skylark gs 455 gsx clone(US $18,500.00) 1969 buick skylark custom convertible 2-door 5.7l

1969 buick skylark custom convertible 2-door 5.7l 1979 buick skylark s coupe 2-door 3.8l 45,000 original miles

1979 buick skylark s coupe 2-door 3.8l 45,000 original miles

Auto Services in Oregon

Westgate Auto Ctr ★★★★★

University Honda ★★★★★

Trademark Transmissions ★★★★★

Tlk Automotive Repair ★★★★★

Shelby`s Auto Electric ★★★★★

Sears Auto Center ★★★★★

Auto blog

GM cutting Chevy Sonic, Buick Verano production by more than 20%

Sat, Jun 13 2015General Motors' Orion Assembly plant in Michigan is seeing even more production cuts this year to further reduce inventories of the Chevrolet Sonic and Buick Verano. These latest adjustments mean layoffs for about 100 workers in phases starting in July. "GM Orion Assembly will adjust plant production capacity to better align with market demand," the company said in a statement announcing the change. Through May, sales of the Sonic are down 28.5 percent to 29,082 vehicles, and the Verano is off 15.6 percent, with 15,279 sold this year. According to unnamed plant insiders speaking to Automotive News, the assembly rate is slowing at Orion Assembly from the current 33 cars an hour down to 26 an hour, a 21-percent reduction. GM is also reportedly going to keep the plant idle for three weeks during the normal summer shutdown, rather than the usual two. Earlier in the year, the factory was idled for two weeks due to excess supply of the Sonic and Verano. In March, it was closed again for several days for the same reason. The Orion Assembly plant is the future home to the line for the Chevy Bolt EV. GM Statement: GM Orion Assembly will adjust plant production capacity to better align with market demand. A phased layoff of approximately 100 employees will begin in July 2015 and conclude by year-end. Related Video: News Source: Automotive News - sub. req.Image Credit: Bill Pugliano / Getty Images Plants/Manufacturing Buick Chevrolet GM Hatchback Sedan buick verano orion assembly

2018 Buick Enclave launches luxury Avenir trim

Wed, Apr 12 2017Remember the shapely Buick Avenir Concept from the 2015 Detroit Auto Show? Well, this isn't that, even if they both share the same name. Meet the Buick Enclave Avenir, a new trim built atop Buick's redesigned 2018 Enclave seven-passenger crossover. Think of it as Buick's version of GMC's Denali trim and you'll be on the right track. As the brand's new top trim level, everything that's normally optional in the Enclave comes standard in the Avenir, along with a bunch of exclusive content. And this is just the first application of the Avenir package for Buick – expect the rest of the TriShield brand's products to get a similar makeover in due time. All Avenir models from Buick will get what the brand is calling a three-dimensional mesh grille with a new set of chrome wings. From there, the Enclave edition bundles unique pearl nickel 20-inch wheels, a Rear Camera Mirror like the one seen from Cadillac, and a new kind of LED headlamps that use something called Evonik Acrylite lighting technology. An in-car air ionizer promises to keep the cabin smelling fresh. The rest of the Enclave package sounds pretty good, too. It's got a standard 3.6-liter V6 engine with 302 horsepower and 260 pound-feet of torque, mated to a nine-speed automatic transmission. Front-wheel drive is standard, and all-wheel drive is optional. A tow rating of 5,000 pounds is standard fare for this class, as are seven seats inside. A frameless eight-inch LCD screen and integrated 4G wireless connectivity are other family-friendly highlights. We expect more Avenir-branded models to make their appearance in the Buick showroom soon. In the meantime, check out the Enclave Avenir in the image gallery above, and stay tuned for more from New York. Related Video:

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.