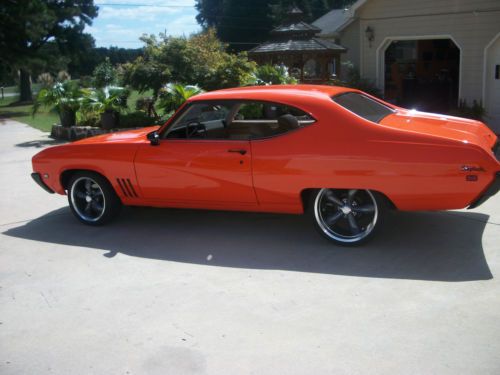

1969 Buick Skylark Base Hardtop 2-door 4.1l on 2040-cars

North Hollywood, California, United States

|

69 buick skylark custom 86765 miles. original 400 big block buick motor with 340hp. 4-barrel carburetor with a turbo Hydramantic shift transmission. Dual Ponce Track. tire front p215/70/or14 back tire p255/70/or15. need some body work dent on the right back qtr. panel. front qtr. right panel has rust on the bottom rust in the truck. Contact me at gwesley78@gmail.com. $10,000 or best offer.

|

Buick Skylark for Sale

1970 buick skylark gs 455 convertible 4 speed

1970 buick skylark gs 455 convertible 4 speed 1972 buick skylark roller no engine or trans.

1972 buick skylark roller no engine or trans. 1970 buick skylark custom convertible, full custom, digital dash, shaved, clean!

1970 buick skylark custom convertible, full custom, digital dash, shaved, clean! 1968 buick skylark custom hardtop 4-door 5.7l(US $4,900.00)

1968 buick skylark custom hardtop 4-door 5.7l(US $4,900.00) 1969 buick skylark hardtop 2-door 5.7l

1969 buick skylark hardtop 2-door 5.7l 1969 buick skylark custom convertible 2-door 4.1l(US $10,500.00)

1969 buick skylark custom convertible 2-door 4.1l(US $10,500.00)

Auto Services in California

Z Auto Sales & Leasing ★★★★★

X-treme Auto Care ★★★★★

Wrona`s Quality Auto Repair ★★★★★

Woody`s Truck & Auto Body ★★★★★

Winter Chevrolet - Honda ★★★★★

Western Towing ★★★★★

Auto blog

Porsche and Buick earn top honors in J.D. Power Sales Satisfaction Index Study

Wed, Nov 8 2023Customer satisfaction with car buying has been at a low point over the past few years, as price increases, inventory shortages, and COVID restrictions have complicated every part of the process. There are signs of improvement, however, as J.D. Powerís 2023 U.S. Sales Satisfaction Index Study showed that customer satisfaction has improved slightly from a year ago. J.D. Power rates satisfaction on a 1,000-point scale, finding that it improved seven points to 793 from last year. Improving inventory levels and a slow leveling off of prices have contributed to that improvement, and fewer people are paying above MSRP for new cars. Some auto brands performed better than others with sales satisfaction. Porsche ranked highest among premium brands, followed by Alfa Romeo. Buick took the top spot among mass-market brands, with GMC, Chevrolet, and Mitsubishi behind. J.D. Power also handed out segment-level awards: Premium Cars: Porsche Premium SUV: Porsche Mass-Market Car: Chevrolet Mass-Market SUV/Minivan: GMC Mass-Market Truck: GMC Despite the increase in sales satisfaction, there¬ís still room for improvement to reach pre-pandemic levels. J.D. Power noted gaps in salesperson knowledge as an area of improvement. Buyers rated salespeople much better during a gas vehicle purchase than with EVs, citing their expertise as a challenge. Pricing remains a challenge despite an improvement since 2022, and satisfaction is still below pre-pandemic levels. Mass-market buyers reported a slight bump in satisfaction, while premium buyers felt that pricing was less fair than a year before. It¬ís an interesting contrast, showing that dealer pricing tactics can significantly impact satisfaction with the sales process. Fewer people may be paying more than MSRP, but several premium models still list with significant markups. Even more interesting is Porsche¬ís top spot on the satisfaction list, as its cars often sell with huge upcharges, and it¬ís exceedingly tricky even to get a build allocation for some models. Buick Chevrolet GMC Porsche Car Buying Ownership

J.D. Power: Mini, Lexus again offer most satisfying sales experience

Thu, 29 Nov 2012JD Power has released its annual Sales Satisfaction Index Study, and once again Mini and Lexus have taken top honors. Overall, buyers are more satisfied with the auto-buying sales experience than they were last year, with those surveyed reporting an average score of 664 points on a 1,000-point scale. That's up from 648 in 2011. Dealer satisfaction also increased by five points over last year as well.

All told, Lexus brought home an index score of 737, which was high enough to put it atop the luxury brands for the second year in a row. JD Power says Infiniti came in second in that category with a score of 728 and Cadillac rounded out the podium with it's rating of 725. Speaking of Infiniti, that brand saw the single largest jump in sales satisfaction of any brand on the survey, popping up 52 index points over 2011.

Among mass-market brands, Mini ranked highest with a score of 712, followed closely by Buick with 706 and GMC farther down the line with 683. You can check out the full press release below for more information.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT ó General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.