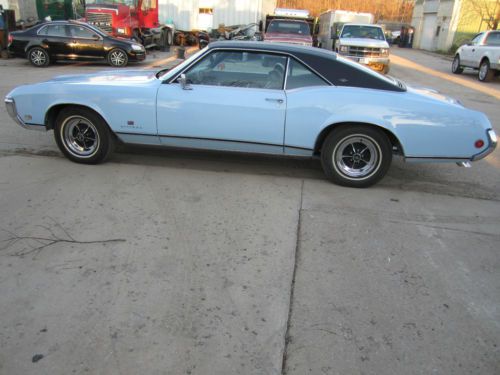

Body Is In Excellant Condition on 2040-cars

Roswell, New Mexico, United States

|

STARTED RESTORING THE CAR GOT THE BODY DONE, BUT DUE TO HEALTH REASONS CAN'T COMPLETE IT.

|

Buick Riviera for Sale

1983 buick riviera xx anniversary edition indy pace car replica rare find !!(US $13,500.00)

1983 buick riviera xx anniversary edition indy pace car replica rare find !!(US $13,500.00) 1963 buick riviera base hardtop 2-door 6.6l(US $13,000.00)

1963 buick riviera base hardtop 2-door 6.6l(US $13,000.00) 98 buick riviera, supercharged engine no reserve

98 buick riviera, supercharged engine no reserve #'s matching 455 riv, window sticker & build card, correct color code, must see!(US $15,995.00)

#'s matching 455 riv, window sticker & build card, correct color code, must see!(US $15,995.00) Beautiful 1967 buick riviera triple black original condition. black plate ca car

Beautiful 1967 buick riviera triple black original condition. black plate ca car 1969 buick riviera base hardtop 2-door 7.0l 430 engine

1969 buick riviera base hardtop 2-door 7.0l 430 engine

Auto Services in New Mexico

Tint Masters Inc ★★★★★

Silva Auto Electric ★★★★★

Santa Fe Motorplex ★★★★★

Ray`s Truck Service ★★★★★

Just Fix It ★★★★★

Integrity Automotive-Westside ★★★★★

Auto blog

Trump prods General Motors over its auto plants in China

Sat, Aug 31 2019WASHINGTON — U.S. President Donald Trump, who is engaged in a trade war with Beijing, said on Friday that the largest U.S. automaker, General Motors, should begin moving its operations back to the United States. "General Motors, which was once the Giant of Detroit, is now one of the smallest auto manufacturers there. They moved major plants to China, BEFORE I CAME INTO OFFICE. This was done despite the saving help given them by the USA. Now they should start moving back to America again?" Trump said in a post on Twitter. Trump appeared to be referring to a Bloomberg News story that reported GM's hourly workforce of 46,000 U.S. workers has fallen behind that of Fiat Chrysler as the smallest of the Detroit Three automakers. Over the past four decades, GM has dramatically cut the size of its overall U.S. workforce, which numbered nearly 620,000 in 1979. GM did not directly comment on Trump's tweet. "GMÂ’s China operations are not a threat to U.S. jobs," the company said in a fact sheet, noting that its joint ventures have sent $16 billion in equity income to GM since 2010 and that it has invested $23 billion in U.S. operations since 2009. GM's U.S. hourly workforce has fallen by about 4,000 jobs since the end of 2018 to about where it was a decade ago. Trump's ire with GM comes as contract talks with the United Auto Workers union with the Detroit Three automakers intensify ahead of a Sept. 14 deadline. Trump has previously attacked GM for building vehicles in Mexico and for ending production at plants in Michigan, Ohio and Maryland and threatened to cut GM subsidies in retaliation. GM's decision to close four plants in the United States is a central issue in the contract talks. Trump has made boosting auto jobs a key priority and has often attacked automakers on Twitter for not doing enough to boost U.S. employment. His 2020 re-election bid will hinge on holding key industrial battleground states like Wisconsin, Pennsylvania and Michigan that narrowly voted for him in 2016. China is the worldÂ’s largest auto market, and government policy favors automakers assembling vehicles there, and not importing them from overseas. In response to TrumpÂ’s latest tariffs, China said last week it will reinstitute 25% tariffs on U.S.-made vehicles. The U.S. is imposing 15% tariffs on more than $125 billion in Chinese goods starting Sunday. GM sold 3.6 million vehicles in China last year accounting for 43% of its worldwide sales.

Buick Avista concept is 'buildable', but not a priority

Tue, Mar 22 2016Buick could build the striking Avista concept that debuted at the Detroit Auto Show, though it's not a top priority, the brand's top executive said Tuesday in New York. "The reaction's been so great, we'll try to run the numbers and see if there's a business case," said Duncan Aldred, Buick vice president of sales, service, and marketing. Buick will show the Avista in red this week at the New York Auto Show as a followup to its Detroit debut. Buick actually built two prototypes, which are being used to promote the brand's performance potential at auto shows around the world this year. "It's very buildable," Aldred told reporters after the reveal of the reveal of the 2017 Encore small crossover before the New York Auto Show. "Ultimately, it comes down to priorities." He added, "We'd love to do it. We could do it, but [there's] lots of things we'd love to do... Nothing to confirm or deny." The Avista concept suggests a sports car with a twin-turbo V6 with 400 horsepower put to the rear wheels. The two-door followed another impressive Buick concept, the Avenir, which was four-door styling exercise from the 2015 Detroit show. Though the Avista remains on the minds of enthusiasts – helped in part by Buick – the priorities for the brand are crossovers. The Avista offers style, but the freshened Encore is the substance for Buick in New York, which along with the Envision, launches this year into the red-hot utility segment. The new Cascada convertible and redesigned LaCrosse also are joining Buick's lineup this year. While the Avista is doable, the brand clearly has other priorities ahead of it. Related Video:

Bob Seger's Detroit Made music video is an homage to the Motor City

Tue, 16 Sep 2014At this point, Bob Seger feels like the living embodiment of old-school rock 'n' roll. The Michigan native has been strumming out classic records like Night Moves for decades, and he just released a new single called Detroit Made. It sounds like a future staple of just about every classic car show within the next few years, and the video is dedicated to the Motor City, past and future.

Detroit Made is all about cruising in the city in a classic Buick Electra 225, perhaps better known as a "deuce and a quarter." It's straight-down-the-middle rock and could just as easily be from a decades-old Seger album as something new.

The video for the new single mixes shots of American classics cruising along Woodward Avenue with a contemporary look at the city. Sure, there are the well-known dilapidated buildings falling into rubble, but the people there aren't just letting the city die. Other parts show the attempts to clean things up and rebuild. Check out the video if you need a few minutes of old school rockin' in your life.