1983 Buick Riviera Base Convertible 2-door 5.0l on 2040-cars

Chagrin Falls, Ohio, United States

|

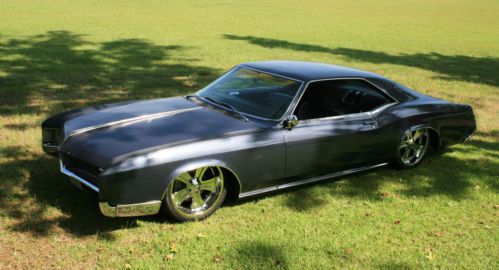

1983 Buick Riviera convertible

Great shape. Everything works. New tires and shocks. 89,000 miles! Engine runs great. Transmission works great. Drives down the road like floating on a cloud. $9,500 OBO. Buyer must make own arrangements for a prompt removal. Sold AS IS. Questions? Call Bob 440-829-8165. |

Buick Riviera for Sale

1983 buick riviera base convertible 2-door 5.0l

1983 buick riviera base convertible 2-door 5.0l 1966 buick riviera gran sport 465 wildcat!! 68,017 original miles!!!!!

1966 buick riviera gran sport 465 wildcat!! 68,017 original miles!!!!! 1963 buick riviera 401 nailhead automatic power windows

1963 buick riviera 401 nailhead automatic power windows 1973 buick riviera ~hot looking ride~ blue & white sport coupe am/fm/cd pwr+++(US $12,107.00)

1973 buick riviera ~hot looking ride~ blue & white sport coupe am/fm/cd pwr+++(US $12,107.00) 1966 buick riviera base hardtop 2-door 7.0l california car

1966 buick riviera base hardtop 2-door 7.0l california car 1999 buick riviera coupe 2-door 3.8l supercharged

1999 buick riviera coupe 2-door 3.8l supercharged

Auto Services in Ohio

Wired Right ★★★★★

Wheel Medic Inc ★★★★★

Wheatley Auto Service Center ★★★★★

Walt`s Auto Inc ★★★★★

Walton Hills Auto Service ★★★★★

Tuffy Auto Service Centers ★★★★★

Auto blog

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

GM China President says automaker could export vehicles from China to US

Sat, 20 Apr 2013At a press conference on Saturday at the Shanghai Motor Show, General Motors announced plans to further expand its presence in the Chinese market. Among those commitments are plans to build four new plants by the end of 2015, giving the automaker the capacity to produce around five million vehicles a year in the country.

In order to make the most of that expansion, GM is adding 400 dealerships in China this year alone (for a total of 4,200 sales points), and it's eyeing 5,100 dealers by 2015. Yet not all of that production will stay in China - GM is planning to increase exports as well. Officials estimate the company will export somewhere between 100,000 and 130,000 Chinese-built vehicles this year - a record. And it's gunning for more.

Autoblog asked GM China president Bob Socia (above) if that means the company might eventually export new vehicles built in China to the United States, and he responded:

Buick Envision CUV launches in China, is America next?

Fri, 29 Aug 2014Buick is launching its new midsize Envision crossover in China at the Chengdu Motor Show, where it will slot between the subcompact Encore and larger Enclave. While it might be hard to muster too much excitement about a Chinese-market crossover, don't completely ignore this one. There's a very good chance it could be on sale in North America to fill the same hole in the brand's lineup over here, possibly as a 2016 model.

We recently spied the Envision completely undisguised as it was arriving at the Chengdu show for its debut. The CUV still looks like a stretched Encore from some front angles, but that isn't necessarily a bad thing. It's got a similar oversized grille, hood vents (presumably faux) and large greenhouse as its little brother. Where the midsize CUV differs is its prominent crease running down the side and the different rear treatment, with wing-shaped trim cutting into the taillights.

The interior looks like a pretty nice place to spend time, too, with a predictable mix of leather, wood and metal, and it should be quiet in there with its active noise cancelation system. Infotainment is provided by an eight-inch touchscreen with a touchpad and voice controls.