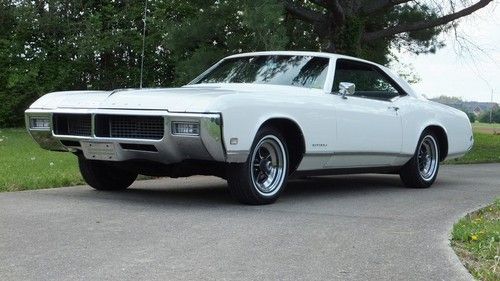

1965 Buick Riviera on 2040-cars

Hinckley, Ohio, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:425 340 HP

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 8

Make: Buick

Model: Riviera

Trim: DELUXE

Drive Type: REAR

Mileage: 59,066

Disability Equipped: No

Exterior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Black

Listed for auction is a pretty solid project 1965 Buick Riviera.The car has it's original numbers matching 425 engine which was pretty rare,most came with 401 in 1965.The engine runs well after sitting for some time( could use tune-up).Has super turbine 400 trans which works fine but has bad leak in pan gasket.The rear end is an open unit,not sure of gear ratio,most likely a 3.08 or 3.23.The brakes work.The exterior of the car is pretty ugly with surface rust.Someone stripped the original paint and shot cheap lacquer primer on it.The quarter panels,door skins,front fenders are very solid as well as the rear window and up around front windshield.Rockers are perfect.Tail pan looks good and solid.Trunk has some pin holes.Hood leading edge is soft(have another for extra $)Worst part was the floor pans which have been replaced professionally.There is still one patch that needs to be installed under the passenger side rear seat.The car is really straight with the exception of the driver side fender which has an older repair.Interior is pretty nice black deluxe interior .Carpet is usable but could be replaced.Dash has cracks.Wiring needs attention for windows and dash lighting,power seat.Glass is good condition.Wheels are in decent condition and tires have quite a bit of thread.Car is 95% all there.Items missing of note,headlight motor,headlight trim.Car needs paint and TLC.The hood and grill will be installed before pick up.

Buick Riviera for Sale

1965 buick riviera. driver, gs trim, straight body,rosewood steering wheel,(US $6,500.00)

1965 buick riviera. driver, gs trim, straight body,rosewood steering wheel,(US $6,500.00) 36,180 original miles - factory ordered gran sport - super wildcat - factory a/c(US $52,900.00)

36,180 original miles - factory ordered gran sport - super wildcat - factory a/c(US $52,900.00) 1998 buick riviera supercharged*fl car*low miles*heated seats*warranty*(US $9,595.00)

1998 buick riviera supercharged*fl car*low miles*heated seats*warranty*(US $9,595.00) 1963 buick riviera custom, collector car, 1960 car, street rod, hot rod(US $39,000.00)

1963 buick riviera custom, collector car, 1960 car, street rod, hot rod(US $39,000.00) 1996 buick ****** supercharged 3.8l *********

1996 buick ****** supercharged 3.8l ********* 68-1968~buick~riviera~original

68-1968~buick~riviera~original

Auto Services in Ohio

Xenia Radiator & Auto Service ★★★★★

West Main Auto Repair ★★★★★

Top Knotch Automotive ★★★★★

Tom Hatem Automotive ★★★★★

Stanford Allen Chevrolet Cadillac ★★★★★

Soft Touch Car Wash Systems ★★★★★

Auto blog

Cadillac, Buick and Chevy decisions impacted by worries abroad

Fri, 05 Jul 2013European Concerns Drive GM, But Beware Of The French Connection

GM's bid to rationalize Europe will impact the products that will be offered domestically.

It seems that Europe is defining the future of General Motors more so than its home North American market. Having axed Saturn, Pontiac and Hummer, GM has done a fairly good job of repositioning its remaining four divisions, Cadillac, Chevrolet, Buick and GMC. Cadillac carries the luxury banner. Chevrolet is aimed at the masses with cars and trucks along with a nod to performance thanks to Camaro and Corvette. Buick bridges the premium gap between Chevy and Cadillac, while GMC offers a hardcore work/upscale proposition.

Junkyard Gem: 1990 Buick Reatta Coupe

Sun, Nov 6 2022During the 1980s, General Motors worked hard to woo back American car shoppers who had defected to European luxury brands. Swanky interiors, futuristic electronics and Europe-influenced styling found their way into quite a few GM models during the second half of the decade. Pontiac had the 6000 STE, Oldsmobile offered the Toronado Trofeo, Cadillac sold the Turin-Hamtramck-built Allante, and Buick produced the sporty Reatta two-seater. Just under 22,000 Reattas were built during the 1988 through 1991 model years, and today's Junkyard Find is the fifth example I've found during my junkyard travels. The Reatta was the most expensive 1990 Buick, priced at $28,335 for the coupe and $34,995 for the convertible (or about $65,895 and $81,380 in inflation-adjusted 2022 dollars). For that kind of money, American car shoppers in 1990 could get a BMW 325i in coupe or convertible form for $24,650 or $33,850. They could get a Saab 900 Turbo convertible for $32,995 or an Audi Coupe Quattro for $29,750. Each of those European competitors had sophisticated overhead-cam engines and grippy suspensions, but the Reatta was built on a shortened version of the chassis that went under the Barcalounger-esque Buick Riviera and its engine was the old-timey pushrod Buick V6. The 3.8-liter Buick V6 had been made quite reliable and acceptably smooth by the time this car was built, and it made 165 horsepower (just three fewer than the BMW 325i), but Buick salesmen didn't have much to brag about when showing this engine compartment to a 35-year-old youngster who had just driven a Saab 900 Turbo. The antiquated engine was problem enough, but the lack of a manual transmission served to chase off additional potential buyers. A four-speed automatic was mandatory in every Reatta. Just in case some traditional (i.e. Greatest Generation members) Buick customers might consider this glamorous two-seater, Buick scared them off with the Reatta's video-game-style digital dash and its way-ahead-of-its-time Graphics Control Center touchscreen interface. You can't win! The Graphics Control Center hardware has been grabbed from this dash (the components also fit optioned-up Rivieras and Trofeos of the same era, so junkyard shoppers pull them for resale). Naturally, a Reatta owner would want a hardwired car phone. If you really wanted to be cool in the early 1990s, you bought a Chrysler product with the amazing VisorPhone.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.