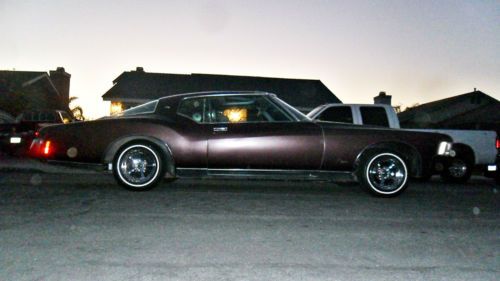

1963 Buick Riviera Retro-custom on 2040-cars

Lavallette, New Jersey, United States

Vehicle Title:Clear

Year: 1963

Drive Type: rwd

Make: Buick

Mileage: 34,500

Model: Riviera

Exterior Color: Red

Trim: Base Hardtop 2-Door

Interior Color: Red

Buick Riviera for Sale

1966 buick riviera gs gran sport original not 1965 1963 1964 original ca car(US $4,500.00)

1966 buick riviera gs gran sport original not 1965 1963 1964 original ca car(US $4,500.00) Superb original 1963 buick riviera original highly optioned california zero rust

Superb original 1963 buick riviera original highly optioned california zero rust 1973 buick riviera boat tail 455-4, running driving project, 42" moonroof

1973 buick riviera boat tail 455-4, running driving project, 42" moonroof 1983 buick riviera coupe blue ***no reserve***

1983 buick riviera coupe blue ***no reserve*** 1963 buick riviera 455 wildcat v8 76k original low miles white mint(US $18,900.00)

1963 buick riviera 455 wildcat v8 76k original low miles white mint(US $18,900.00) 1972 buick riviera boattail 455 nice older driver not gs

1972 buick riviera boattail 455 nice older driver not gs

Auto Services in New Jersey

Woodstock Automotive Inc ★★★★★

Windrim Autobody ★★★★★

We Buy Cars NJ ★★★★★

Unique Scrap & Auto - USA ★★★★★

Turnersville Pre-Owned ★★★★★

Trilenium Auto Recyclers ★★★★★

Auto blog

China-market Buick Electra E5 meets the world

Mon, Nov 28 2022We now know the Buick Envista crossover is on the way to the U.S. market after its recent debut in China. The Chinese Ministry of Industry and Information Technology has previewed another Buick crossover that will eventually get here, the release spotted by Car News China. The battery-electric Electra E5 was outed as part of the ministry process of opening up a public comment for new market entries. This is the Buick-branded Ultium-based EV that inaugurates a new electric era for GM brands over there, the E5 landing in the middle of the consecutive E1 to E9 trademarks Buick reserved a few years ago. The five-seat crossover's dimensions have been given as 192.6 inches long, 75 inches wide, and 66.2 inches tall, on a wheelbase 116.3 inches long. That size puts it on the same wheelbase as the coming 2024 Chevrolet Equinox EV, with a length about two inches longer. The base wheels measure 18 inches, the options list offers 20-inch units. The battery pack is sourced from a joint venture between CATL and SAIC, the latter being GM's joint venture partner in China. The automaker said it's "tailored for China" but we don't know what that means, nor do we know the capacity. Thanks to the MIIT information, we do know the E5 weighs 5,666 pounds and in this initial form will be powered by one 241-horsepower motor that can achieve a top speed to 112 miles per hour. Spy photographers caught an Electra SUV clad in camo doing the rounds in Michigan earlier this month with all the same design cues seen on the Chinese model — narrow headlights and taillights, three-piece high brake light on the hatch spoiler, and the same wheels. Although we could be wrong, we'd bet a fair bit of money our Electra will come with more than 241 horsepower, though. Even our compact Buick Envision gets 228 hp, and it weighs almost 2,000 pounds less than the China-market Electra E5.  The same over there as here, the E5 represents Buick's first proper move toward the all-electric lineup scheduled to be completed by 2030. In China, it will mean the sunset of current EV offerings like the Buick Velite 6 MAV wagon-like vehicle, and the Chevy-Bolt-based Velite 7. Car News China said neither sell well, calling the Velite 6 "a bit of an oddball," and the 7 a little small for the Chinese market. Younger, tech-happy buyers will be lured with the first strokes of SAIC's Smart Cockpit and GM's Super Cruise. Deliveries should commence at the beginning of next year in China, the E5's arrival in the U.S.

Chevy Bolt-based prototype may be a Buick EV for China

Thu, Jan 9 2020Late last spring, we got a look at a GM prototype that was clearly based on the Chevy Bolt EV, but with updated styling. It seemed like it could be a more crossover-styled Bolt, given the recently trademarked name of EUV. Now we get another look at the prototype, but the bodywork seems less suggestive of a Chevy, and more of a Buick. This vehicle definitely still appears to be based on the Bolt, rather than on another small GM platform. In the photos of it next to the current model, the size, wheelbase and profile are extremely similar. There are differences, though. The nose isn't as sloped or as rounded, and the rear window kicks up a little earlier. The biggest changes are in the front and rear fascias, and it's here that we see hints of Buick. There are prominent air inlets on each side of the front bumper that give the car a more aggressive look. The headlights still have a fairly rounded, organic look, but with little extensions like fangs underneath. The styled running-light section, rounded shape and the smoked lenses seem very Buick-like. The grille features a large badge that doesn't fit the shape of a bow-tie, and is more that of a round logo like Buick's. Around at the back, the full-width taillights stand out, and in the middle there is obviously a round badge, again like a Buick. The wide taillights would also be a natural evolution of Buick's current light design language that uses somewhat wide and thin lights. The rear bumper has been redesigned with new lower taillights. Now that we've established that this seems very much like a Buick, we don't think we'll see this particular version offered here with the badge. This is more likely a Buick version of the Bolt for the Chinese market, where the brand is associated with luxury and has been the spearhead for GM's electric and hybrid models. In fact, the Chevy Volt hybrid was sold there as the Buick Velite 5, which was part of a family of a electrified Velite models. This would probably also carry a Velite badge as well. While we might not see this specific Buick variant, we probably will see it offered as a Chevy in some form. With its more aggressive, crossover shape, it could be the rumored EUV model. Or it could be just a refresh of the current Bolt, since the model has been largely unchanged since its introduction for the 2017 model year. And extrapolating from this prototype, we can see how the headlights could be tweaked to tie into those air scoops as on the Suburban and Silverado.

2018 Buick Enclave slims down for spy shots

Tue, Jul 19 2016Most vehicles are refreshed every five years or so. New technology and styling is required to keep up with the latest trends. Although this cycle is common, there are some vehicles, like the Buick Enclave, that seem to stick around far past their expiration date. We now have spy shots of what appears to be the nine-year old Enclave's replacement. Although the vehicle in the photos is completely covered in camouflage, we can make out the new Buick family grill. There are a set of LED running lights up front and what appear to be a location for foglights toward the bottom. The camo covering is cut in places to allow gaps for sensors, presumably for parking and other driver aids. Out back, the rectangular taillights don't appear to be production ready. The whole rear, especially the glass, looks smaller than the outgoing model, though it is difficult to properly tell through the camouflage. The rear bumper has wide cuts for the dual exhaust pipes, and again the camo has cutouts for sensors. The side profile reveals the biggest change with the new Enclave. The current version shares a platform with the Chevrolet Traverse and the original GMC Acadia, some of the largest vehicles on the market. The all-new 2017 Acadia scaled down in order to compete against midsize crossovers and now has more in common with the smaller, Chinese-built Buick Envision. That doesn't mean the Enclave and Acadia are entirely separate. Both the Enclave and upcoming Traverse will ride on a stretched version of the Acadia platform. The general profile remains the same, but it's apparent that the vehicle in these photos is longer than the new GMC. Most other details are speculation. The Enclave will most likely arrive with GM's 3.6 liter V6. With the introduction of the Envision, the Enclave is expected to move upmarket to compete against the Acura MDX and Volvo XC90. Because of the slightly narrower shape, passenger seating is expected to fall to seven. The new crossover will probably lose a bit of weight with the redesign. The new Buick is expected to debut next year as a 2018 model. Look for the reveal of the Chevrolet Traverse replacement as well. Related Video: Featured Gallery Buick Enclave Spy Shots View 20 Photos Spy Photos Buick Crossover

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.037 s, 7974 u