2005 Buick Lacrosse Cxs Sedan 4-door 3.6l on 2040-cars

Lebanon, Ohio, United States

Engine:3.6L 217Cu. In. V6 GAS DOHC Naturally Aspirated

Vehicle Title:Clear

Body Type:Sedan

Fuel Type:GAS

For Sale By:Private Seller

Exterior Color: Red

Make: Buick

Interior Color: Tan

Model: LaCrosse

Trim: CXS Sedan 4-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: FWD

Options: Sunroof, Leather Seats, CD Player

Number of Cylinders: 6

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Mileage: 56,000

Sub Model: CXS

Buick Lacrosse for Sale

Cxs 3.6l gps nav remote start heated & cooled leather seats sunroof moonroof

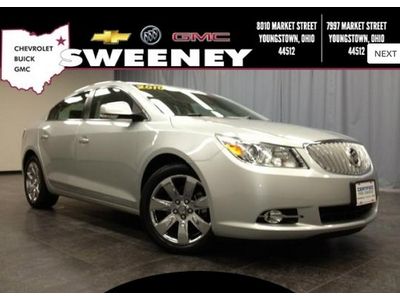

Cxs 3.6l gps nav remote start heated & cooled leather seats sunroof moonroof 2012 buick lacrosse, touring series, black metallic(US $27,000.00)

2012 buick lacrosse, touring series, black metallic(US $27,000.00) 2010 buick lacrosse cxl 3.0l.push-start/cooled leather/sensors**no reserve**

2010 buick lacrosse cxl 3.0l.push-start/cooled leather/sensors**no reserve** 2007 white cxs!

2007 white cxs! 2010 buick lacrosse cxl awd black navigation sunroof heated cooled leather

2010 buick lacrosse cxl awd black navigation sunroof heated cooled leather Leather onstar air conditioning, dual-zone automatic climate cont

Leather onstar air conditioning, dual-zone automatic climate cont

Auto Services in Ohio

Zig`s Auto Service ★★★★★

Zeppetella Auto Service ★★★★★

Willis Automobile Service ★★★★★

Voss Collision Centre ★★★★★

Updated Automotive ★★★★★

Tri C Motors ★★★★★

Auto blog

Buick's new logo ditches the ring, levels the shields

Tue, Mar 29 2022Buick's logo is about to receive a relatively major update. The new-look emblem appeared in a trademark filing in March 2022, and a leaked image posted on social media has given us a better look at the design that should appear on production cars in the not-too-distant future. Published on Instagram by an account called Buick_Saudi_Arabia, the photo shows what seems to be Buick's new logo on the middle of a steering wheel. The changes made aren't groundbreaking, but they're certainly noticeable. The ring is gone, and the red, white, and blue shields are separated from each other and positioned on the same level. As of writing, the shields are staggered and surrounded by a ring.      View this post on Instagram            A post shared by Buick Saudi Arabia (@buick_saudi_arabia) One question that comes to mind is: why now? Buick has used its current logo for decades without significantly updating it, so what prompted the company to give the design a makeover? Several factors undoubtedly influenced this decision, but one that's worth shining light on is that the brand is no longer twinned with Germany-based Opel. For many years, some Opel-designed models made their way to the United States with Buick emblems on both ends. No one in Europe has heard of a Buick Regal; folks there know the sedan as the Opel Insignia. And, since the visual differences between these cars were often minor, using a Buick logo whose basic silhouette was similar to Opel's logo simplified the design process. Neatly integrating, say, Chevrolet's bowtie-shaped emblem into the Insignia's grille would have been harder, though more improbable acts of badge-engineering have been committed (the Ford Maverick was once a Nissan). General Motors sold Opel to PSA Peugeot-Citroen in 2017, and both carmakers are now part of Stellantis, so Buick's trans-Atlantic design ties have been cut. Losing the Opel connection gives Buick's design team more leeway to experiment with new ideas, like a revamped logo. Keep in mind that nothing is official yet. Full details and an explanation of what the new logo means should emerge soon. Why the shields? Buick isn't rooted in sword-fighting, so why have shields appeared on its cars for over 60 years? The answer, according to Buick, is relatively vague. What's certain is that the tri-shield logo didn't appear on Buick's early cars.

Buick Avista concept is 'buildable', but not a priority

Tue, Mar 22 2016Buick could build the striking Avista concept that debuted at the Detroit Auto Show, though it's not a top priority, the brand's top executive said Tuesday in New York. "The reaction's been so great, we'll try to run the numbers and see if there's a business case," said Duncan Aldred, Buick vice president of sales, service, and marketing. Buick will show the Avista in red this week at the New York Auto Show as a followup to its Detroit debut. Buick actually built two prototypes, which are being used to promote the brand's performance potential at auto shows around the world this year. "It's very buildable," Aldred told reporters after the reveal of the reveal of the 2017 Encore small crossover before the New York Auto Show. "Ultimately, it comes down to priorities." He added, "We'd love to do it. We could do it, but [there's] lots of things we'd love to do... Nothing to confirm or deny." The Avista concept suggests a sports car with a twin-turbo V6 with 400 horsepower put to the rear wheels. The two-door followed another impressive Buick concept, the Avenir, which was four-door styling exercise from the 2015 Detroit show. Though the Avista remains on the minds of enthusiasts – helped in part by Buick – the priorities for the brand are crossovers. The Avista offers style, but the freshened Encore is the substance for Buick in New York, which along with the Envision, launches this year into the red-hot utility segment. The new Cascada convertible and redesigned LaCrosse also are joining Buick's lineup this year. While the Avista is doable, the brand clearly has other priorities ahead of it. Related Video:

How to hack a Buick Regal with CarKnow

Thu, 08 Aug 2013If you own an Apple iPhone or Android device, perhaps you've been tempted to jailbreak or root it. This process gives you access to the the software's code, and can be used to make minor or drastic changes to its operating system. CarKnow, a company in Boston, is working applying a similar concept to the automobile.

Translogic recently took a look inside CarKnow to see just how it can tweak the computers inside a car and what sort of things can be done. As our transportation tech sister site explains, CarKnow basically created a digital duplicate of their Buick Regal in the cloud, while harvesting data generated to create custom apps and infiltrate the deepest function of their test car.

And before you freak out about people maliciously taking over your car, CarKnow's founder, Josh Siegel, stresses that it isn't quite so easy as driving up alongside someone. Take a look at the full video below to see just what it's like to jailbreak a car.