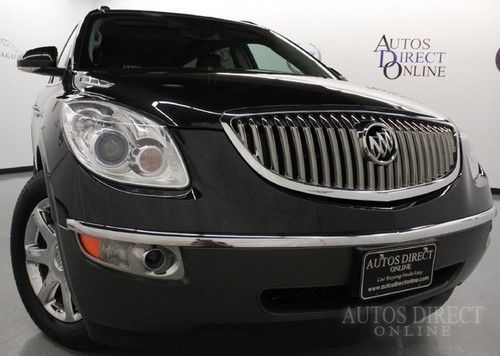

2011 Buick Cxl on 2040-cars

Boerne, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:3.6L 217Cu. In. V6 GAS DOHC Naturally Aspirated

Body Type:Sport Utility

Fuel Type:GAS

Make: Buick

Model: Enclave

Trim: CXL Sport Utility 4-Door

Disability Equipped: No

Doors: 4

Drive Type: AWD

Drivetrain: All Wheel Drive

Mileage: 27,227

Sub Model: CXL

Number of Cylinders: 6

Exterior Color: Black

Interior Color: Black

Buick Enclave for Sale

Brown financing warranty leather htd sunroof tv dvd chrome 19s extras 2 owner(US $21,900.00)

Brown financing warranty leather htd sunroof tv dvd chrome 19s extras 2 owner(US $21,900.00) 2008 buick enclave cxl sport utility 4-door 3.6l

2008 buick enclave cxl sport utility 4-door 3.6l 2011 buick enclave cx 7 pass cruise ctrl xenons 68k mi texas direct auto(US $19,980.00)

2011 buick enclave cx 7 pass cruise ctrl xenons 68k mi texas direct auto(US $19,980.00) Cxl w/2xl suv 3.6l cd heated mirrors power mirror(s) bucket seats back-up camera

Cxl w/2xl suv 3.6l cd heated mirrors power mirror(s) bucket seats back-up camera We finance 10 cxl awd nav dvd sunroof back-up cam heated/cooled seats bluetooth(US $20,500.00)

We finance 10 cxl awd nav dvd sunroof back-up cam heated/cooled seats bluetooth(US $20,500.00) 2010 buick leather/heated seats/power gate

2010 buick leather/heated seats/power gate

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

2023 Buick Envision prices up by at least $1,900 over 2022

Sat, Sep 10 2022When Buick uploads the configurator for the 2023 Envision, shoppers will find the mid-sized crossover more expensive than the 2022 model. GM Authority got hold of next year's pricing, revealing that MSRPs will go up by $1,900 on the bottom two trims and $5,810 on the top Avenir trim. The new math, which includes the destination charge increasing $200 to $1,395, erases the discounts that arrived with 2022 Envision pricing earlier this year. Retail cost for the coming Avenir with front-wheel drive after the destination charge will be: Preferred FWD: $34,795 Essence FWD: $38,895 Avenir FWD: $47,055 Adding all-wheel drive means another $1,800 on the Essence and Avenir. Doing the same for the entry-level Preferred means pushing MSRP up by $3,650 because of the $1,850 Convenience Package is mandatory when turning the rear axle. The $1,900 upcharge for Preferred and Essence entails $1,500 for three years of OnStar and Connected Services, GM making the telematics service standard on the Cadillac, GMC, and Buick lineups as well as the Chevrolet Corvette for next year. That leaves the remaining $400 as a pure model-year price bump. The much larger rise for the Avenir is because it comes with a lot more equipment. For 2023 this trim makes the $1,965 and Technology Package II and $1,450 Panoramic Power Moonroof standard. The Technology Package adds enhanced LED headlights, adaptive cruise control, adaptive dampers, enhanced automatic emergency braking and parking assist, and a rear camera mirror with washer. Those bundles represent $3,415 of the upcharge, adding $1,500 for OnStar takes that to $4,915, leaving $895 as the model-year price bump. The rest should be carryover, save for potential changes to the exterior color menu. If there's any big news for the model next year, it would be the potential arrival of an Envision GX that would add about eight inches of overall length, with two of that between the wheels. Related video:

Don't buy that crossover! Buy a cladded wagon instead!

Fri, Nov 10 2017If you're looking to buy a car soon, and you're like most Americans, there's a strong chance you're considering buying a crossover SUV. That's what people want nowadays. People like the tough, tall exterior that suggests adventure and preparedness, they like the high seating position, they like the all wheel drive many have and they like the practicality. Because of this, crossovers have rapidly supplanted typical cars such as sedans, wagons, and more as the most popular vehicles in the country. But they're compromised, too. They're often heavy, thirsty, and expensive compared with more conventional cars. The good news is, there's an alternative, a happy medium between the straight crossover and the traditional car. They're lifted wagons, and they're the best crossover SUVs around. And for those who may not know what we're talking about, we're talking about cars and wagons that have been given a suspension lift for more ground clearance and a higher ride height, and often have all wheel drive standard or optional. They also usually have chunky plastic body cladding to make them look tough and durable. Examples include the Subaru Crosstrek, Audi A4 Allroad, Buick Regal TourX, and Volkswagen Golf Alltrack, among others. Because of the suspension and body modifications, these vehicles fit the trendy crossover mold quite well. And in the case of long-running nameplates such as the Subaru Outback and Volvo Cross Country models, they even have some heritage as outdoorsy machines. They also provide the higher driving position that crossover buyers love. And in some cases, such as with the Golf Alltrack, we've learned they offer better ride quality than their road-oriented siblings. View 9 Photos So these tall wagons offer the key things crossover buyers want, but what makes them better than traditional crossovers is that they have the advantages of the cars they're based on. For instance, the aforementioned Golf Alltrack still drives mostly like a Golf, which is to say, it's nimble, feels peppy, and is easy to maneuver because of its relatively small size. We can't really say the same for the Tiguan, which feels generally more sluggish and uninteresting than the Alltrack. And we mention Volkswagen's compact crossover because it starts at nearly the same price as the Alltrack. Some of the difference in giddy-up can be explained by weight. Normal crossovers can be fairly portly, while these lifted wagons are notably lighter.

2022 Buick Envision mostly costs a little less than in 2021

Mon, Feb 14 2022When Buick gave the world the second-gen Envision for the 2021 model year, the brand also gave Buick shoppers big discounts, cutting $1,700 from the entry-level Preferred trim's price compared to 2021. Buick's done the same on a smaller scale for 2022, albeit this time the brand made it an exchange, not a freebie. Pricing for the 2022 Envision after the $1,195 destination charge, as well as the differences from 2021, is: Preferred FWD: $32,695 ($300 less) Preferred ST FWD: $34,140 ($180 less) Preferred AWD: $36,345 ($1,550) Preferred ST AWD: $37,790 ($1,670) Essence FWD: $36,795 ($400 less) Essence ST FWD: $38,290 ($230 less) Essence AWD: $38,595 ($400 less) Essence ST AWD: $40,090 ($230 less) Avenir FWD: $41,045 ($550 less) Avenir AWD: $42,845 ($550 less) Buick's publicized list of changes for the 2022 Envision are the addition of a new Sapphire Metallic exterior color, and the Sport Touring package now including the "ST" logo embroidered on the front seat headrests and alloy pedals for all trims, plus contrasting red stitching on the Essence ST trim. What Buick left out, as GM Authority reports, is that some previously standard equipment is now optional, explaining the discounts of a few hundred bucks. Buyers need to buy a new $200 Safety Package to get blind spot and rear cross traffic alerts, which used to be standard with the Driver Confidence Plus suite. Powered lumbar for the driver's seat is also a new option that was formerly standard, bundled with different items and costing a different amount depending on trim. The real shocker is the four-figure price leap tacked onto the Preferred all-wheel-drive trims. In 2021, it cost $1,800 to send power to the rear axle. For 2022, it costs $3,650 to get AWD on the Preferred, but the AWD option on Essence and Avenir trims hasn't budged from $1,800. We aren't clear on the reasons for the change. Every Avenir is powered by a 2.0-liter turbocharged four-cylinder with 230 horsepower and 258 pound-feet of torque, shifting through a nine-speed automatic transmission. Related video: