2003 Bmw Z4 2.5i on 2040-cars

Indianapolis, Indiana, United States

Engine:2.5L 2494CC 152Cu. In. l6 GAS DOHC Naturally Aspirated

Body Type:Convertible

Transmission:Manual

Fuel Type:GAS

Make: BMW

Disability Equipped: No

Model: Z4

Number of doors: 2

Trim: 2.5i Convertible 2-Door

Inspection: Vehicle has been inspected (include details in your description)

Series: 2.5i

Drive Type: RWD

Certification: None

Mileage: 95,272

Drivetrain: RWD

Exterior Color: Black

Interior Color: Black

Number of Cylinders: 6

Warranty: Unspecified

BMW Z4 for Sale

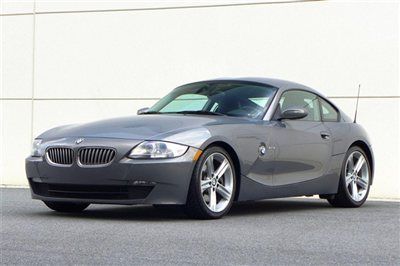

2008 bmw z4 coupe, red interior, rare car! super clean, don't wait!(US $25,991.00)

2008 bmw z4 coupe, red interior, rare car! super clean, don't wait!(US $25,991.00) 2003 bmw z4 2.5i convertible 2-door 2.5l(US $13,900.00)

2003 bmw z4 2.5i convertible 2-door 2.5l(US $13,900.00) Low miles * 2007 bmw z4 premium pkg heated seats sport pkg steptronic auto trans

Low miles * 2007 bmw z4 premium pkg heated seats sport pkg steptronic auto trans 2004 bmw z4 3.0i convertible 2-door 3.0l

2004 bmw z4 3.0i convertible 2-door 3.0l Premium package sport package bmw certified pre-owned warranty(US $23,800.00)

Premium package sport package bmw certified pre-owned warranty(US $23,800.00) 2007 bmw z4(US $18,990.00)

2007 bmw z4(US $18,990.00)

Auto Services in Indiana

Zang`s Collision Consultants ★★★★★

Woody`s Hot Rodz ★★★★★

Wilson`s Auto Service ★★★★★

Vrabic Car Center ★★★★★

Vorderman Autobody ★★★★★

Voelz Body Shop Inc ★★★★★

Auto blog

In-demand BMW i8 deliveries start in June, and it's more efficient than we thought

Thu, Mar 13 2014Memo to Elon Musk: objects in the rear-view mirror may be closer than they appear. In this case, it's a couple of plug-in BMWs. And they represent the closest thing to a true competitor for Musk and the Tesla Motors electric vehicles. The German automaker re-confirmed that demand for its upcoming i8 plug-in hybrid will exceed the initial supply batch, though BMW didn't release any specific numbers, Reuters says. BMW will start production next month with deliveries commencing in June for the 362-horsepower i8. The news is consistent with a November estimate from BMW that indicated that the first year of i8s were essentially spoken for in advance. We learned in late January that the number of i3 battery-electric vehicles imported to the US won't meet demand during that vehicle's first year of sales either. Here's the thing: all these people were interested in the i8 when BMW said the car got the equivalent of 94 miles per gallon. Turns out, those calculations were a bit off. Reuters also notes that the new numbers show the i8 gets 112 MPGe. That's on the lenient European cycle, but if anyone was holding out for an i8 with triple-figure fuel economy, your time (to get on the waiting list) has come.Motley Fool proposed late last month that BMW is positioned to be Tesla's only real competition when it comes to high-performance plug-in vehicles. The reasoning was that the BMW plug-ins, like the Teslas, are being built from scratch and don't just have EV powertrains dropped into existing vehicle platforms. Whether or not the competition is truly a two-team race is something we're not sure is completely decided yet, but we know it'll be fun to watch unfold either way. Want proof? Check out Autoblog's enjoyable First Drive of the i8 here.

Next BMW 5 Series hits the 'Ring

Fri, Apr 24 2015Here are our latest photos showing the new BMW 5 Series, codenamed G30, testing at the Nurburgring. Based on the fairy door on the left front fender, we'll take this as the purported PHEV version that we caught last time around on German city streets. According to the insiders at BMW Blog, the 5er hybrid will take heavy inspiration from the X5 xDrive40e, including the 2.0-liter four-cylinder engine with electric assistance and a combined power rating of about 300 horsepower. The lighter CLAR architecture making its way under the 3, 5, 6, and 7 Series models is expected to remove anywhere from 80 to 100 kilograms in the 5, enabling non-US markets to partake of the 150-hp, turbodiesel three-cylinder engine at the entry-level end. However, the engine symphony will run up the scale through four-, six-, and eight-cylinder registers that include a 400-hp M550 diesel and a 600-hp V8 in the M5. The tech story is 'Go Go Gadget G30,' with rumors of autonomous abilities like being able to overtake other cars on its own – and signaling beforehand – and parking itself. Inductive charging through a floor-mounted plate, as shown at this year's Consumer Electronics Show, a new iDrive layout with a touchscreen and gesture-enabled functions, and over-the-air updates are also expected. We could see it revealed at next year's Geneva Motor Show, or maybe the 2016 Auto China, in Beijing, or sooner.

Is the skill of rev matching being lost to computers?

Fri, Oct 9 2015If the ability to drive a vehicle equipped with a manual gearbox is becoming a lost art, then the skill of being able to match revs on downshifts is the stuff they would teach at the automotive equivalent of the Shaolin Temple. The usefulness of rev matching in street driving is limited most of the time – aside from sounding cool and impressing your friends. But out on a race track or the occasional fast, windy road, its benefits are abundantly clear. While in motion, the engine speed and wheel speed of a vehicle with a manual transmission are kept in sync when the clutch is engaged (i.e. when the clutch pedal is not being pressed down). However, when changing gear, that mechanical link is severed briefly, and the synchronization between the motor and wheels is broken. When upshifting during acceleration, this isn't much of an issue, as there's typically not a huge disparity between engine speed and wheel speed as a car accelerates. Rev-matching downshifts is the stuff they would teach at the automotive equivalent of the Shaolin Temple. But when slowing down and downshifting – as you might do when approaching a corner at a high rate of speed – that gap of time caused by the disengagement of the clutch from the engine causes the revs to drop. Without bringing up the revs somehow to help the engine speed match the wheel speed in the gear you're about to use, you'll typically get a sudden jolt when re-engaging the clutch as physics brings everything back into sync. That jolt can be a big problem when you're moving along swiftly, causing instability or even a loss of traction, particularly in rear-wheel-drive cars. So the point of rev matching is to blip the throttle simultaneously as you downshift gears in order to bring the engine speed to a closer match with the wheel speed before you re-engage the clutch in that lower gear, in turn providing a much smoother downshift. When braking is thrown in, you get heel-toe downshifting, which involves some dexterity to use all three pedals at the same time with just two feet – clutch in, slow the car while revving, clutch out. However, even if you're aware of heel-toe technique and the basic elements of how to perform a rev match, perfecting it to the point of making it useful can be difficult.