2015 Aston Martin Vantage Gt on 2040-cars

Long Beach, California, United States

Fuel Type:Gasoline

For Sale By:Private Seller

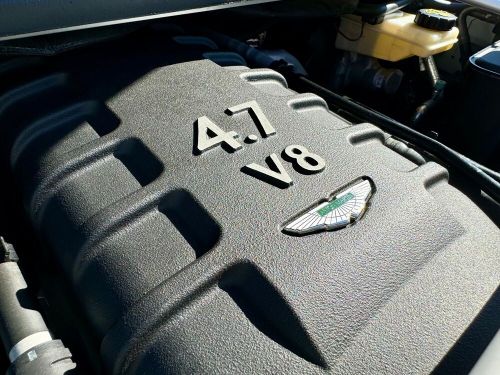

Engine:4.7L AJ37 V8

Body Type:Coupe

Vehicle Title:Clean

VIN (Vehicle Identification Number): scfekbal7fgc19725

Mileage: 21400

Make: Aston Martin

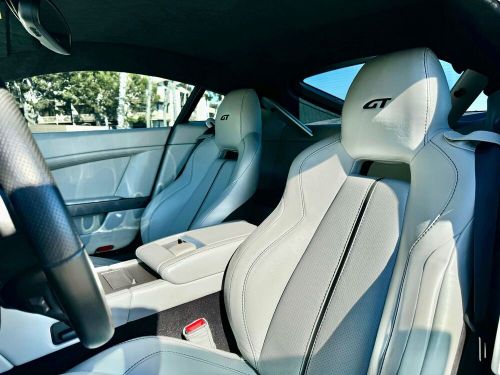

Interior Color: Gray

Previously Registered Overseas: No

Number of Seats: 2

Number of Previous Owners: 2

Fuel Consumption Rate: 14

Drive Side: Left-Hand Drive

Independent Vehicle Inspection: Yes

Engine Size: 4.7 L

Exterior Color: Silver

Car Type: Performance Vehicle

Number of Doors: 2

Features: Air Conditioning, Alloy Wheels, AM/FM Stereo, Automatic Headlamp Switching, Automatic Wiper, CD Player, Climate Control, Cruise Control, Electric Mirrors, Electronic Stability Control, Folding Mirrors, Leather Interior, Leather Seats, Metallic Paint, Navigation System, Parking Sensors, Particulate Filter, Power Locks, Power Seats, Power Steering, Power Windows, Reversing Radar, Seat Heating, Sport Seats, Tilt Steering Wheel, Tinted Rear Windows

Trim: GT

Number of Cylinders: 8

Drive Type: RWD

Service History Available: Yes

Safety Features: Anti-Lock Brakes, Driver Airbag, Electronic Stability Program (ESP), Fog Lights, Immobiliser, Passenger Airbag, Safety Belt Pretensioners

Model: Vantage

Country/Region of Manufacture: United Kingdom

Aston Martin Vantage for Sale

2017 aston martin vantage(US $103,950.00)

2017 aston martin vantage(US $103,950.00) 2015 aston martin vantage s(US $109,950.00)

2015 aston martin vantage s(US $109,950.00) 2015 aston martin vantage gt 6-speed low mile with carbon trim + technology(US $89,000.00)

2015 aston martin vantage gt 6-speed low mile with carbon trim + technology(US $89,000.00) 2020 aston martin vantage amr in china grey with forged emblems, premium aud(US $146,000.00)

2020 aston martin vantage amr in china grey with forged emblems, premium aud(US $146,000.00) 2022 aston martin vantage roadster(US $110,495.75)

2022 aston martin vantage roadster(US $110,495.75) 2020 aston martin vantage 2dr cpe(US $20,953.00)

2020 aston martin vantage 2dr cpe(US $20,953.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Aston Martin skids in stock market debut

Wed, Oct 3 2018LONDON — Shares in luxury automaker Aston Martin fell as much as 6.5 percent on their market debut in London on Wednesday as investors and analysts raised concerns over Aston's ability to deliver an ambitious rollout of new models. The company, which last year made its first profit since 2010 and has gone bankrupt seven times, had priced its shares at 19 pounds each, giving it a market capitalization of 4.33 billion pounds ($5.63 billion). The shares fell to as low as 17.75 pounds. Aston Martin has plans to launch a new model every year from 2016 to 2022. "(It) has very aggressive growth plans. The execution of that growth needs to be flawless — nothing eats cash more than a car company when the cycle turns. There is concern that it's more cyclical than the commentary has been," said James Congdon, managing director of cashflow returns specialist Quest. "The banks have done a good job for their client — but there's no bounce." Aston is going all-in Aston Martin — full name Aston Martin Lagonda Global Holdings Plc — expects to produce around 7,100 to 7,300 cars in 2019, and 9,600 to 9,800 cars in 2020. It aims to increase production to 14,000 cars in the medium term, helped by new models and improving its manufacturing process. The company is investing all of its cashflow to try to achieve this, leaving nothing for dividends or paying down debt. "In terms of execution risk — this is what I've done for all of my career. I'm an engineer: we mitigate risk," Chief Executive Andy Palmer, who has led a turnaround plan at the company since 2014, told Reuters. Palmer played down risks to the business from Britain leaving the European Union, even as other car manufacturers step up warnings over a disorderly Brexit. He said Aston Martin was "relatively well insulated" from the effects of Brexit because Europe is not its biggest market and it may actually benefit from exporting with a cheaper pound. However, 60 percent of its parts are imported from the EU and will be hit by tariffs if there is no trade deal. "Obviously we'd all prefer no tariffs to be frank, no doubt, but the industry has to learn to adapt, and it always has adapted to changes," Palmer said. Valuation In 2017, Aston Martin had adjusted earnings before tax interest, depreciation and amortization (EBITDA) of 206.5 million pounds, up from 100.9 million pounds in 2016.

Aston Martin will make a profit for the first time since 2010

Wed, Nov 22 2017LONDON — Aston Martin is on course to post its first annual pre-tax profit since 2010 as strong demand for the luxury automaker's DB11 sports car boosts its performance. Pre-tax profit reached 22 million pounds ($29 million) in the first nine months of 2017, reversing a loss of 124 million pounds in the same period in 2016, Aston said on Wednesday. "Our strong financial performance and continued profitability reflect the growing appeal of our high-performance sports cars, with the new DB11 Volante and a new Vantage expected to stimulate further demand in the coming year," Chief Executive Andy Palmer said. Asked on Monday whether the firm would be in the black this year, Palmer told Reuters: "It's our intention to be." Aston Martin, which is mainly owned by Kuwaiti and Italian private equity firms, last posted a profit in 2010. Its losses then grew, partly due to lack of new models, a high-profile recall and an extended period without a chief executive. Since Palmer's appointment in 2014, the firm has pursued a turnaround plan designed to boost its model lineup, quadruple volumes and produce its first SUV at a new plant in Wales, setting up a possible stock market flotation. Volumes rose 65 percent to 3,330 cars in the first nine months of the year, prompting the firm to raise its full-year guidance to expect core earnings of at least 180 million pounds on revenue of over 840 million pounds. Third-quarter profit stood at 0.8 million pounds, reflecting a quieter period across the car sector when demand falls as people take holidays and some customers prefer to wait until after the vacation period to have their cars delivered. On Tuesday, the firm launched its new Vantage model, which will take its output to 7,000 sports cars in 2019, its highest level in a decade. Related Video:

Canadian billionaire Lawrence Stroll leads $240 million Aston Martin investment

Fri, Jan 31 2020After months of rumors and speculation, Canadian billionaire Lawrence Stroll confirmed he led the purchase of a 16.7% stake in Aston Martin for GBP182 million ($239 million). The investment is part of a GBP500 million ($656 million) round of emergency funding that will help the British automaker overcome serious financial challenges. Yew Tree Overseas Limited, a consortium of international investors led by Stroll, built its stake by buying 45.6 million new ordinary Aston Martin shares on the London Stock Exchange, according to Autocar. Aston Martin raised the remaining GBP318 million ($417 million) by giving existing investors the opportunity to buy more shares, the BBC learned. It's not a full bailout, but it's close. Aston Martin ended 2019 in dire financial straits. Stroll will replace Penny Hughes as Aston Martin's chairman; CEO Andy Palmer is expected to keep his job. Several sources confirmed the Racing Point Formula One team owned by Stroll will be rebranded Aston Martin after the 2020 season, and Autocar reported the company will quickly need to eliminate jobs and slash costs. "The difficult trading performance in 2019 resulted in severe pressure on liquidity, which has left the company with no alternative but to seek substantial additional equity financing. Without this, the balance sheet is not robust enough to support the operations of the group," Hughes admitted in an interview with the BBC. Stroll's' appointment to the Aston Martin board comes as the company prepares to overhaul its product plan. It notably confirmed the rumors claiming it put the battery-powered Rapide project on the back burner until further notice, and it delayed plans to revive the Lagonda nameplate on a series of extra-luxurious electric vehicles until after 2025. The first car was originally scheduled to reach the market in 2022, but the battery technology is expensive to develop, and Aston must save about 10 million pounds (around $13 million) annually. The firm will instead focus on mid-engined sports cars. Still according to Autocar, it will begin delivering the 1,160-horsepower Valkyrie hypercar this year, and it's on track to launch the Valhalla in 2022. The Vanquish will go mid-engined shortly after. Delaying electric cars doesn't mean abandoning electrification, and Aston Martin hopes to release "a fuel-efficient, modular V6 engine with hybrid capabilities" by the middle of the 2020s.